Thanksgiving 2020 saw Bitcoin take a dramatic 17% dive. With the holiday approaching, many are wondering if history will repeat itself.

A Repeat of the “Thanksgiving Massacre”?

Recently, Bitcoin’s price dropped 8%, fueling speculation of another significant drop. Galaxy Digital’s Head of Research, Alex Thorn, pointed out the similarities between the current market and the 2020 crash, asking if history might rhyme.

The Global M2 Money Supply: A Potential Culprit?

One possible reason for a potential crash is the global M2 money supply. Analyst Joe Consorti from Theya noted a correlation between Bitcoin’s price and global M2, with a roughly 70-day lag. A recent decrease in global M2 could lead to a 20-25% Bitcoin correction, potentially dropping the price to around $73,000. However, Consorti acknowledges that Bitcoin has defied such trends before, and factors like ETF inflows and corporate buying could provide support. He emphasizes the importance of understanding Bitcoin’s connection to the broader economic environment.

A More Optimistic Outlook

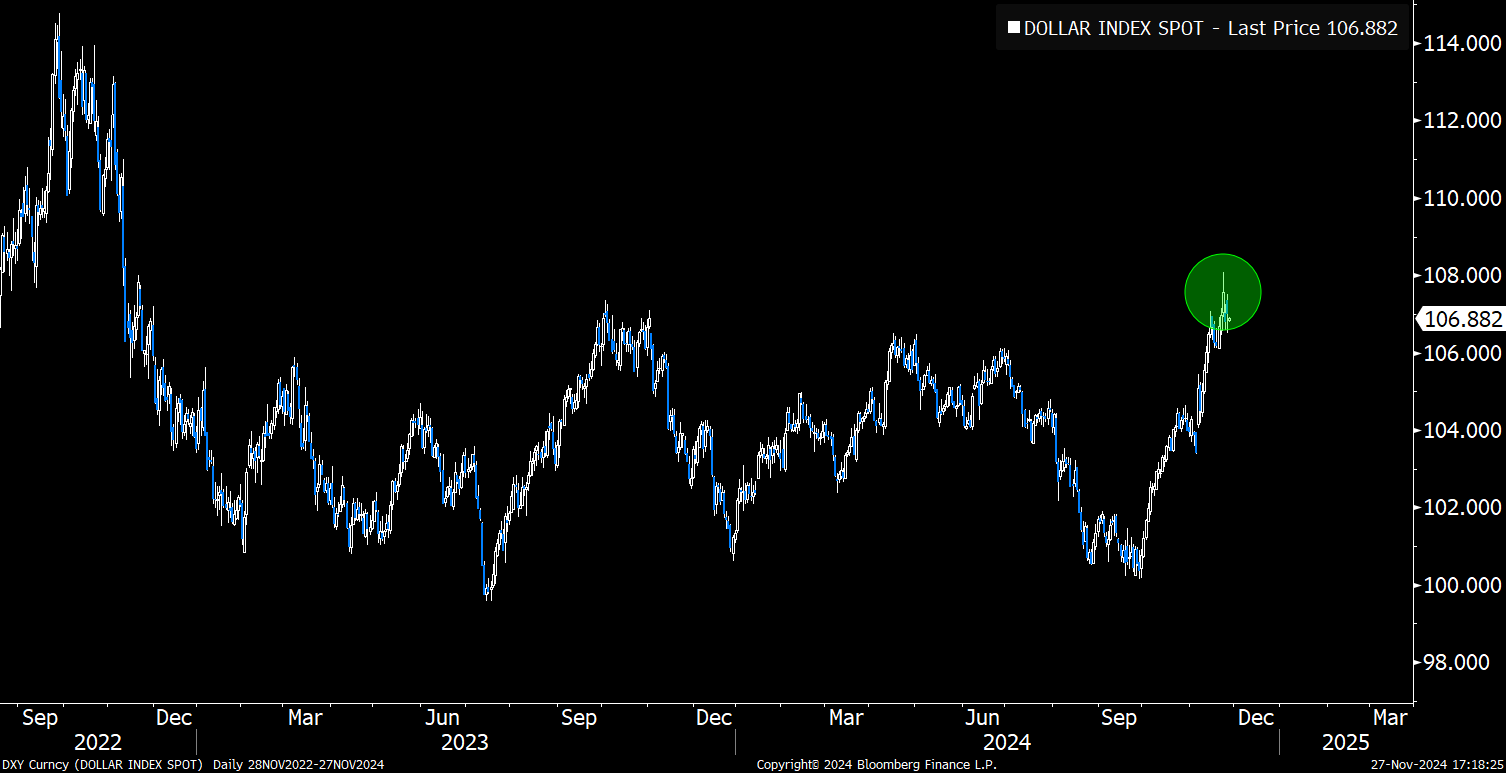

Despite the concerns, some analysts remain optimistic. Jamie Coutts, Chief Crypto Analyst at Real Vision, points to strong buying pressure for Bitcoin, even with tightening liquidity. He highlights the possibility of policy changes by the Federal Reserve that could boost risk assets, suggesting a bullish outlook for Bitcoin in 2025.

The Bottom Line

While the possibility of a Bitcoin price correction exists, the overall outlook is mixed. Analysts are divided on whether a significant drop is imminent, with some pointing to potential economic factors and others highlighting continued buying pressure. The current price hovers around $93,250.