A massive crypto investor, known as a “whale,” recently spent a staggering $24.7 million on Ethereum-based altcoins. This surge in buying activity came after the U.S. Securities and Exchange Commission (SEC) approved the listing of spot Ethereum exchange-traded funds (ETFs).

Whale’s Altcoin Haul

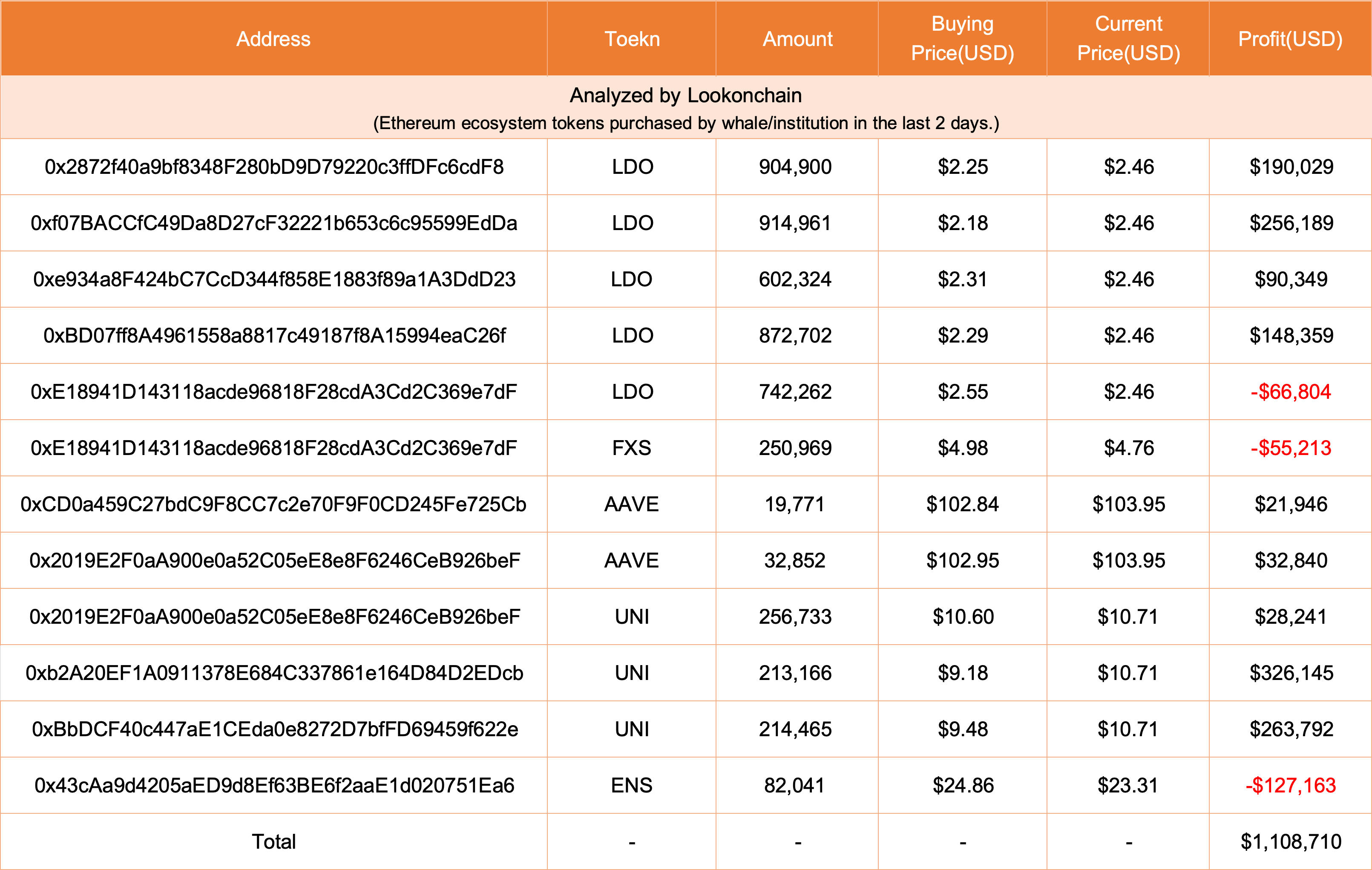

According to blockchain tracking firm Lookonchain, the whale acquired Ethereum just before news of the ETH ETF approval broke. Following the green light from the SEC, the whale accumulated altcoins like Lido (LDO), Uniswap (UNI), Aave (AAVE), Ethereum Name Service (ENS), and Fraxshare (FXS).

Whale’s Strategy

The whale’s strategy involved buying Ethereum at $3,000 and then using the profits to purchase altcoins. The whale has reportedly made an unrealized profit of $1.1 million on the altcoin investments.

Other Whale Activity

Lookonchain also observed a whale on the Solana network shifting its holdings to Dogecoin rival dogwifhat (WIF). The whale spent $2.98 million to acquire WIF, causing its price to rise by approximately 7%.

Implications for the Market

The whale’s actions suggest that institutional investors are becoming more comfortable with investing in cryptocurrencies. The approval of spot ETH ETFs is a significant step in the mainstream adoption of crypto. It is likely that we will see more whales and institutional investors entering the crypto market in the future.