So, imagine this: Bitcoin skyrocketing to a staggering $1 million in just a matter of days or weeks. Sounds wild, right? Well, that’s the bold prediction from Samson Mow, the CEO of JAN3. And before you dismiss it as pure speculation, Mow argues that Bitcoin’s knack for defying expectations is precisely what makes this meteoric rise a possibility.

Max Pain for the Majority

Mow’s not just throwing numbers out there; he’s diving into the concept of “max pain” for the majority. The unpredictable nature of Bitcoin, as he puts it, is what sets the stage for a rapid price surge. Such a spike could throw a wrench not only into individual plans but potentially disrupt entire economic systems.

Under Mow’s leadership, JAN3 has been gearing up to bring entire nation-states into the Bitcoin ecosystem. However, an abrupt price hike could seriously complicate this ambitious plan.

Breaking Models and Practicality

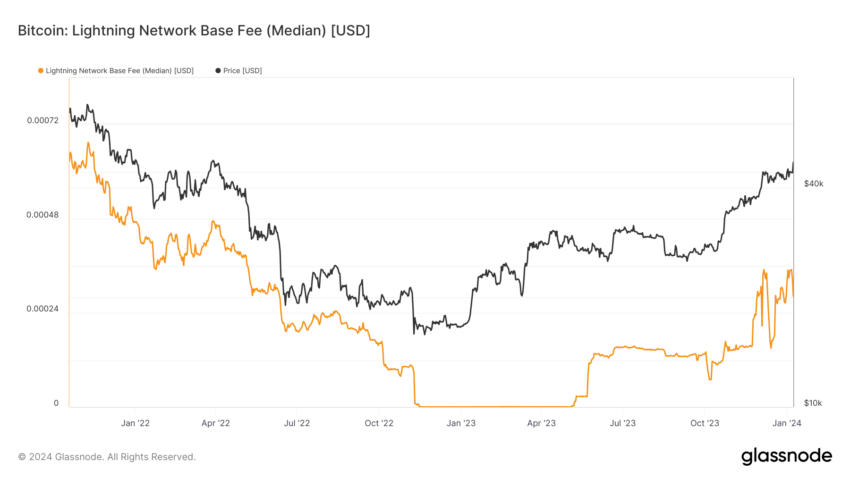

Mow brings up Plan B’s Stock-to-Flow model, a popular tool for predicting Bitcoin prices, suggesting that it might crumble under the pressure of a million-dollar Bitcoin. He also points out potential impracticalities with the Lightning Network, designed to facilitate faster and cheaper transactions. A sudden surge to $1 million could render current lightning channels useless, challenging the assumption of “cheap” transaction fees.

Impacts on Big Players

Imagine MicroStrategy, led by Michael Saylor, striving to own 1% of the Bitcoin supply, only to find it slipping away due to the unexpected price surge. Similarly, El Salvador, a country making significant strides in adopting Bitcoin, might miss out on issuing Bitcoin bonds and building reserves at lower prices.

And then, Mow humorously suggests that Bitcoin’s hyperbitcoinization could spell job losses for notable economists and central bankers, as the financial landscape rapidly reshapes around Bitcoin. Even gold advocates like Peter Schiff might face a tough reality check, grappling with the psychological impact of Bitcoin hitting the million-dollar mark.

Missed Opportunities and Unforeseen Shifts

In the bigger picture, Mow’s prediction paints a picture of missed opportunities for the global population. A sudden leap to $1 million could mean that most people miss their chance to invest in Bitcoin conventionally. Instead, earning Bitcoin through work might become the only viable option for many.

Mow wraps it up by stressing that the likelihood of Bitcoin making an unexpected move, causing “max pain” for a large number of people, is substantial. He points to factors like spot Bitcoin ETF approvals, the upcoming Bitcoin halving, nation-state adoption, renewed quantitative easing, and the Veblen effect as potential game-changers not yet reflected in Bitcoin’s current price.

While Mow’s prediction might raise eyebrows, it’s a vivid reminder of Bitcoin’s inherent unpredictability and its capacity for significant disruption.