Billionaire Chamath Palihapitiya believes the US economy is already in a downturn, despite official GDP growth figures.

GDP Measurement Concerns

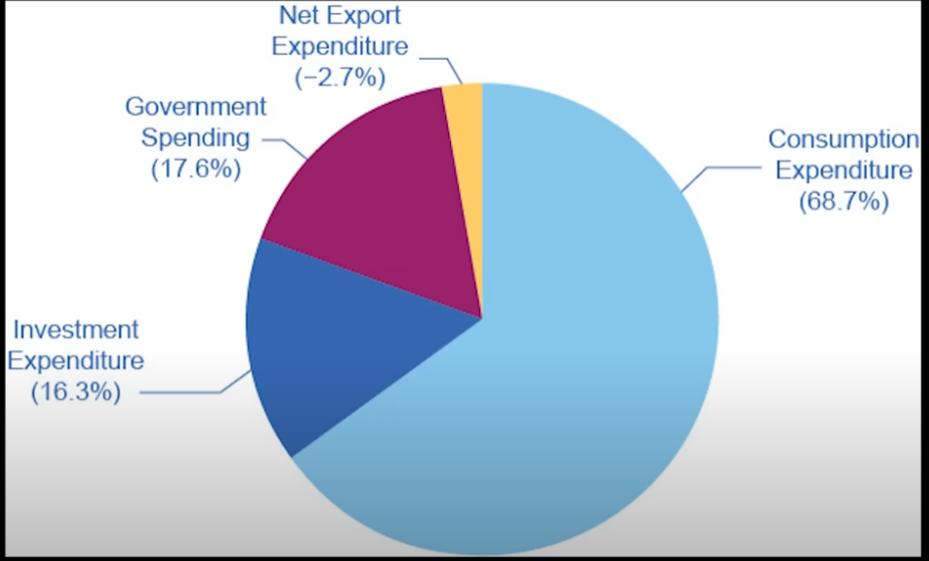

Palihapitiya argues that GDP, which measures the value of goods and services produced, may not accurately reflect the economy’s true state. He notes that GDP growth is driven by consumer spending, business investment, government spending, and exports.

However, when interest rates are high, consumers and businesses tend to save more and invest less. Government spending, on the other hand, remains high regardless of interest rates.

Discrepancy between GDP and Public Perception

Palihapitiya believes that this dynamic has led to a disconnect between GDP figures and public perception. While GDP may show growth, many Americans feel they have less money due to rising costs and stagnant wages.

Quasi-Synthetic Recession

Palihapitiya suggests that the economy is in a “quasi-synthetic” recession, where GDP numbers do not reflect the actual economic conditions experienced by most Americans. He argues that the sustained government spending is artificially propping up the economy, masking the underlying weakness.

Call for Reassessment

Palihapitiya urges a reassessment of economic measurement methods to better capture the true state of the economy. He believes that the current GDP metric fails to accurately reflect the experiences of average Americans.