Regulated stablecoins are on the rise, and Circle’s USDC is leading the pack.

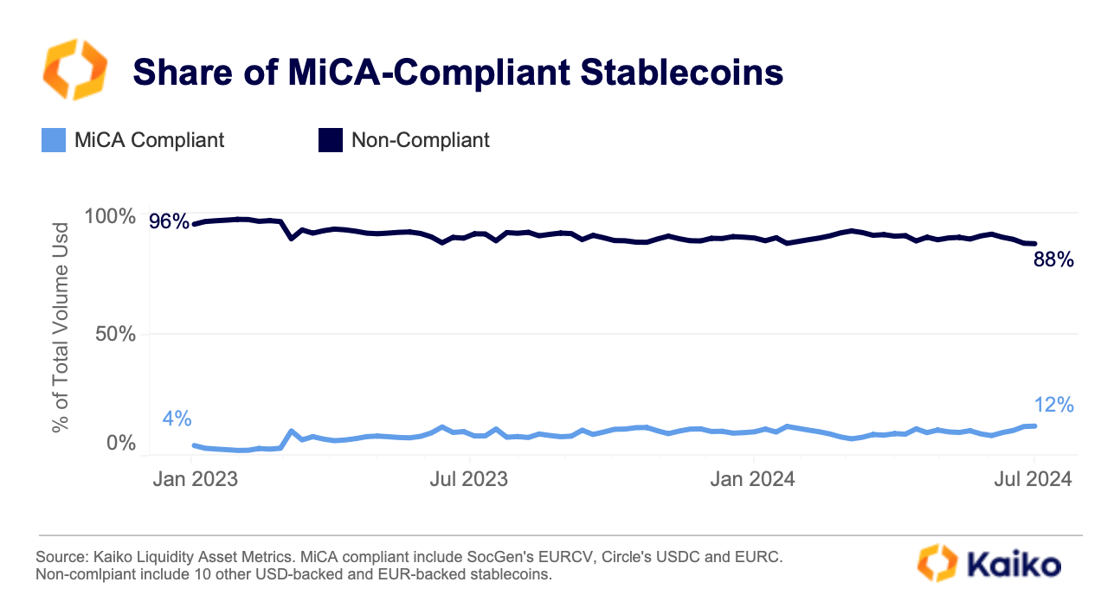

According to crypto analytics firm Kaiko, USDC is seeing the most demand among regulated stablecoins. This is partly because Circle recently announced that USDC and EURC would comply with European crypto regulations. Since then, both stablecoins have seen a big jump in trading volume.

Transparency is Key

While non-regulated stablecoins still dominate the market, regulated stablecoins are gaining ground. This is likely due to investors wanting more transparency and regulation. Major crypto exchanges are already taking action, delisting non-compliant stablecoins for European customers.

USDC is Growing in Popularity

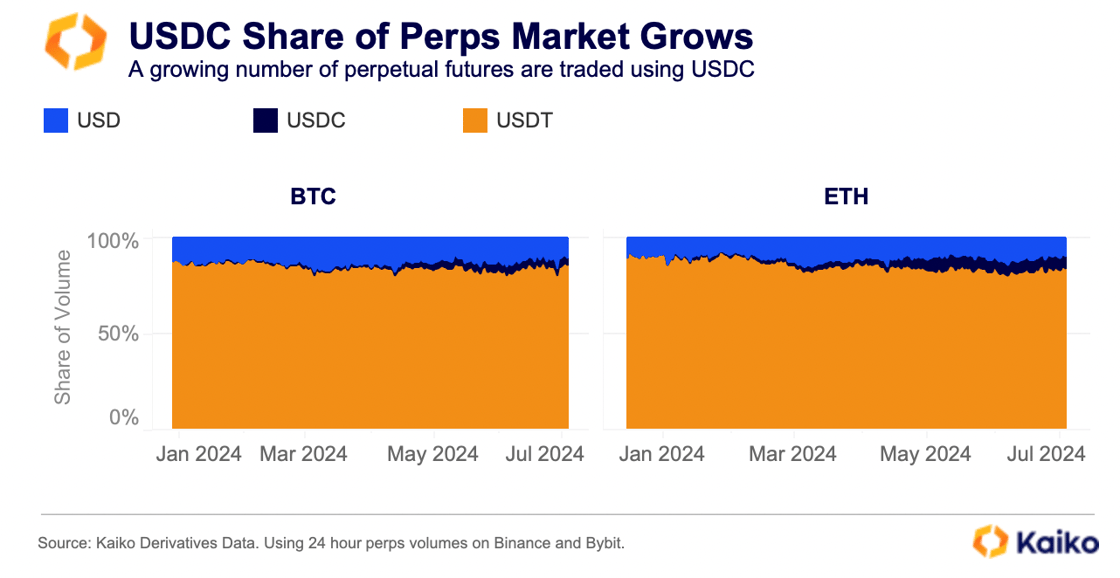

Another factor driving USDC’s growth is its increasing use in perpetual futures contracts. While USDC still lags behind Tether’s USDT in this area, its share of the market is steadily growing. This shows that investors are increasingly choosing regulated stablecoins like USDC as crypto regulations come into effect.

The Bottom Line

The future of stablecoins looks bright for regulated options like USDC. As more investors demand transparency and regulation, we can expect to see even more growth in the USDC market.