Bitcoin’s price has been stuck in a rut lately, even though the Federal Reserve just cut interest rates for the first time since 2020. This has left many investors scratching their heads.

Don’t Get Carried Away by Interest Rates

Andrew Kang, CEO of Mechanism Capital, thinks people are putting too much emphasis on interest rates and China’s economic stimulus. He argues that while these factors are important, they’re not the only things that drive Bitcoin’s price.

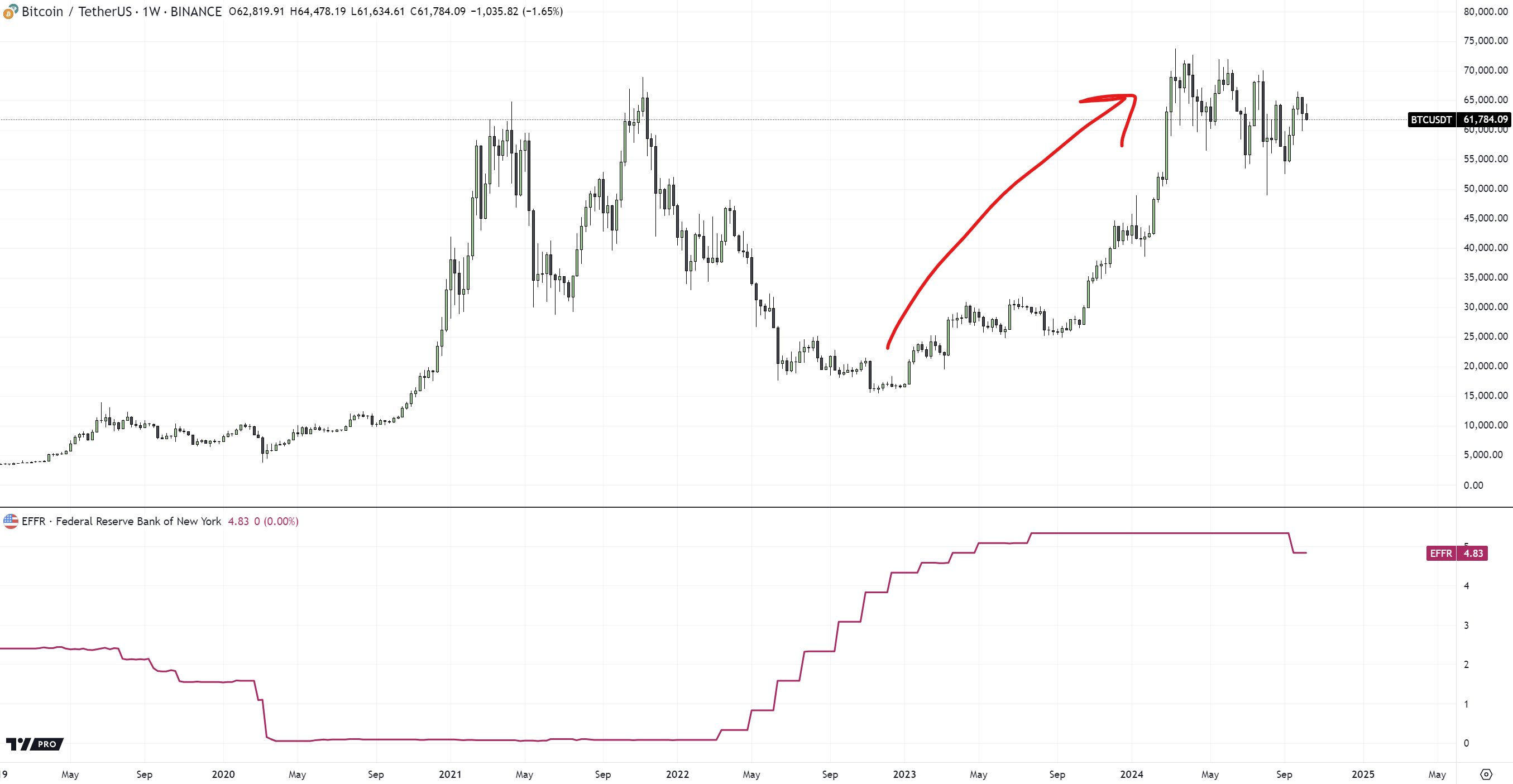

He points out that Bitcoin actually went up a lot during a period when interest rates were high. So, just because rates are going down doesn’t mean Bitcoin is guaranteed to skyrocket.

Kang believes that the market is overreacting to interest rate changes. He says that equities are more closely tied to interest rates because they’re used to value company earnings.

China’s Stimulus Isn’t a Magic Bullet

Kang also says that China’s economic stimulus won’t have a huge impact on Bitcoin. He points out that Chinese investors are actually moving away from crypto and into the stock market.

What’s Really Moving Bitcoin?

So, what’s actually driving Bitcoin’s price? Kang thinks it’s more about things like the potential launch of a Bitcoin ETF. He also points out that Bitcoin’s price has historically been more closely tied to the amount of money in circulation than interest rates.

The Future of Bitcoin

Kang isn’t bearish on Bitcoin, but he thinks it will stay within a range of $50,000 to $72,000 for now. He believes there will still be opportunities to make money in the market, but warns that there could be some volatility.

Overall, it seems like the market is still figuring out what will drive Bitcoin’s price in the future. While interest rates and China’s stimulus are important factors, they’re not the only things to consider.