Background

VanEck, an investment firm known for its Bitcoin ETFs, recently settled with the SEC over charges related to a lack of disclosure.

The Issue

In 2021, VanEck launched the Social Sentiment ETF (BUZZ), which tracked an index based on social media insights. However, the SEC found that VanEck failed to disclose:

- The involvement of a social media influencer in promoting the ETF

- A fee structure that would increase the influencer’s compensation as the fund grew

Impact on the Board

This lack of disclosure prevented the ETF’s board from fully evaluating the potential impact of these arrangements on the fund’s management fee.

SEC’s Response

The SEC charged VanEck with violating the Investment Company Act and Investment Advisers Act.

Settlement

Without admitting or denying the findings, VanEck agreed to:

- Pay a $1.75 million civil penalty

- Implement measures to prevent similar disclosure failures

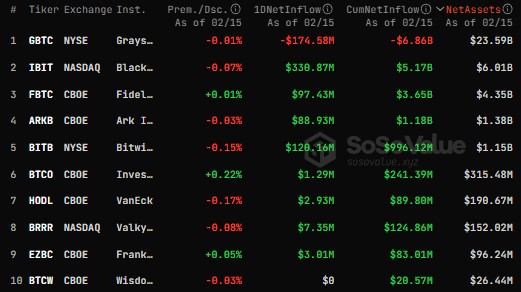

Fee Cut for HODL Bitcoin ETF

In a separate development, VanEck announced a fee reduction for its HODL Bitcoin ETF to 0.20%. This move comes amid competition in the spot Bitcoin ETF market.

Market Trends

The spot Bitcoin ETF market has seen significant investor interest, with net inflows totaling $477 million on February 15th. BlackRock’s IBIT ETF has been a standout performer, with a net inflow of $330 million on the same day.