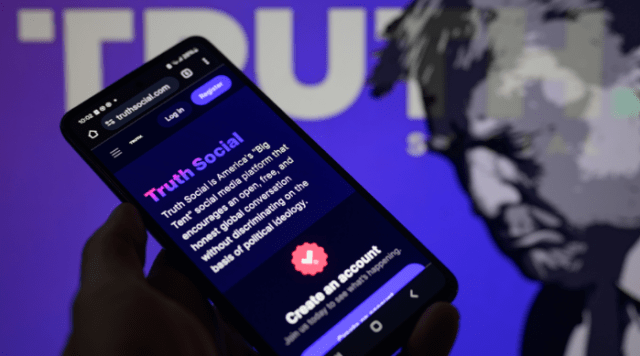

Trump Media’s Truth Social is making waves in the crypto world, submitting an application for a Bitcoin and Ether exchange-traded fund (ETF). This move signals a growing acceptance of crypto investments and throws a wrench into the already competitive ETF market.

A Crypto ETF? What’s the Big Deal?

Truth Social wants to launch an ETF on the NYSE Arca, holding 75% Bitcoin and 25% Ether. Yorkville America Digital is sponsoring the fund, and Crypto.com’s custody arm will securely store the crypto. The application, filed in June, is now under SEC review – a process that could be sped up.

SEC Scrutiny and the Race to Market

The SEC is currently reviewing the application, a process that usually takes around 45 days. This application is one of many, with big players like BlackRock and Fidelity also vying for approval for their own crypto ETFs. Some are focusing solely on Bitcoin, others on Ether, and now we have a Bitcoin/Ether combo in the mix.

The SEC is working on a new automated review system which could drastically reduce review times from months to weeks. This system aims to standardize things like custody and reporting requirements. However, even with this system, approvals aren’t guaranteed. For example, Fidelity’s Solana ETF application recently faced a delay.

What’s Next?

The SEC can approve, reject, or request changes to Truth Social’s application. If the SEC’s push for faster reviews continues, we might see several spot-crypto ETFs hit the market this year. However, until then, every step in the process—from amendments to public comments—will be crucial.

The ETF Battleground

This isn’t just about bragging rights. The success of these ETFs will depend on factors like fees, trading speed, and the trust placed in the custodians. With many applications already in the pipeline, competition is fierce. Investors should keep a close eye on developments to make informed decisions. Truth Social’s entry has definitely added fuel to the fire, and its application could be the one that either breaks the ice or slams the door shut on this wave of crypto ETFs.