The US banking system is facing some challenges, according to the Federal Deposit Insurance Corporation (FDIC). The number of banks considered “problem banks” is on the rise, and banks are still dealing with billions of dollars in losses on investments.

More Banks on the “Problem List”

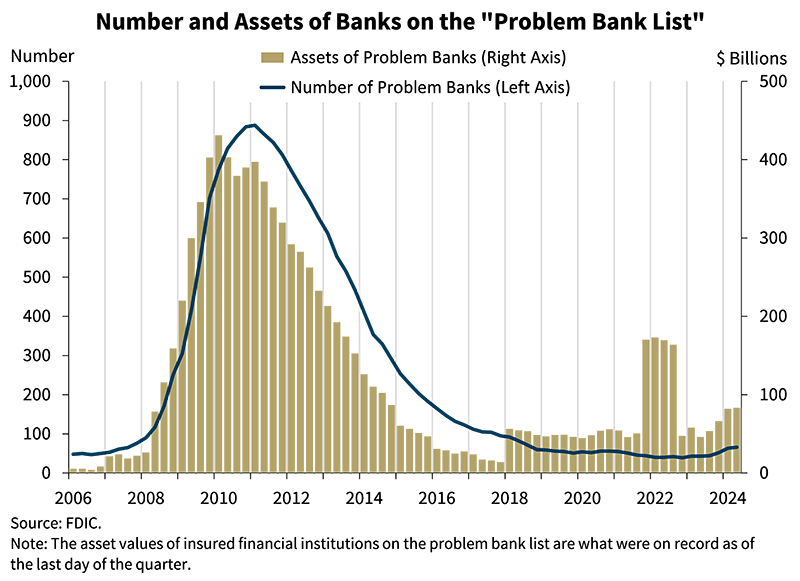

The FDIC’s latest report shows that 66 banks are now on its “Problem Bank List,” up from 63 in the previous quarter. This is the fifth quarter in a row that the number of banks with serious financial, operational, or managerial issues has increased.

While this number represents only 1.5% of all banks, it’s still a cause for concern. The FDIC says that a healthy banking system typically has between 1% and 2% of banks on the “Problem Bank List.”

Billions in Losses

The FDIC also reported that US banks are sitting on a whopping $512.9 billion in unrealized losses on securities. This represents a slight decrease from the previous quarter, but it’s still a huge amount of money.

These losses are largely due to rising interest rates, which have driven down the value of bonds held by banks. The FDIC’s chairman, Martin Gruenberg, says that while the banking industry is showing resilience, there are still risks.

Risks Remain

Gruenberg warns that the banking industry faces significant risks from economic uncertainty, rising interest rates, and global events. These factors could lead to challenges with credit quality, earnings, and liquidity.

He also highlights concerns about specific loan portfolios, such as those for office properties, credit cards, and multifamily loans. The FDIC is keeping a close eye on these areas, along with funding and margin pressures.