A crypto analyst who correctly predicted Bitcoin’s price drop earlier this year thinks BTC is nearing its lowest point.

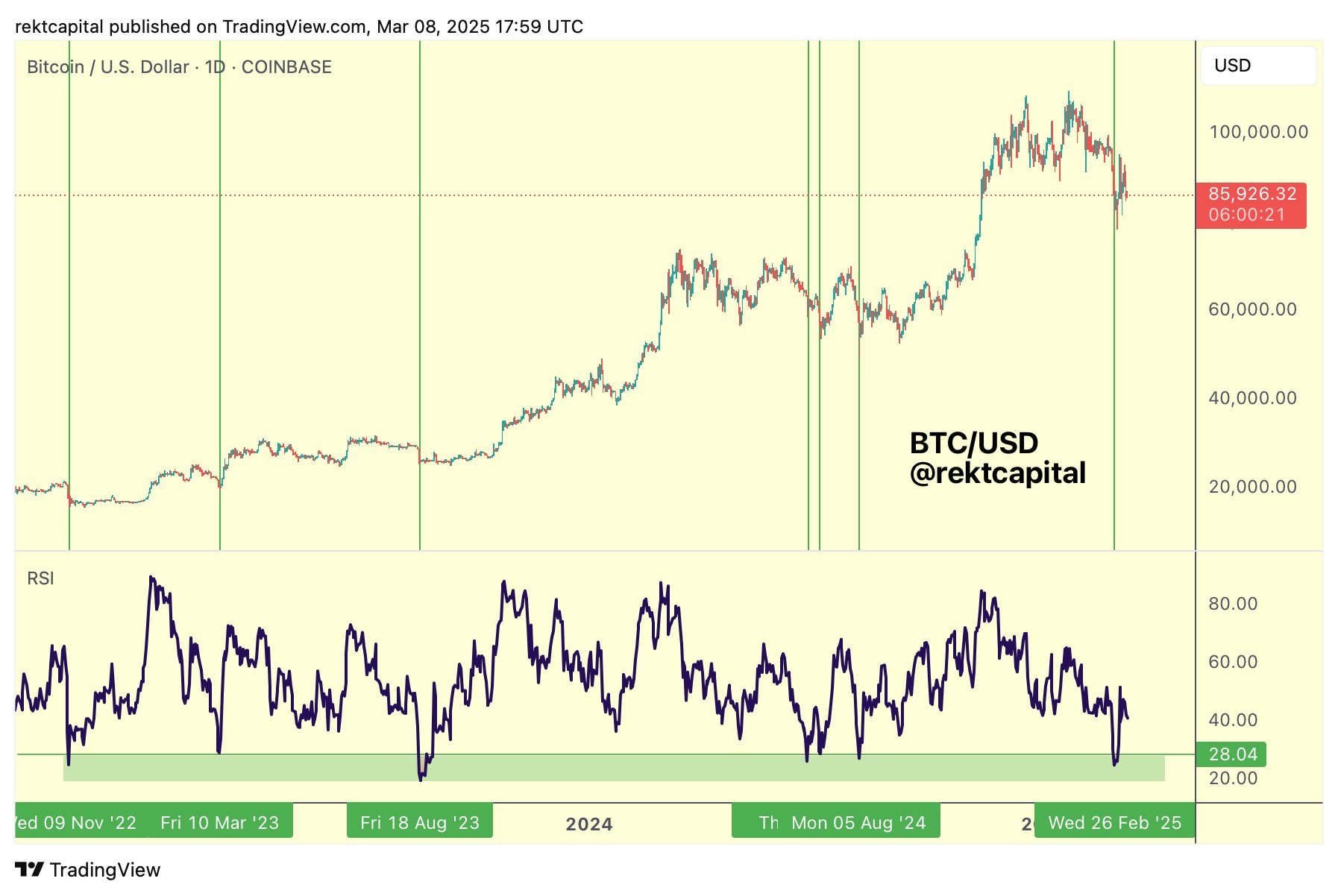

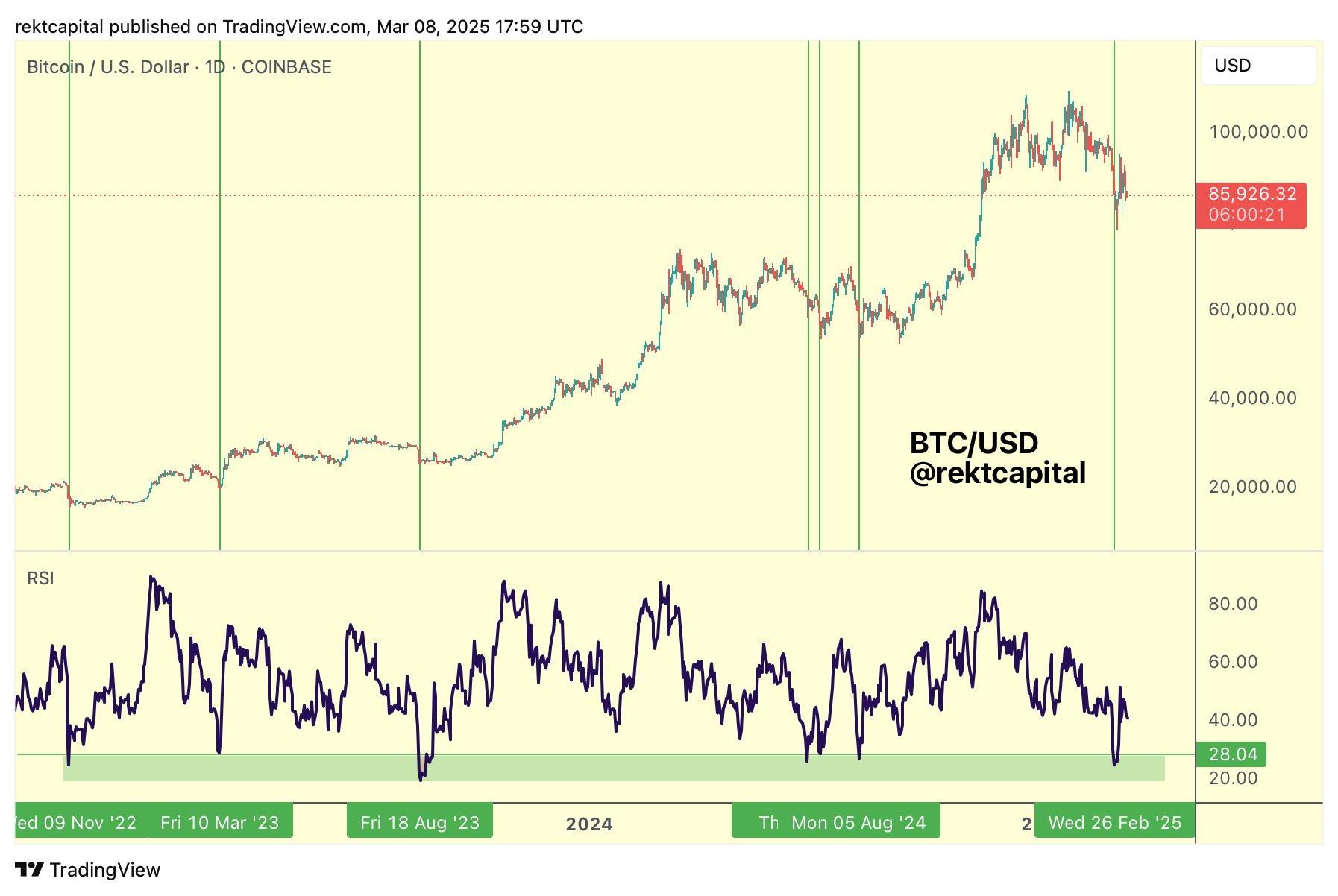

Oversold RSI Signals Potential Reversal

Rekt Capital, a popular analyst with over 500,000 followers on X (formerly Twitter), points to Bitcoin’s Relative Strength Index (RSI). The RSI is a technical indicator that often signals potential trend reversals. Rekt Capital notes that Bitcoin’s daily RSI has fallen into oversold territory, a level it’s reached before, each time resulting in a price rebound. He highlights that similar RSI levels in 2022 coincided with a price crash, but subsequent dips into oversold territory have been followed by upward price movements.

Potential Bottom Between $71,700 and $78,000

Based on historical data and the current RSI, Rekt Capital suggests Bitcoin might find a bottom somewhere between $71,700 and $78,000. He acknowledges that Bitcoin has recently made a lower high, but emphasizes that previous instances of low RSI values have been followed by price bottoms or near-bottoms.

Comparing Bitcoin to Cronos (CRO)

To further support his claim, Rekt Capital compares Bitcoin’s potential price action to that of Cronos (CRO). He suggests that both cryptocurrencies may be forming a “double bottom” pattern, a bullish indicator often seen before a price surge. He notes that CRO appears to have already broken out of its double bottom pattern.

Double Bottom Pattern: A Bullish Sign?

A double bottom is generally considered a bullish reversal pattern, meaning it suggests the asset has hit its lowest point and is preparing to rise. Rekt Capital’s chart indicates that CRO might have already broken through the resistance level of its double bottom pattern.

Current Bitcoin Price and Disclaimer

At the time of writing, Bitcoin is trading around $82,207, down slightly in the last day. It’s important to remember that this analysis is just one perspective, and cryptocurrency investments are inherently risky. Always do your own research before making any investment decisions.