A fund manager thinks the current dip in Bitcoin prices is nothing to worry about. He’s calling it a “boogeyman” and lists eight reasons why he’s still bullish on Bitcoin.

Germany’s Bitcoin Dump is Nearing its End

Germany has been selling off a lot of Bitcoin, but the fund manager thinks this is almost over. He expects the market to shrug off the remaining sales soon.

Mt. Gox Repayments Won’t Cause a Market Crash

The fund manager doesn’t think the repayment of Mt. Gox creditors will cause a massive sell-off. He believes they’ll sell their Bitcoin slowly and strategically, minimizing the impact on the market.

US Government Bitcoin Sales Won’t Disrupt the Market

The US government has been selling some of its Bitcoin holdings, but the fund manager believes they’re doing it gradually and won’t cause any major market disruptions.

Retail Investors are Buying the Dip

Retail investors are using Bitcoin ETFs to buy Bitcoin at lower prices, indicating strong interest and a bullish sentiment.

Ethereum ETFs are Coming Soon

The anticipation of US spot Ethereum ETFs is already priced into the market. This means that the launch of these ETFs could have a positive impact on the price of Ethereum.

Interest Rate Cuts are on the Horizon

The market expects the Federal Reserve to cut interest rates soon, which could be good news for Bitcoin.

A Trump Presidency Could Be Good for Bitcoin

The fund manager thinks Bitcoin could benefit from a Trump presidency, as Trump has expressed support for cryptocurrencies.

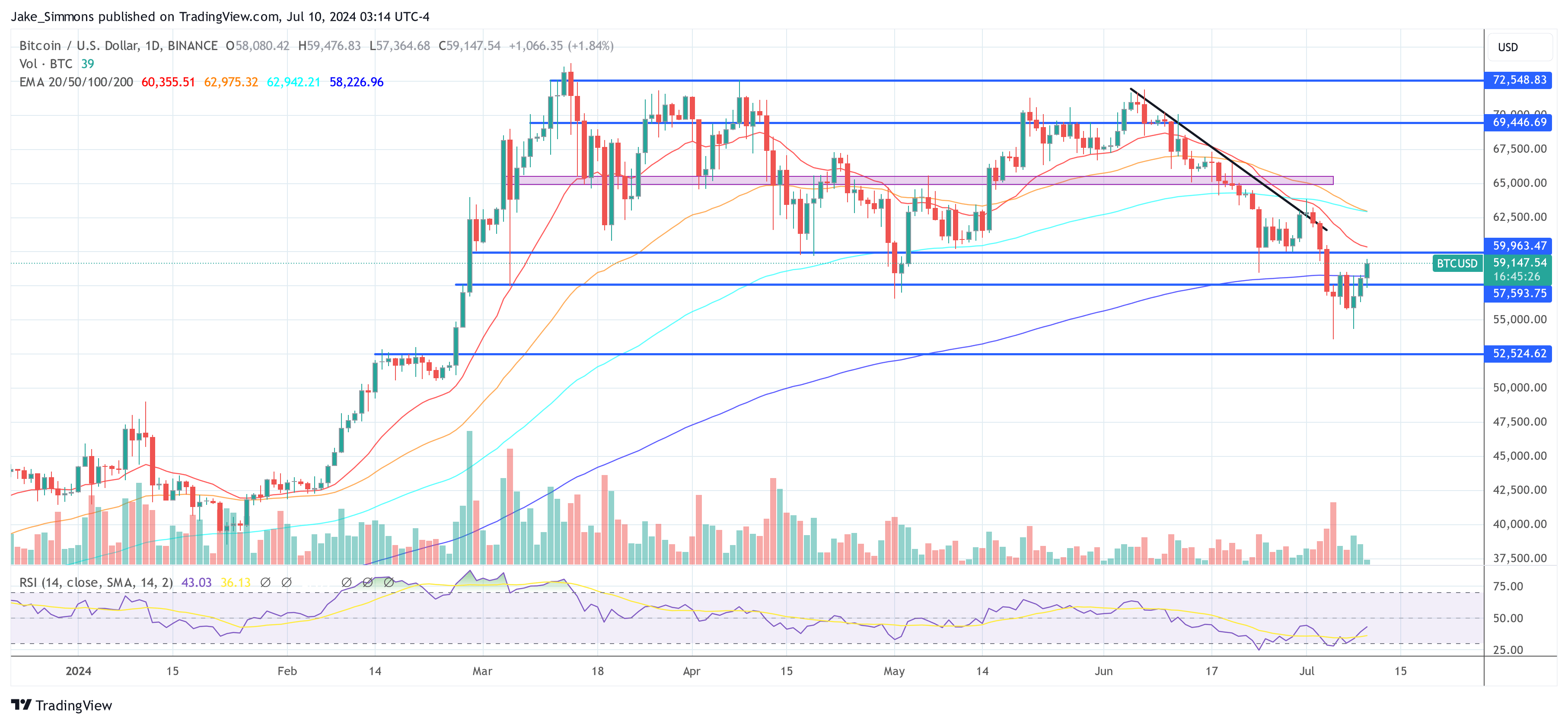

Bitcoin is Undervalued Compared to the Nasdaq

The Nasdaq is hitting new highs, while Bitcoin is lagging behind. The fund manager believes this means Bitcoin is undervalued and could soon catch up.