Major Wall Street firms are increasingly worried about a US recession.

Increased Recession Probabilities

JPMorgan Chase has bumped up its recession prediction for the US economy to 40%, up from 30% earlier this year. They cite uncertainty caused by government policies as a major factor. Goldman Sachs is also more pessimistic, raising its recession probability forecast from 15% to 20%. Both firms point to the ongoing impact of these policies, even in the face of negative economic data.

Capital Flight Concerns

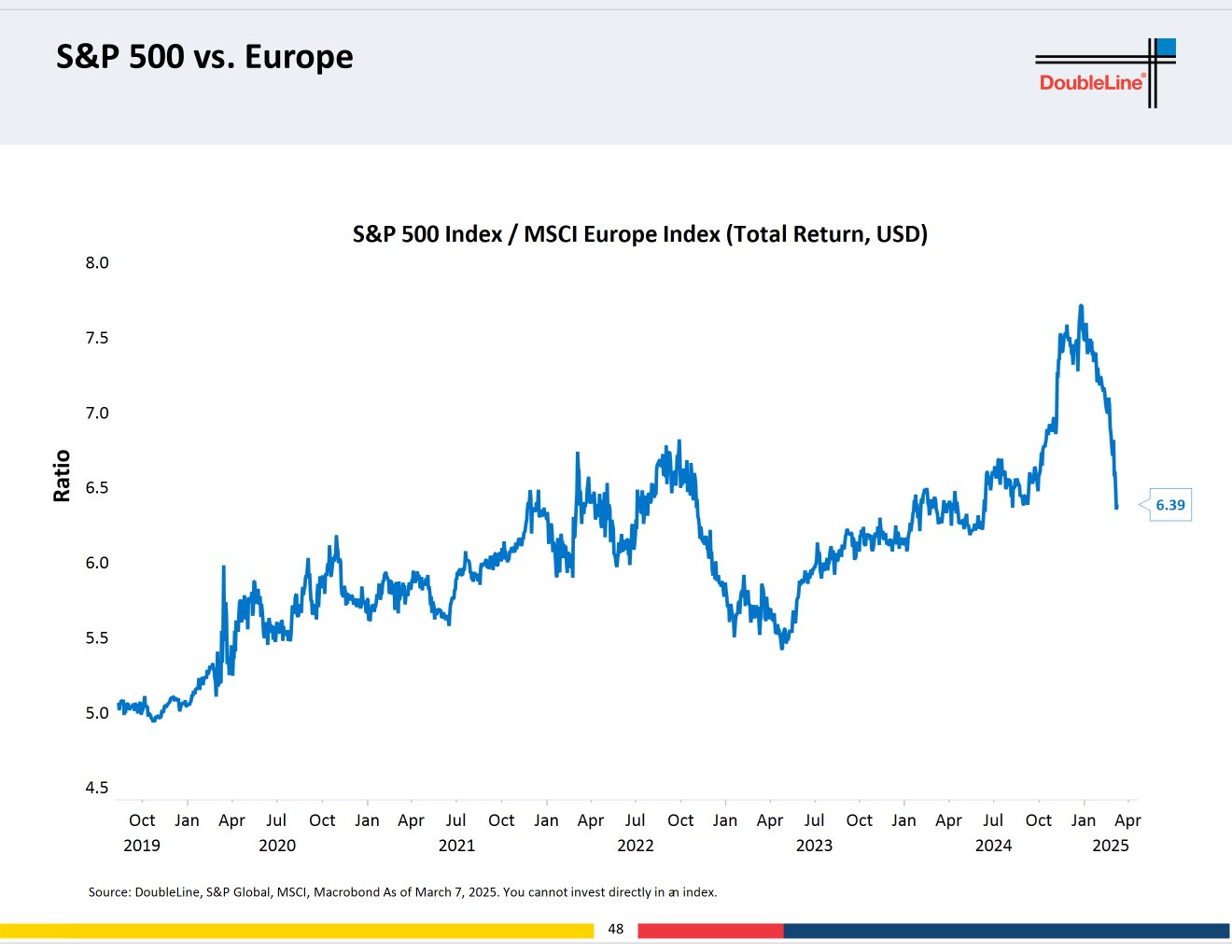

Adding to the gloom, renowned investor Jeffrey Gundlach (“Bond King”) warns of a potential long-term capital flight from the US. He believes Europe’s push to revitalize its industries could draw significant investment away from the US for years, maybe even decades. This shift, he says, could lead to European stocks outperforming US stocks for a considerable period. He notes that the relative performance of US and European stocks is already approaching 2021 levels.

The Bottom Line

The combination of increased recession probabilities from major financial institutions and the warning of prolonged capital flight paints a concerning picture for the US economy. These predictions should be considered alongside other economic indicators and investment strategies. Remember, this is not financial advice; always do your own research before making investment decisions.