A leading crypto analytics firm, Santiment, is cautioning that the digital asset markets may soon experience a corrective move.

Altcoin Interest Spikes

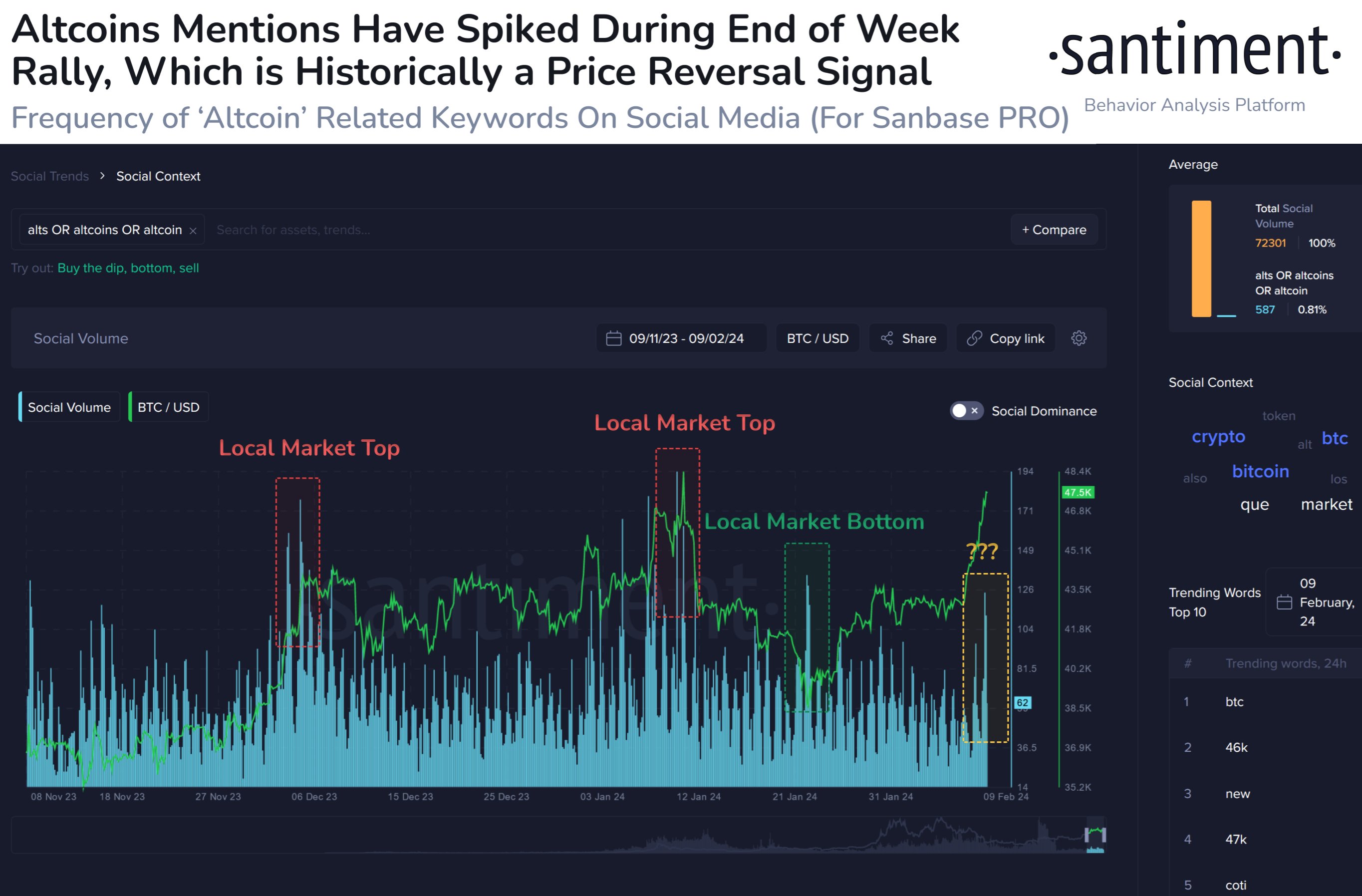

Santiment observed a surge in interest in altcoins on social media platforms during the recent market rally. Mentions of “alt,” “altcoins,” and “altcoin” spiked towards the end of last week, indicating growing excitement among traders.

Greed Signals

The analytics firm interprets this surge in altcoin interest as a sign of greed, especially in light of the simultaneous rise in prices.

Bullish Trend Since October

Santiment notes that the broader crypto markets have been on a bullish trend since October, with Bitcoin (BTC) and altcoins experiencing upward momentum.

Bitcoin’s Price Surge

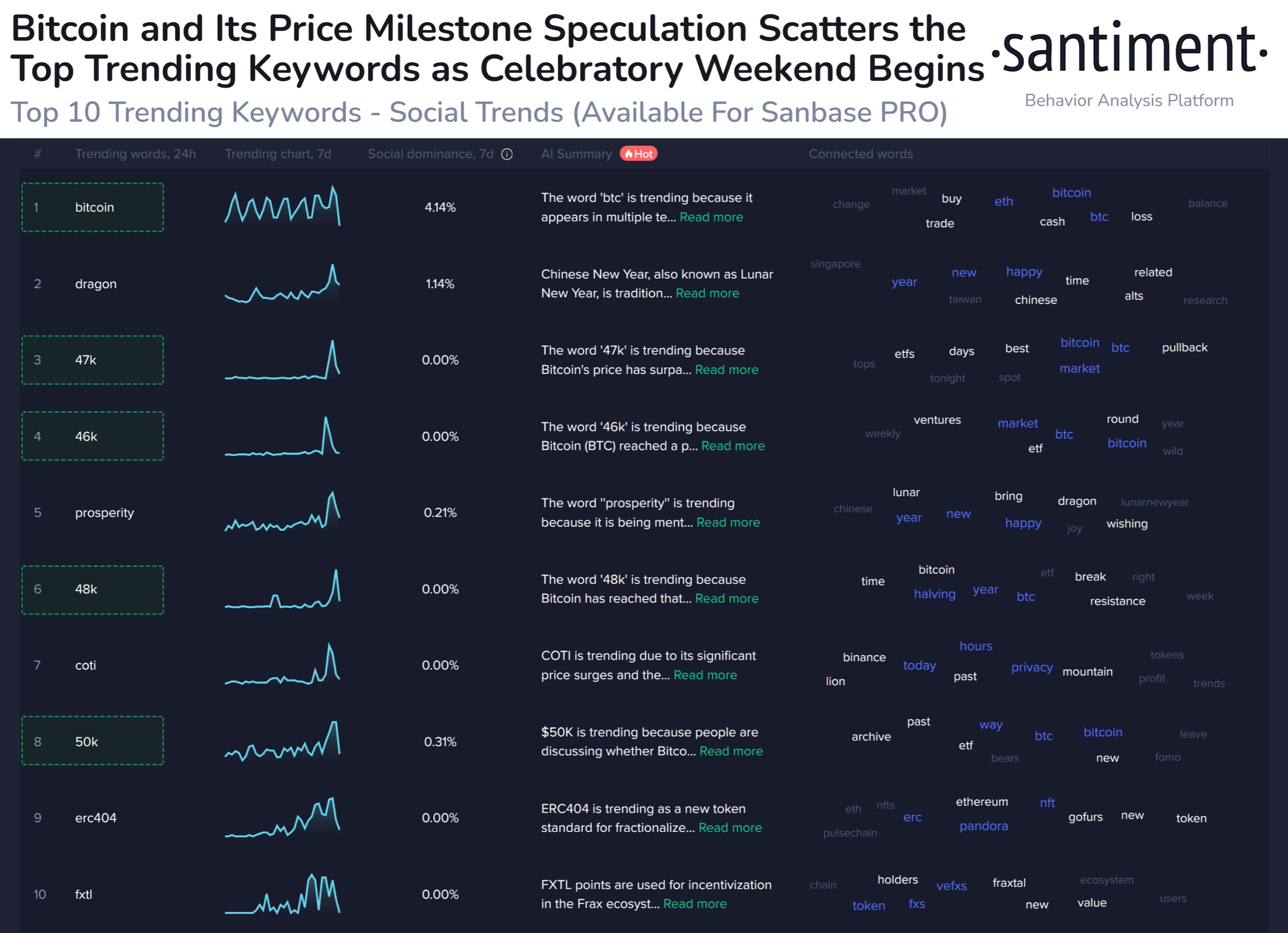

Bitcoin’s recent price increase of 13% in the past week has led to speculation about new support and resistance levels, with $50,000 being a widely anticipated target.

Altcoins’ Reaction

Ironically, as Bitcoin surpassed these price levels, altcoins experienced a downturn over the weekend, as traders became overly focused on BTC’s price.

Historical Pattern

Santiment identifies a historical pattern in the bull cycle that began in October:

- Bitcoin enjoys an isolated pump, and the crowd becomes BTC dominant.

- Profits get distributed into altcoins, and the crowd gets greedy.

- Bitcoin retraces mildly, and altseason ends more drastically.

Potential Retracement

The analytics firm suggests monitoring how traders respond to the second step of this cycle this weekend and whether they start raising open interest levels on speculative altcoins. If so, step 3 (a retracement) may occur soon.

Current Bitcoin Price

At the time of writing, Bitcoin is trading at $48,196, showing a 1.41% increase in the last 24 hours.