On Thursday, Bitcoin whales, investors holding significant amounts of the cryptocurrency, seized the opportunity of a price dip to accumulate a massive $1.235 billion worth of BTC.

Whales Accumulate at Low Prices

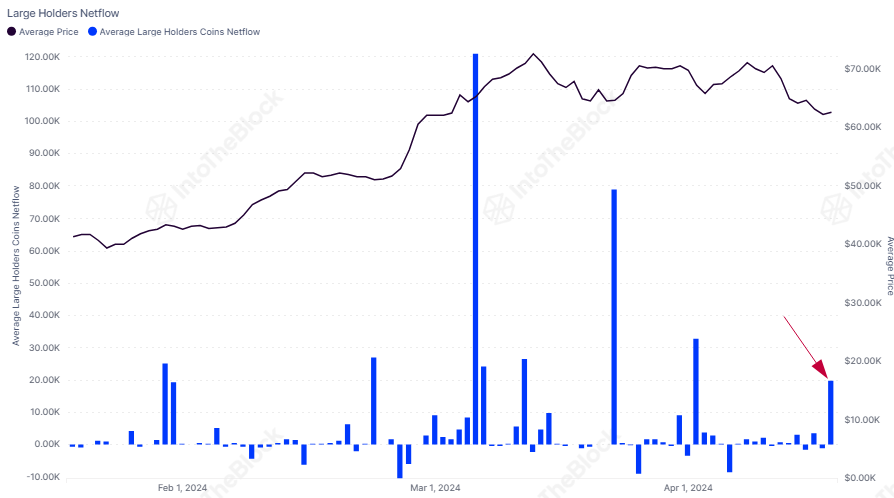

According to IntoTheBlock, a crypto analytics firm, whales with over 0.1% of the total BTC supply collectively bought 19,760 Bitcoins at an average price of $62,500 per coin. Historically, such accumulations by whales have often preceded price increases for Bitcoin.

Miners Sell Ahead of Halving

IntoTheBlock also observed that miners’ BTC holdings have reached a 12-year low ahead of the halving event on Friday night. This indicates that miners have been selling their Bitcoin in anticipation of the halving, which reduces the block rewards for miners from 6.25 BTC to 3.125 BTC.

Halving History Favors Bulls

IntoTheBlock analyzed the historical price impact of Bitcoin halvings and found that a bullish trend typically emerges after each halving, lasting for approximately one year.

Outflows from Exchanges

In addition to the whale accumulation, IntoTheBlock reported that $180 million worth of Bitcoin and $0.5 billion worth of Ethereum (ETH) were withdrawn from centralized exchanges this week. This marks six consecutive weeks of net outflows for Bitcoin and the highest amount of ETH withdrawals since February.