Donald Trump’s new crypto project, World Liberty Financial (WLFI), is making waves in the crypto world. It’s been snapping up digital assets, attracting both excitement and skepticism.

A Major Ethereum Purchase

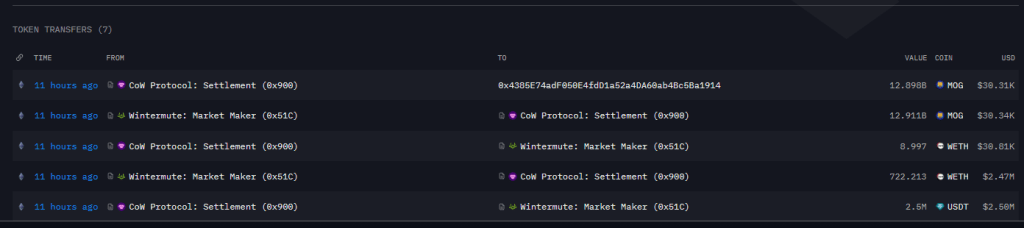

WLFI recently bought 722 Ethereum (ETH) for about $2.5 million, taking advantage of a market dip. This brings their total ETH holdings to a whopping 15,598, worth around $53 million! This move clearly signals WLFI’s ambition to become a major player in decentralized finance (DeFi). Their main goal? To make crypto loans more accessible, challenging traditional banks. This resonates with investors looking for alternatives to traditional financial systems, especially given current banking uncertainties.

Diversifying Investments

WLFI isn’t just focusing on ETH. They’re also investing heavily in other popular cryptocurrencies like Aave (AAVE) and Chainlink (LINK), building a diverse portfolio as part of what Trump calls a “financial revolution.”

Key Players and Concerns

A major factor in WLFI’s success is the involvement of Justin Sun, the TRON founder, who’s invested $30 million and serves as an advisor. Sun brings crypto expertise, while Trump’s name attracts both individual and institutional investors.

However, the partnership isn’t without its critics. Concerns exist about potential conflicts of interest and the possibility of political patronage influencing the venture. WLFI is under close scrutiny as it expands its assets and refines its offerings.

The Road Ahead

While WLFI offers a compelling alternative for those wary of traditional banking, its success in the increasingly crowded DeFi market remains to be seen. Sun’s significant investment and Trump’s high profile have generated huge buzz, but ultimately, WLFI’s future depends on its ability to deliver on its promises while navigating legal hurdles and market volatility.