Ethereum’s Ongoing Volatility

The crypto market has been a rollercoaster lately, with Bitcoin and Ethereum moving in different directions. Bitcoin seems to be settling down, but Ethereum is still facing a lot of uncertainty, especially in the options market.

Implied Volatility: A Measure of Uncertainty

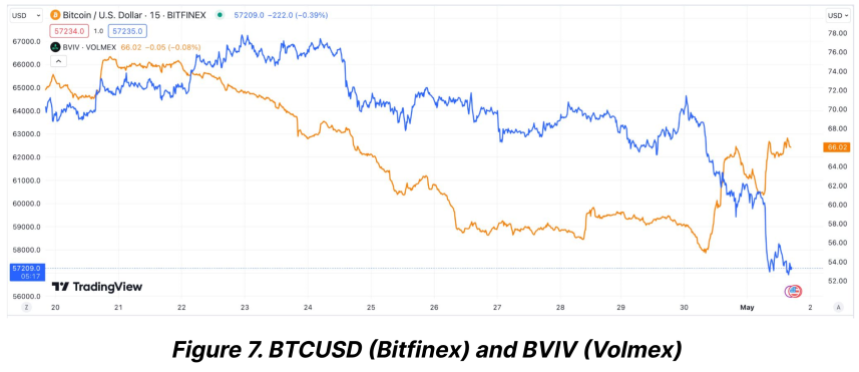

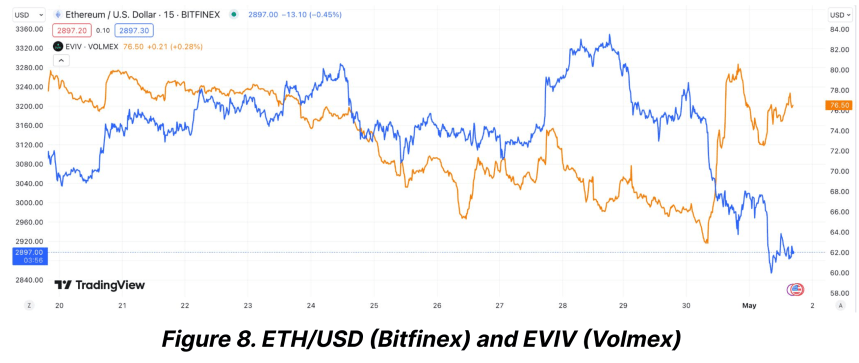

Implied volatility (IV) shows how much investors expect an asset’s price to move in the future. High IV means investors are expecting big price swings.

Ethereum’s IV has stayed high, even though Bitcoin’s has gone down. This suggests that investors are still nervous about Ethereum’s future price.

Reasons for Ethereum’s Volatility

One reason for Ethereum’s volatility is uncertainty about upcoming regulations. The US Securities and Exchange Commission (SEC) is expected to decide on two spot Ethereum ETFs soon. This could have a big impact on the market.

Signs of Recovery

Both Ethereum and Bitcoin have seen some gains in the past week. However, Ethereum has been more volatile, with a slight dip in the last 24 hours.

Network Activity

Ethereum’s network activity has also been slow, with a decrease in the number of transactions and ETH burned. This shows that the market is still cautious.

Future Outlook

Some analysts believe that Ethereum’s current volatility could lead to a strong rebound in the third quarter of the year. They predict that Ethereum could reach $4,000 if market conditions are favorable.