Bitcoin has become the talk of the town, sparking heated discussions in both traditional and cryptocurrency investment circles. Recently, the US Securities and Exchange Commission (SEC) gave the nod to several spot Bitcoin ETFs (exchange-traded funds), adding fuel to the speculative fire.

The ETF Game Changer

The approval of spot Bitcoin ETFs is being hailed as a game-changer, opening up a more mainstream investment avenue for Bitcoin. This move could potentially attract a broader investor base, especially from institutional players. Despite a somewhat subdued initial response in Bitcoin’s price, hovering below $45,000, industry experts and investors maintain an optimistic outlook for the future.

Anthony Scaramucci’s Take

Anthony Scaramucci, the CEO of SkyBridge Capital, sees the ETF approval as a significant breakthrough for Bitcoin. He predicts a price surge to $100,000 within a year, drawing parallels to the historical impact of the first spot gold ETF approval in 2004. While expressing optimism, Scaramucci remains cautious, acknowledging the unpredictable nature of cryptocurrency markets and his own past prediction errors.

“I think Bitcoin will probably see its all-time high at the end of the year… Could Bitcoin be $100,000, which is more or a little bit more than a double over the next year? I do believe that… But I have been wrong so many times before,” Scaramucci noted.

The Halving Factor

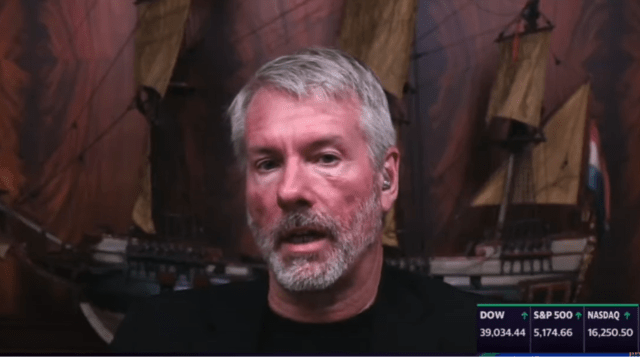

The impending Bitcoin halving in 2024, a code-inherent event reducing miner rewards and capping supply, adds another layer of optimism. MicroStrategy CEO Michael Saylor anticipates a “supply shock” as the halving will significantly reduce the available BTC for miners to sell. This, along with factors like increased usage and decentralization, leads experts like Tim Draper to speculate a $250,000 valuation by July.

Tom Lee’s Perspective

Tom Lee of Fundstrat Global Advisors predicts a short-term rise to $150,000, with a long-term potential of $500,000. He emphasizes Bitcoin’s finite supply and the anticipated demand surge following the spot Bitcoin ETF approval as key drivers.

“There’s a finite supply and now we have a potentially huge increase in demand with a spot bitcoin [ETF] approval, so I think in five years something around half a million would be potentially achievable,” Lee said.

Sky’s the Limit: Cathie Wood’s Bold Forecast

Ark Invest CEO Cathie Wood presents an even more ambitious view. In her “base case,” she envisions Bitcoin reaching $600,000. However, in her “bull case,” she believes Bitcoin could skyrocket to $1.5 million by 2030, driven by significant institutional investments following the SEC approval.

“We think the probability of the bull case has increased with this SEC approval [of spot Bitcoin ETFs]. This is a green light. Our bull case is $1.5 million by 2030… You can see how conservative we are… This is a big idea. It’s the first global decentralized digital rules-based monetary system in history. [Bitcoin] is a very big idea,” Wood explained.

Cautionary Notes

While these bullish predictions are rooted in Bitcoin’s unique attributes, including its finite supply and resilience to external influences, caution is advised. Bitcoin’s past performance, marked by volatility and correlation with stock markets, coupled with regulatory uncertainties, makes it a high-risk venture. Investors are urged to verify facts independently and seek professional advice before making decisions based on these projections.