Trump’s recent criticism of high interest rates has experts wondering about the potential impact on Bitcoin and other assets. His comments, made shortly before his inauguration, suggest a possible shift in US monetary policy.

History Repeating Itself?

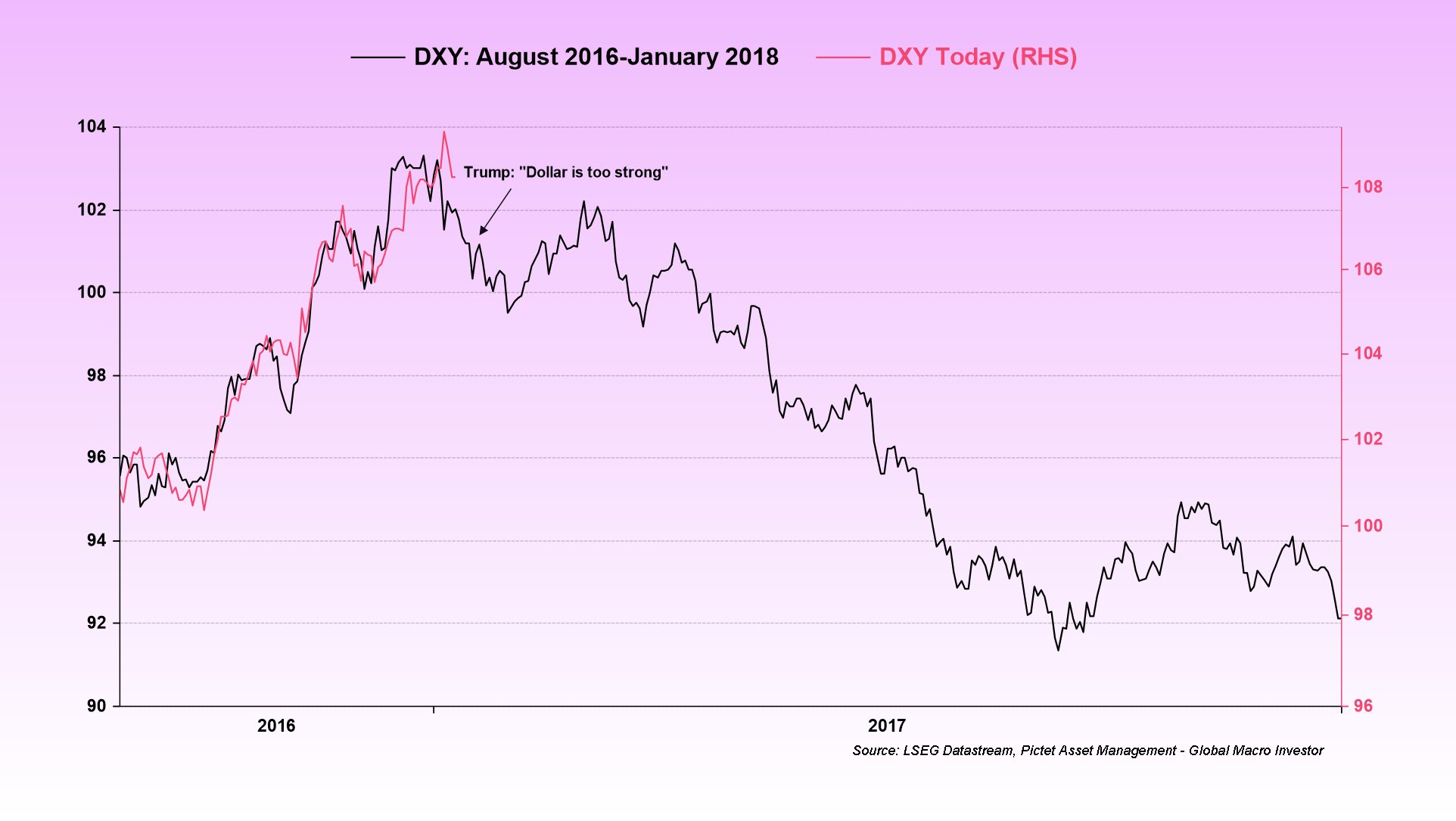

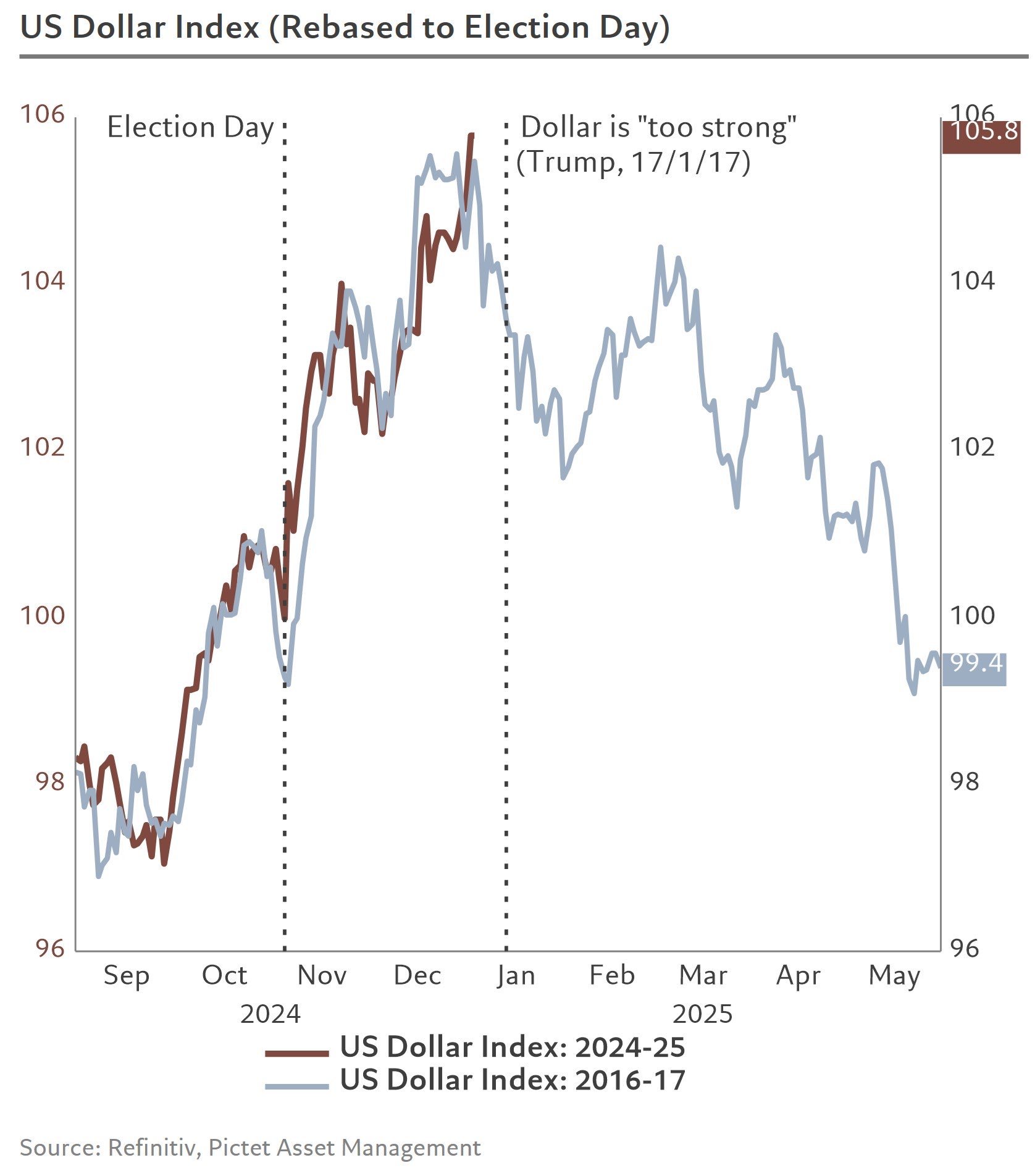

Some analysts see parallels between Trump’s current statements and his 2017 rhetoric. Back then, he criticized a “too strong” US dollar. This was followed by a significant drop in the US Dollar Index (DXY), from around 104 to about 98. This dollar decline coincided with a surge in the stock market and the crypto market, including Bitcoin.

The Strong Dollar and High Interest Rates: A Double Whammy?

One expert, Julien Bittel, highlighted the connection between Trump’s comments and market movements. He argued that just as a strong dollar hurts US businesses, high interest rates stifle exports, harm corporate profits, and slow economic growth. He believes that Trump’s latest comments could lead to a similar scenario as 2017, with a weakening dollar and a rise in risk assets.

Charts and Predictions

Other analysts, like Steve Donzé and Silver Surfer, have also pointed to charts showing similarities between the DXY’s behavior before Trump’s 2017 and 2025 inaugurations. They see a potential for a repeat of the 2017 dollar decline, which could boost Bitcoin and other riskier investments.

The Bitcoin Outlook

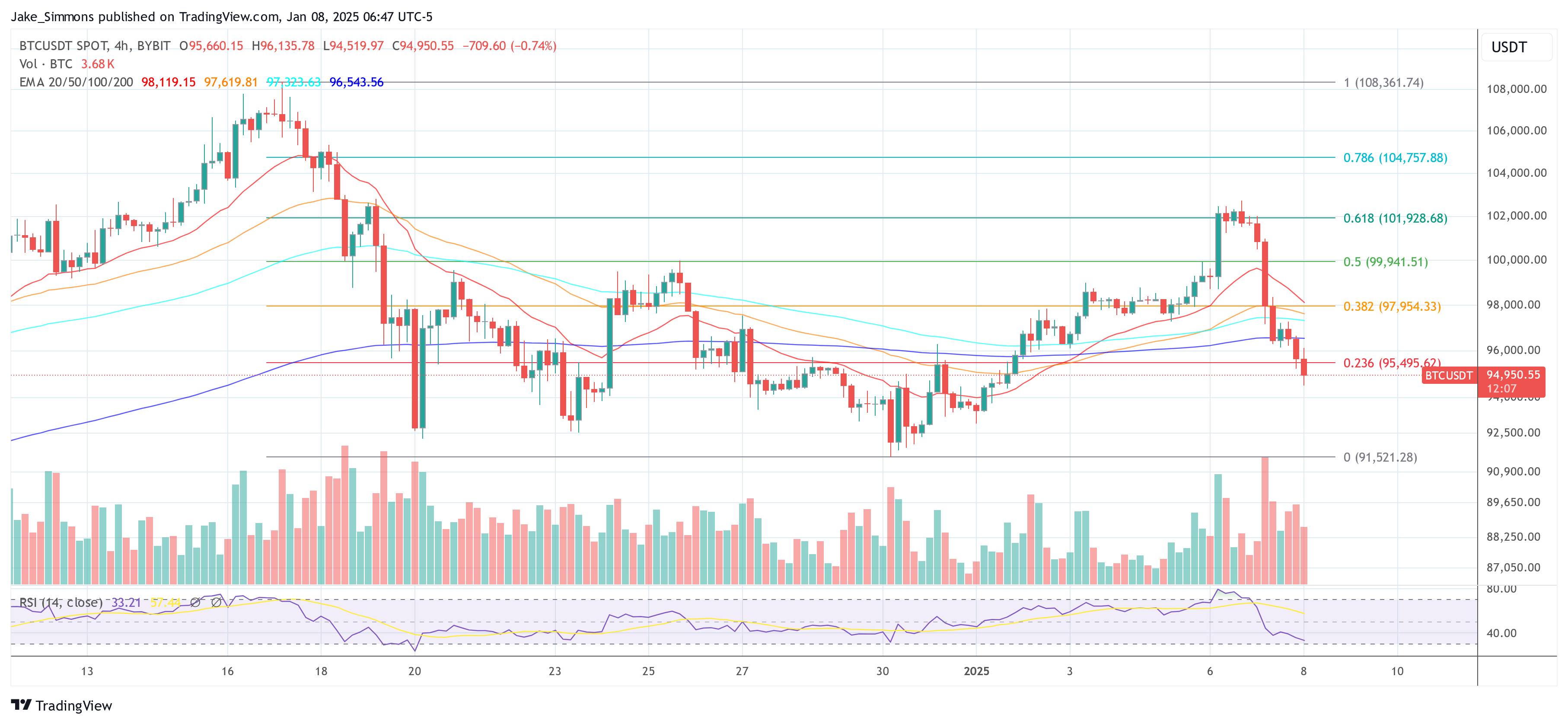

If the dollar does weaken, as some predict, it could lead to increased investment in Bitcoin and other assets considered riskier. At the time of writing, Bitcoin was trading at $94,950. Whether this speculation will pan out remains to be seen.