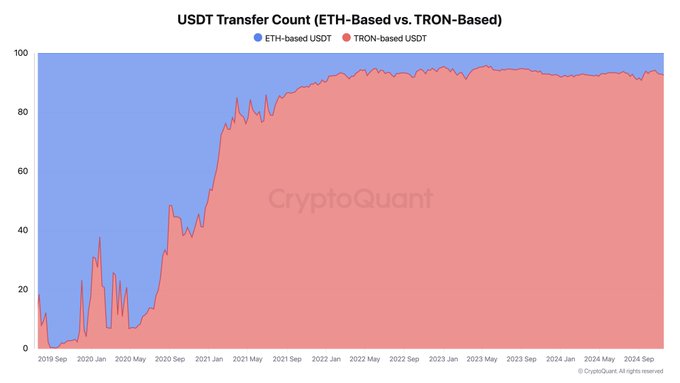

Tron (TRX), an Ethereum competitor, is making waves in the stablecoin market, according to CryptoQuant CEO Ki Young Ju. He highlighted Tron’s impressive achievement on X (formerly Twitter).

Tron’s Stablecoin Success

Ju points out that Tron handles a whopping 92% of all USDT transactions and holds a staggering $60 billion in USDT. This is particularly noteworthy because Tron’s market cap is only $17 billion – meaning the value of USDT on its network is over three times its market capitalization. He attributes this success to Tron’s ability to provide low-cost, fast stablecoin remittances, making it a popular choice for global trade. Ju even called it “the biggest global stablecoin trade remittance system,” adding that he doesn’t own TRX and isn’t being paid to say this, but believes Tron has made a significant impact.

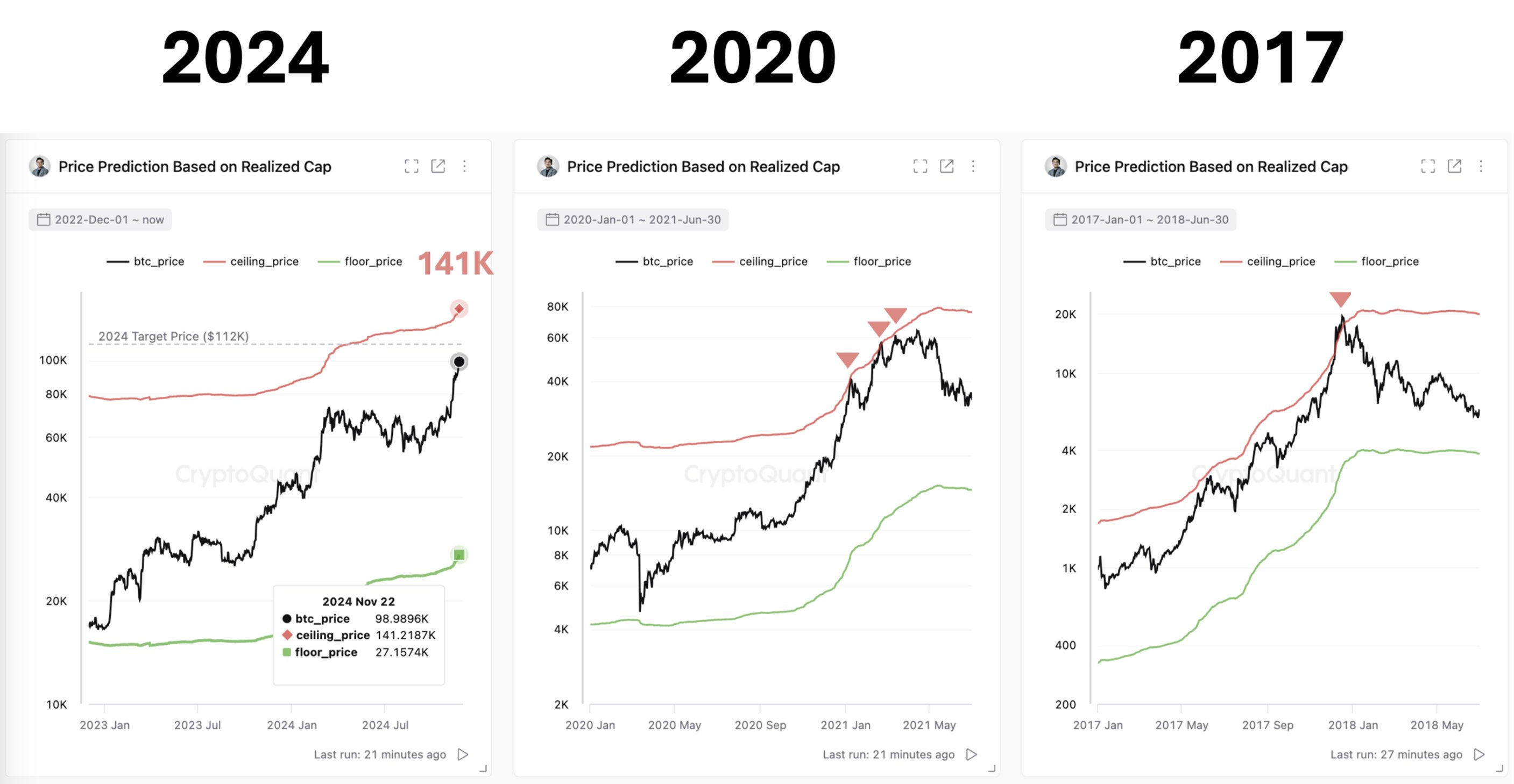

Bitcoin’s Future: Not a Bubble (Yet)

Shifting focus to Bitcoin (BTC), Ju believes it’s too early to label it a bubble. He’s looking at Bitcoin’s realized capitalization (the total value of all BTC based on its last on-chain transaction price) compared to its market capitalization. Historically, he notes, market cap surpasses realized cap during bull markets, peaking as retail investors jump in. The opposite happens in bear markets. Currently, Bitcoin’s market cap hasn’t significantly outpaced its realized cap, suggesting we’re not yet in a bubble phase.

Bitcoin’s Potential Price

Based on Bitcoin’s current realized cap, Ju suggests a potential price rise to $141,000. He emphasizes that the realized cap has been steadily climbing. At the time of writing, Bitcoin was trading around $98,223.

Disclaimer: This information is for general knowledge and shouldn’t be considered investment advice. Always do your own research before making any investment decisions.

/p>