According to Ki Young Ju, CEO of CryptoQuant, the US Bitcoin (BTC) market is poised to lead the next leg up in crypto prices.

Stablecoins and Offshore Liquidity

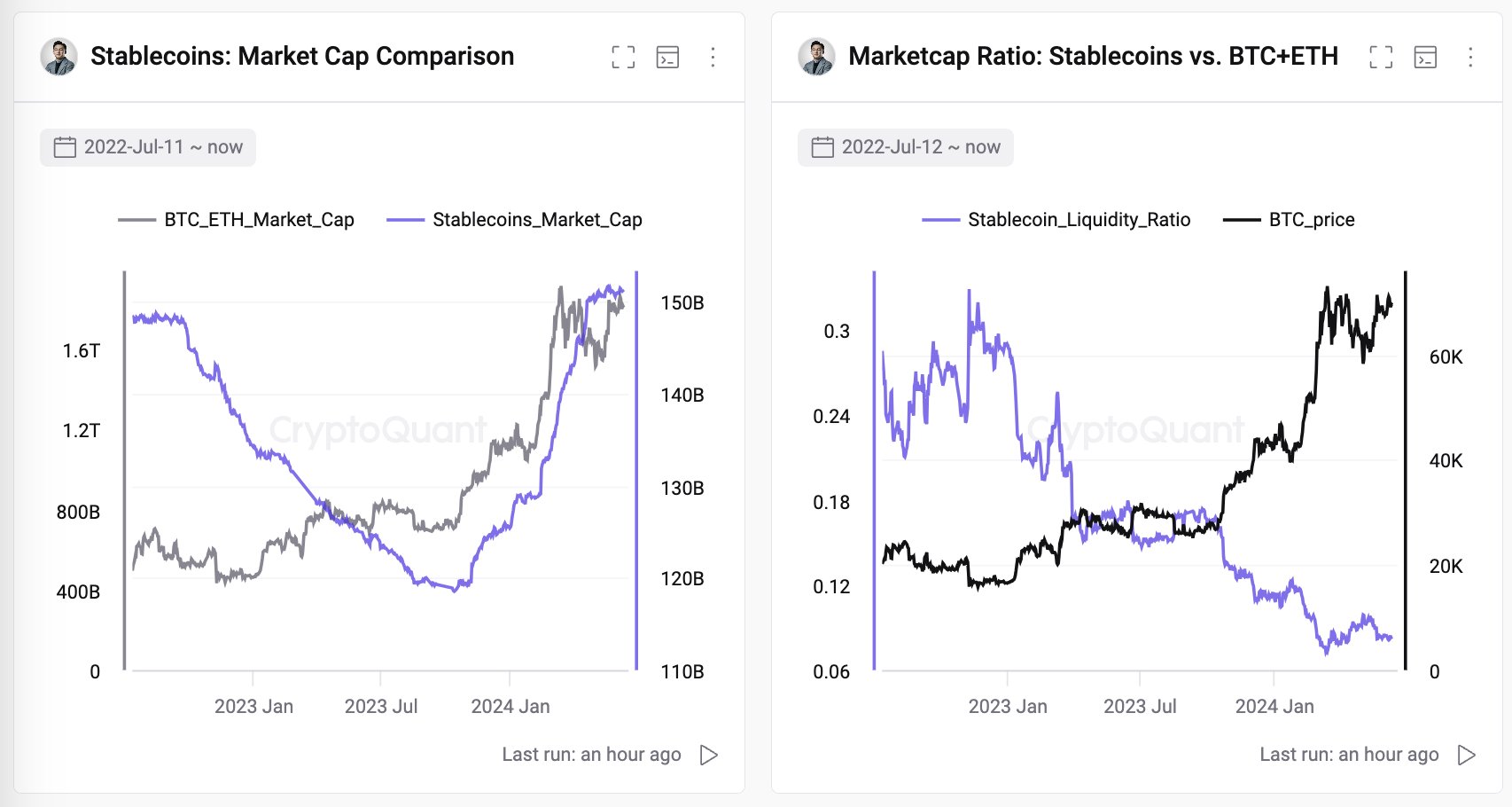

Ju notes that while stablecoins are often seen as a source of global liquidity, their market cap growth is not keeping pace with BTC and ETH. He believes stablecoins alone cannot drive the next market surge.

Coinbase’s Dominance and Institutional Influence

Coinbase, with its 46% dominance in global BTC-USD spot markets, is a major player in the market. Ju attributes its rising influence to institutional brokerage services.

South Korean Market and Altcoin Trading

South Korea’s won (KRW) is the second largest fiat for trading volume, but it primarily involves altcoins. Upbit, a South Korean exchange, saw 82% of its volume come from altcoins last month.

Bitcoin’s Value and Thermo Cap Ratio

Ju emphasizes that Bitcoin is not currently overvalued based on network fundamentals. He cites the “thermo cap ratio,” which represents the investment cost in the Bitcoin network, as evidence.

Conclusion

The US Bitcoin market is expected to be the driving force behind the next crypto surge. While stablecoins and offshore liquidity are important, they are not sufficient on their own. Coinbase’s dominance and institutional involvement, along with the South Korean market’s focus on altcoins, are all factors to consider.