Bitcoin exchange-traded funds (ETFs) saw a massive influx of cash this past week.

A Pac-Man Frenzy

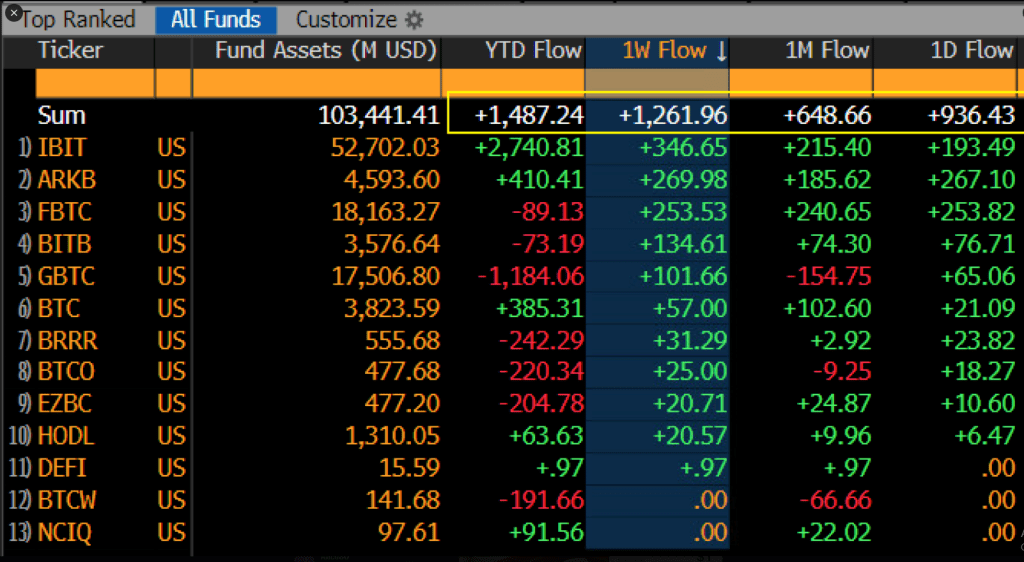

Over $1.2 billion flowed into US-listed Bitcoin ETFs, with nearly a billion dollars pouring in on Tuesday alone! This brings the total assets under management (AUM) to a whopping $103 billion. This surge happened while Bitcoin’s price hit its highest point since early March, exceeding $93,700.

BlackRock Still on Top

BlackRock’s iShares Bitcoin Trust (IBIT) continues to dominate, with $2.7 billion in inflows year-to-date—including another $346 million last week. Other major players like Ark Invest and Grayscale saw significantly smaller inflows. Interestingly, Grayscale’s GBTC saw a net outflow of $1.18 billion since January, bucking the overall trend.

Broader Institutional Interest

Ten out of eleven Bitcoin ETFs saw inflows, showing a diverse range of institutional investment rather than concentration in a few funds. This widespread participation suggests growing confidence in Bitcoin. The total value traded across all Bitcoin spot ETFs reached $496 million, representing almost $57 billion in net assets – a significant portion of the crypto market.

Ethereum and Other Altcoins Struggle

While Bitcoin ETFs thrived, Ethereum investment products experienced their eighth consecutive week of outflows, losing $26.7 million last week and a total of $772 million over the period. Short Bitcoin products also saw continued outflows, totaling $1.2 million for the week and $36 million over seven weeks. The only exception among alternative cryptocurrencies was XRP, which saw significant inflows.

A New Era for Bitcoin?

The massive inflow of funds into Bitcoin ETFs strongly suggests that traditional financial institutions are increasingly accepting cryptocurrency as a legitimate asset class. The sheer volume of investment, especially the near-billion-dollar single-day surge, points towards a potential turning point in mainstream cryptocurrency adoption.