A savvy cryptocurrency trader, known as a “whale” for their large holdings, recently made a huge bet against Bitcoin (BTC) and came out on top despite a coordinated effort to wipe them out.

The Short Sell

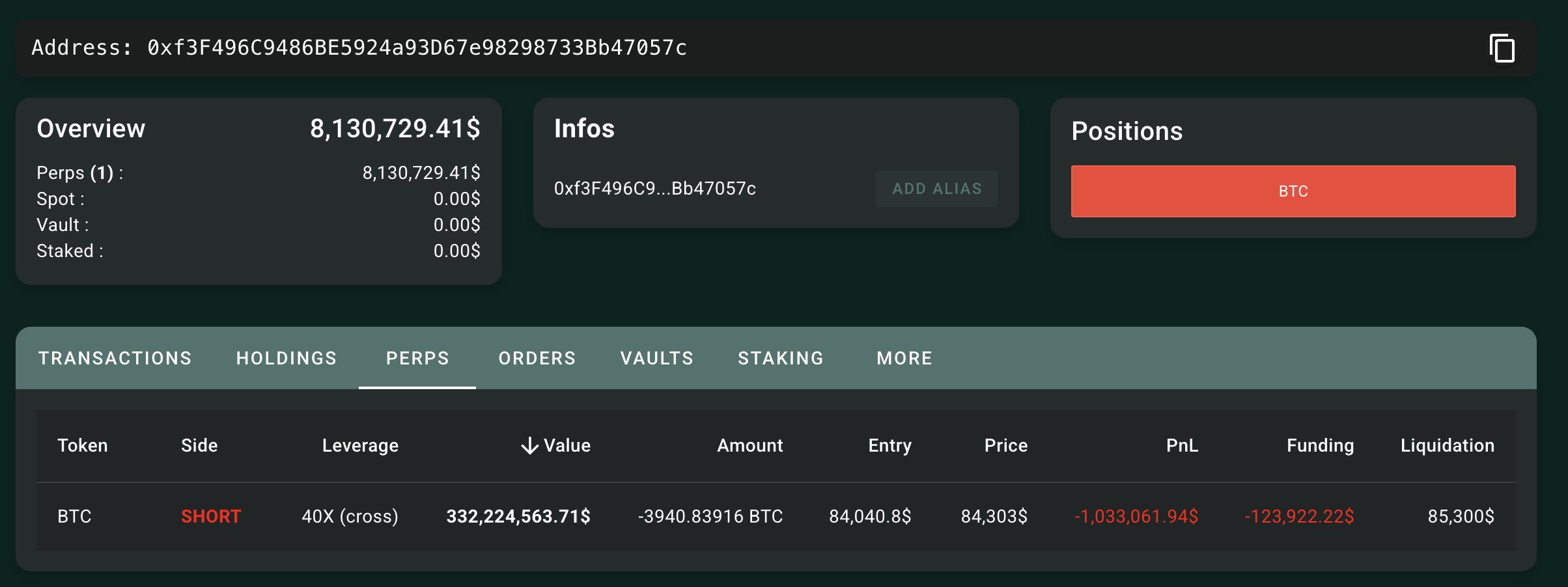

This whale took a massive short position of 3,940 BTC, worth around $332 million, using 40x leverage. This means they borrowed Bitcoin to sell, hoping to buy it back later at a lower price and keep the difference. Their initial entry price was around $84,000 per Bitcoin. The risk? If the price went up, they’d lose big.

Under Attack

Things got interesting when a group of traders publicly announced a plan to drive the Bitcoin price up, aiming to force the whale’s position to be liquidated (meaning they’d be forced to buy back Bitcoin at a loss). They succeeded in briefly pushing the price above $84,690.

A Narrow Escape

The whale, facing potential losses of over $1 million, managed to avoid liquidation by adding $5 million in stablecoins (a type of cryptocurrency pegged to the US dollar) to their account. This increased their buffer, preventing them from being forced to buy back at a loss.

Profit Time

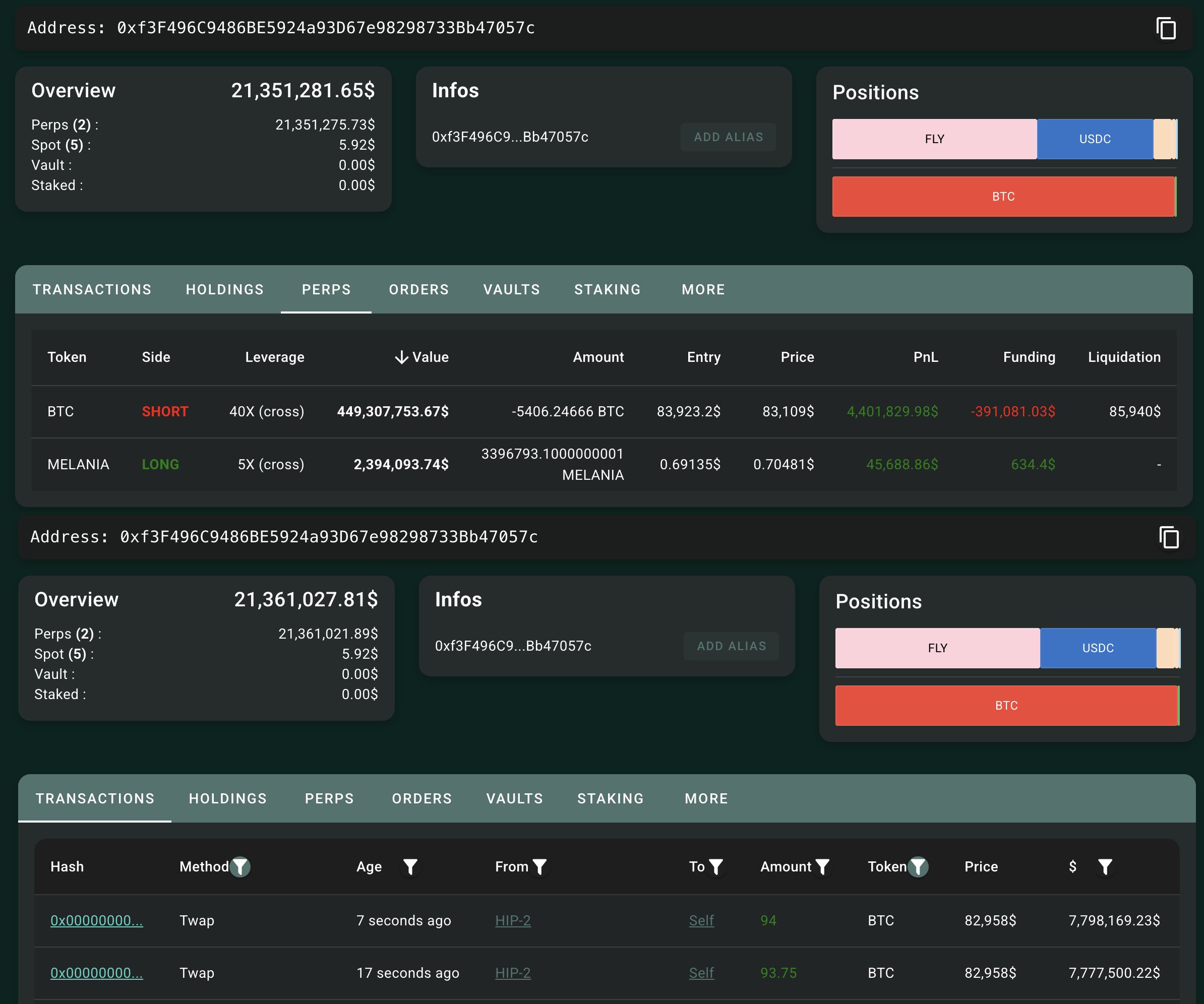

The whale continued to hold their short position, and eventually closed some positions using a time-weighted average price strategy. They now hold 5,406 BTC (worth about $449 million) and are showing an unrealized profit of $4.4 million.

High-Stakes Game

Trading with high leverage can be incredibly risky. While it amplifies potential profits, it also dramatically increases the risk of massive losses if the market moves against you. This whale, however, has a history of successful trades, boasting a 100% win rate one month, earning $16.39 million in profit.

Disclaimer:

This information is for general knowledge and entertainment purposes only and does not constitute financial advice. Investing in cryptocurrencies is highly risky. Do your own research before making any investment decisions./p>