The launch of Spot Ethereum ETFs was supposed to be a big deal for the crypto market, but the price of ETH hasn’t exactly been celebrating. In fact, it’s been dropping since the ETFs started trading.

Why the Sell-Off?

There are a few reasons why ETH is struggling:

- Grayscale Outflows: Investors are pulling their money out of the Grayscale Ethereum fund, which holds a huge amount of ETH. This is happening because Grayscale charges high fees, and there are now cheaper options available.

- Mt. Gox Distributions: The Mt. Gox bankruptcy is causing some people to sell their Bitcoin and Ethereum, putting extra pressure on the market.

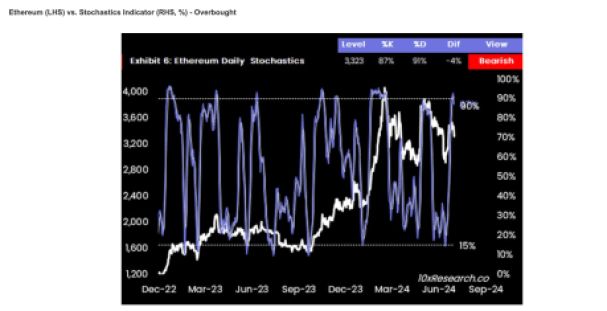

- Technical Indicators: Technical analysis suggests that ETH might have already reached its peak.

Will ETH Recover?

It’s hard to say for sure, but things don’t look great right now. The Grayscale outflows are a major concern, and the technical indicators are suggesting that the price could continue to drop.

What’s Next?

Analysts are predicting that the ETH price could continue to decline in the short term. They are suggesting that now might be a good time to short Ethereum, meaning they expect the price to drop even further.