Accumulation Phase

CryptoQuant CEO Ki Young-Ju noticed similarities between Bitcoin’s current behavior and mid-2020. Back then, prices were stagnant, but there was a lot of activity behind the scenes.

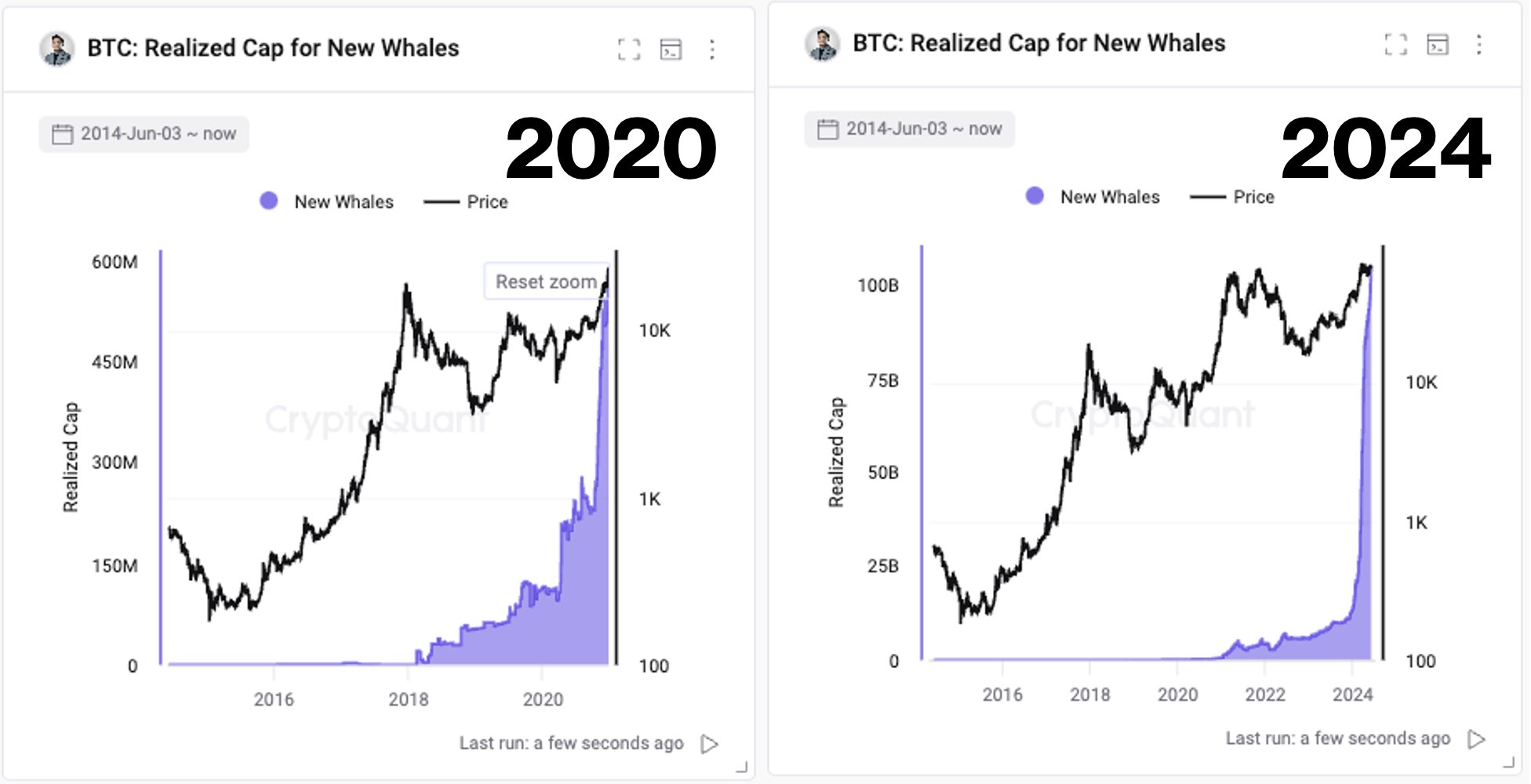

Young-Ju’s charts show a surge in the “realized cap for new whales” in mid-2020. This means large investors were buying up Bitcoin. Despite the current sideways price movement, this trend is repeating itself, with about $1 billion added to new whale wallets daily.

Institutional Interest

This activity suggests that institutions are accumulating Bitcoin. It’s not happening on exchanges, so it’s likely over-the-counter (OTC) deals.

Historical Precedent

In September 2020, Young-Ju pointed out similar activity, which was followed by a 480% surge in Bitcoin’s price.

Potential Impact

The accumulation phase could lead to a significant price movement once the accumulated Bitcoin starts to circulate. This happened in 2020, and it could happen again.

Current Market Conditions

As of writing, Bitcoin is trading at $68,271. The continuous growth in whale holdings and sustained price levels indicate a potential buildup of pressure beneath the surface.