Bitcoin’s price has been hovering around the same level since its peak in March. This has made investors nervous, especially since it recently fell below $60,000.

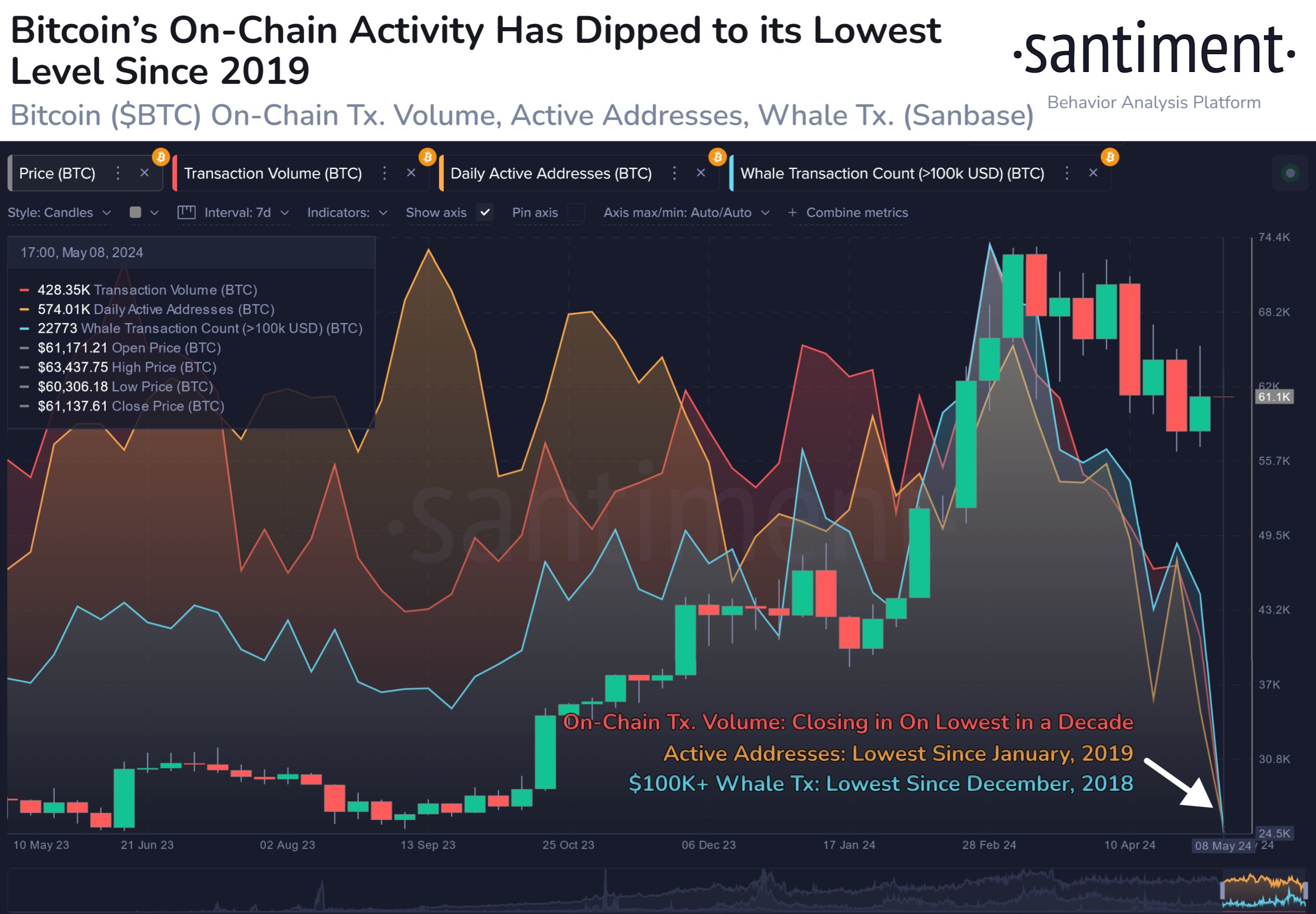

But it’s not just the price that’s slowing down. Data from Santiment shows that activity on the Bitcoin network has also dropped over the past few months.

Low Activity: A Sign of Trouble?

Santiment says that Bitcoin’s on-chain activity is getting close to historic lows. This means that people are trading less Bitcoin, and there are fewer active addresses and whale transactions.

On-chain activity has been at its lowest since 2019. Transaction volume, which measures how many coins are being traded, is also at its lowest in a decade.

The number of daily active addresses, which measures how many different people are using Bitcoin, is also at its lowest since January 2019.

Whale activity, which refers to transactions of over $100,000, has also slowed down. It’s at its lowest point since late 2018.

What Does This Mean for Bitcoin’s Price?

On the surface, this slowdown in activity might seem like a bad sign. But Santiment says it might not necessarily mean that Bitcoin’s price is about to crash.

Instead, they say it’s more likely a sign of “crowd fear and indecision” among traders. This suggests that the market is uncertain about Bitcoin’s future.

Bitcoin’s Price Today

As of writing, Bitcoin is trading just above $60,770, with a slight dip of 0.2% over the past 24 hours.