An expert believes Bitcoin has historically recovered from downturns like the current one.

Miner Capitulation and Bitcoin’s Price

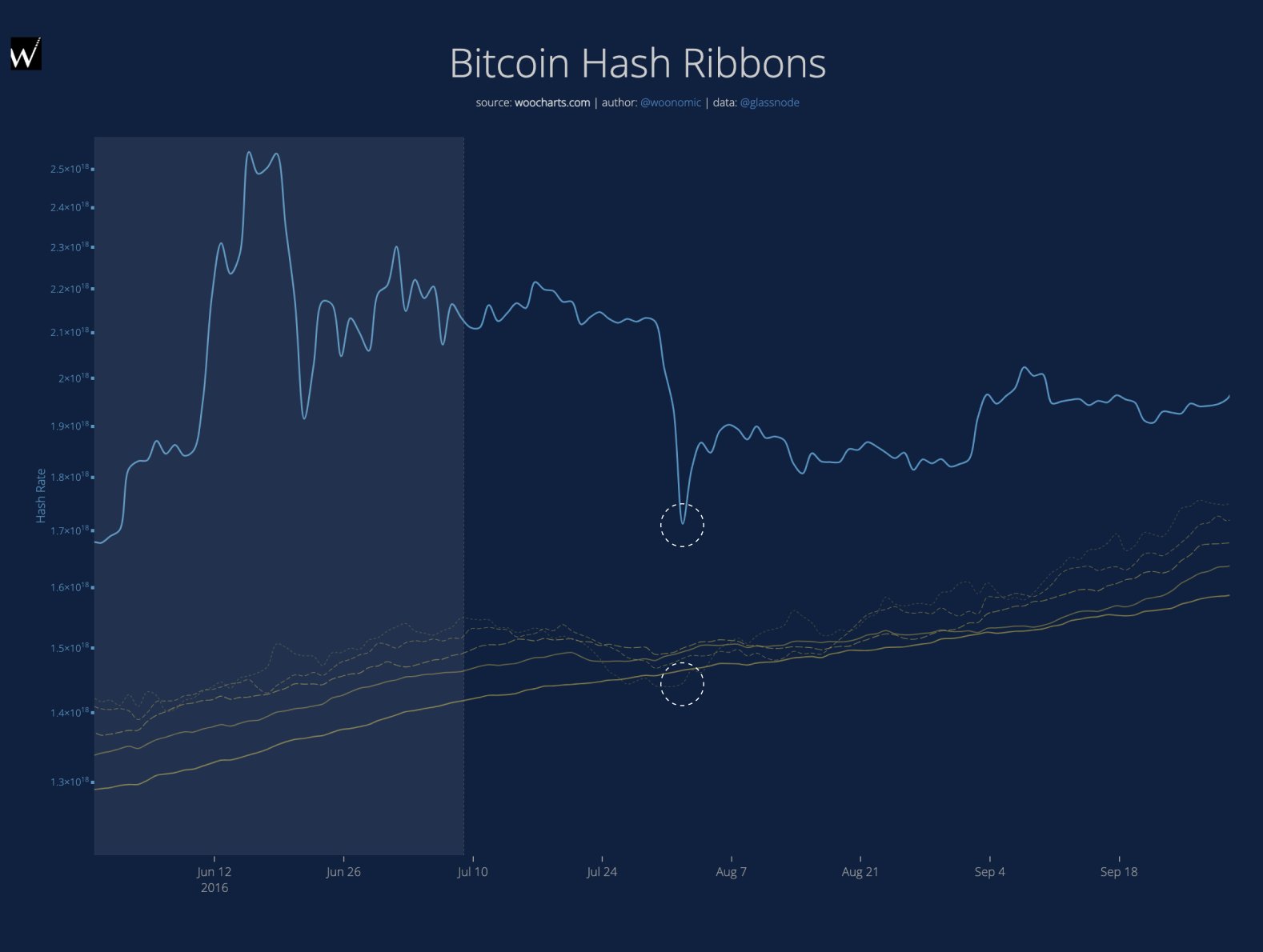

Analyst Willy Woo explains that Bitcoin’s hashrate (a measure of mining power) is linked to its price recovery.

When miners find it profitable to mine Bitcoin, the hashrate increases. When it becomes less profitable, miners may disconnect from the network, causing the hashrate to decrease.

The “hash ribbons” indicator compares short-term and long-term moving averages of the hashrate. When the short-term average falls below the long-term average, it signals mass miner capitulation.

Current Miner Capitulation

According to Woo, Bitcoin recovers when “weak miners die and hash rate recovers.” This happens when capitulation ends.

Currently, the hash ribbons indicate that miners are capitulating. This is due to the recent halving event, which cut block rewards for miners in half.

This capitulation has been ongoing for 61 days, which is longer than previous capitulation periods.

Bitcoin Price Outlook

As of writing, Bitcoin is trading at around $63,900, down over 4% in the past week.

It remains to be seen when the hash ribbons will cross back and if miner recovery will lead to a recovery in Bitcoin’s price.