Bitcoin (BTC) witnessed its largest weekly net outflow from centralized exchanges in eight months, indicating a bullish trend for the top cryptocurrency.

Key Takeaways

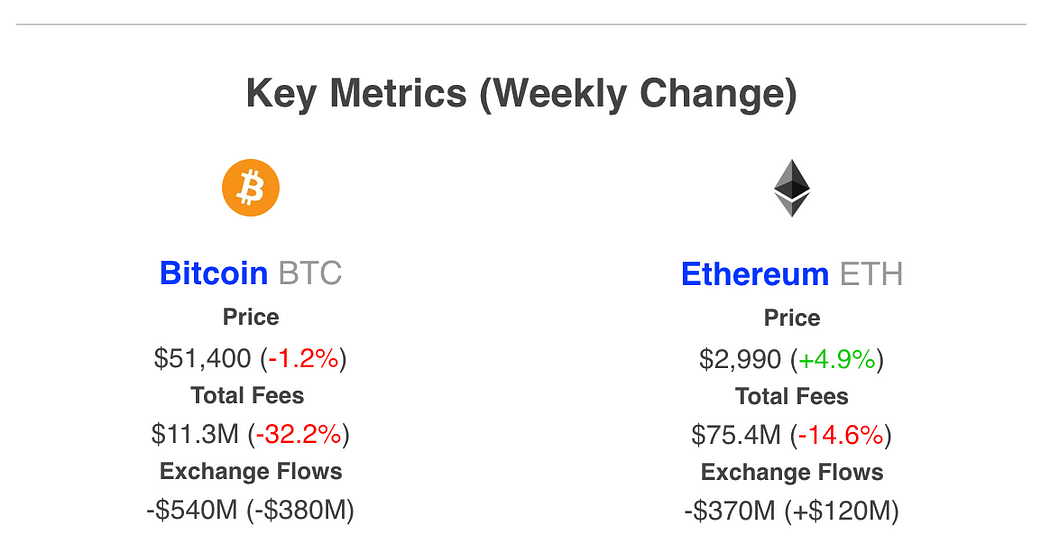

- Bitcoin’s netflows, measuring BTC movement in and out of centralized exchanges, saw a significant outflow of $540 million this week.

- Ethereum (ETH) also experienced net outflows, marking seven consecutive weeks of withdrawals from exchanges.

- The decline in transaction fees for both BTC and ETH suggests reduced willingness to spend the assets.

Analysis

According to crypto analytics firm IntoTheBlock, Bitcoin’s netflows from centralized exchanges reached their highest level since June 2023. This outflow signals a bullish sentiment among investors, as moving BTC off exchanges often indicates long-term holding intentions.

Lucas Outumuro, IntoTheBlock’s head of research, noted that Bitcoin’s fees dropped by 32.2%, possibly due to the decline in ordinal-related activity. Fees reflect the willingness to spend an asset and the demand for its use.

Ethereum’s Net Outflows

Ethereum (ETH) experienced similar net outflows this week, marking seven consecutive weeks of withdrawals from centralized exchanges. The total outflow for ETH amounted to $370 million. Despite the outflows, ETH’s fees dropped by 14.6%, suggesting a reduced willingness to spend the asset.

Market Performance

At the time of writing, Bitcoin is trading at $50,850, down around 2.5% in the past seven days. Ethereum is trading at $2,928, up more than 4% in the past week.

Disclaimer

Opinions expressed in this article are not investment advice. Investors should conduct their own research before making any high-risk investments in Bitcoin, cryptocurrency, or digital assets.