Analyst’s Prediction

Crypto analyst Eric sees Ethereum (ETH) potentially reaching $20,000 during the next bull run. He attributes this prediction to the potential launch of spot Ethereum exchange-traded funds (ETFs) in the United States.

Historical Comparison

Eric highlights Ethereum’s historical tendency to follow Bitcoin’s (BTC) price movements, albeit with a one-cycle lag. In the previous bull market, Bitcoin surged 22-fold from $3,100 to $69,000. If Ethereum follows a similar trajectory, reaching $20,000 is a realistic possibility.

Spot Ethereum ETFs

The approval of spot Ethereum ETFs could be a major catalyst for price appreciation. These ETFs would allow institutional investors to gain exposure to Ethereum without the complexities of directly trading or storing the coin.

SEC Approval

The United States Securities and Exchange Commission (SEC) is expected to follow a similar path to its approval of the first spot Bitcoin ETF in January 2023. However, the agency has historically been cautious in approving spot ETFs, citing market manipulation risks and the absence of proper monitoring tools.

Standard Chartered’s Forecast

Standard Chartered, a global bank, predicts that the SEC will approve the first spot Ethereum ETF in May 2023. The bank believes that ETH prices will be trading around $4,000 by then, driven by general market optimism.

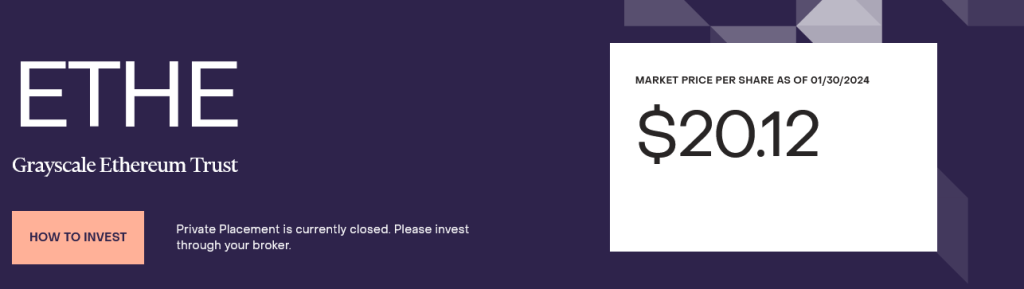

Grayscale’s Role

Grayscale Investments, the issuer of Grayscale Ethereum Trusts (ETHE), is seeking to convert this product into an ETF. Each share traded at around $20 as of January 30. Grayscale’s previous success in winning a legal battle against the SEC over the conversion of their Bitcoin Trust into an ETF bodes well for the approval of spot Ethereum ETFs.

Ethereum Futures ETFs

The recent approval and listing of Ethereum Futures ETFs on the Chicago Mercantile Exchange is seen as a positive development, paving the way for a potential spot ETF listing in May 2024.