A recent report shows a big trend in the crypto world: US startups are dominating venture capital (VC) funding.

US Dominance in Crypto VC

In the final quarter of 2024, almost half of all VC money in crypto and blockchain went to US-based startups – a whopping 46%! Hong Kong was a distant second at 16%, with Singapore and the UK trailing behind. The US also led in the number of deals, accounting for 36% of the total. This happened despite the ongoing regulatory uncertainty in the US. Experts suggest a potential pro-crypto administration could make things even better for US crypto companies.

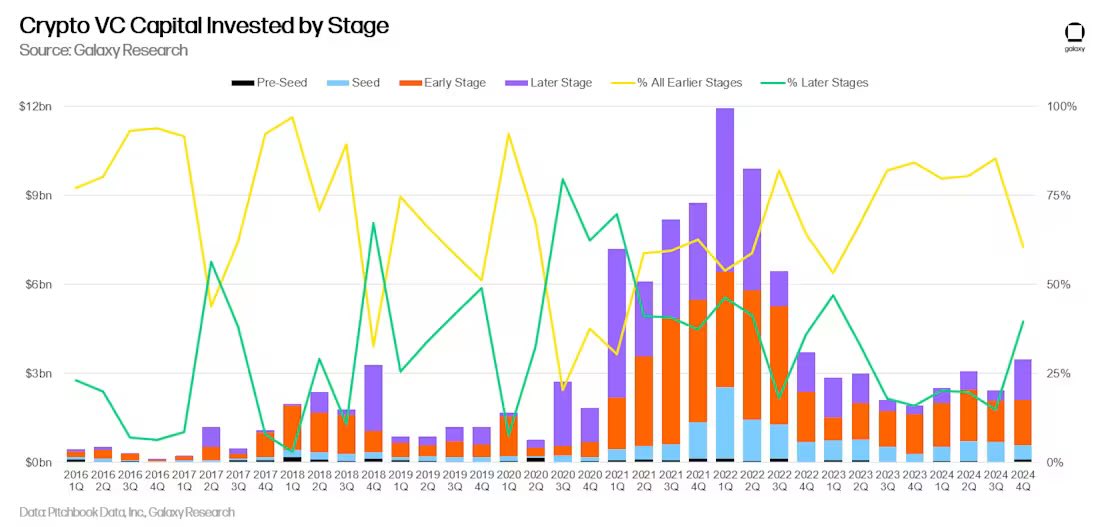

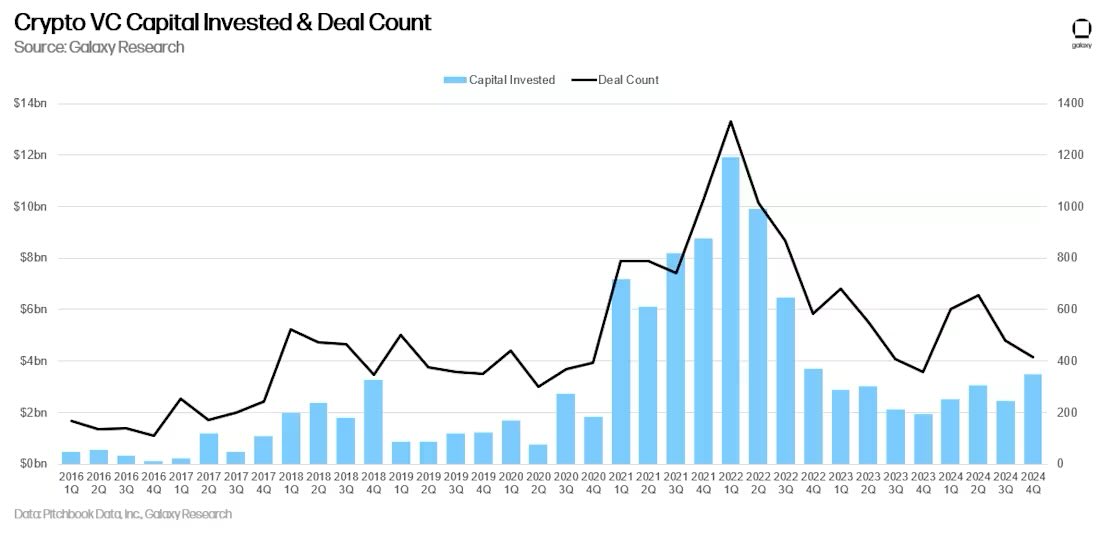

Early and Late-Stage Funding

The report also showed strong interest in both early and late-stage crypto companies. Around 60% of the funding went to early-stage startups, showing continued excitement for new blockchain projects. The other 40% went to more established companies, with big deals like Cantor’s $600 million investment in Tether playing a role. While the number of deals dropped slightly, the total amount invested jumped to $3.5 billion – a 46% increase from the previous quarter. Interestingly, crypto venture funds themselves saw a bit of a slowdown, with only $1 billion allocated to new funds.

What’s Next for US Crypto?

With the US firmly in the lead for crypto VC funding, 2025 looks promising. A more crypto-friendly government could clear up regulatory issues, leading to even more investment. The strong early-stage funding shows that new ideas are still getting support, ensuring continued innovation.

Beyond the US, the report highlighted some key global trends: Web3, decentralized finance (DeFi), and blockchain infrastructure are attracting a lot of investment. These areas are expected to be major drivers of future growth in the crypto world.