Crypto analysts are predicting a potential shakeup in the Bitcoin and broader cryptocurrency markets this September. Based on historical patterns, some believe a crash is likely, followed by a later surge. Let’s examine the details.

September: A Historically Risky Month for Bitcoin?

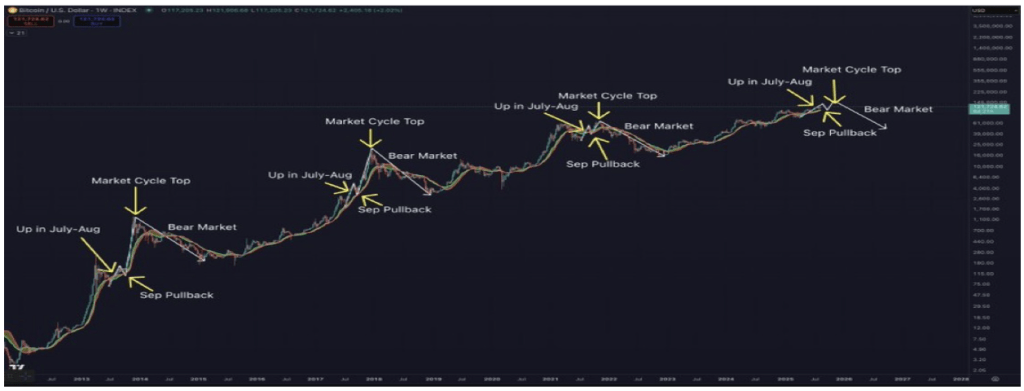

Analyst Benjamin Cowen has pointed out a recurring pattern in Bitcoin’s price behavior after a “halving” event (a significant reduction in Bitcoin’s production rate). His analysis shows that in past cycles (2013, 2017, and 2021):

- July and August: Bitcoin typically sees a price rally, creating a sense of optimism.

- September: A significant price drop usually follows, acting as a kind of market reset.

- Later in the year: A final price surge to a cycle peak occurs, before a long bear market sets in.

Cowen’s analysis suggests that Bitcoin’s price action this year mirrors these past cycles, raising concerns about a potential September crash.

Is the Bitcoin Bull Run Over? Not So Fast.

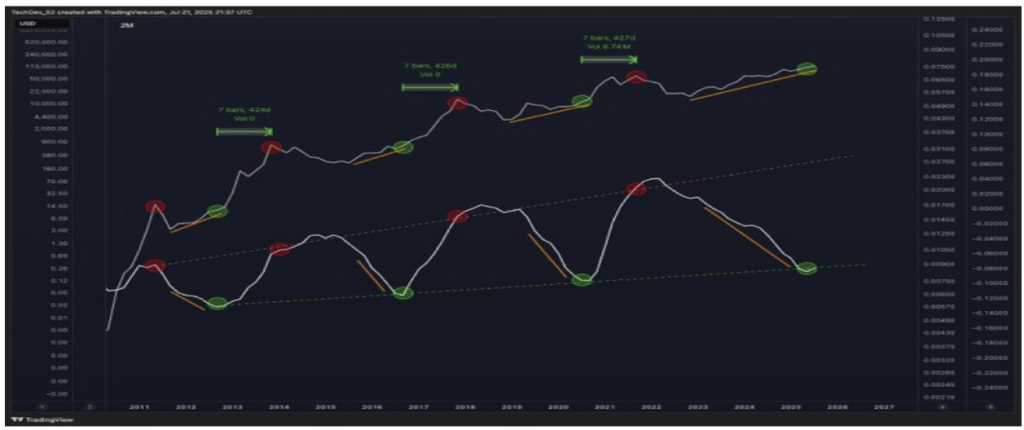

Another analyst, TechDev, offers a different perspective. Their technical analysis shows a different long-term pattern in Bitcoin’s price cycles. This analysis suggests that the market may still have significant growth potential.

TechDev’s chart shows that Bitcoin’s peak prices have historically occurred around 14 months after a specific cyclical signal. Based on this, the current market may be entering a prolonged growth period rather than nearing its peak. This model indicates that a significant price increase could still be ahead.

In short, while some analysts predict a September crash based on past patterns, others believe the market still has room to grow. The cryptocurrency market remains volatile and unpredictable, making it crucial to approach any prediction with caution.