Traditional finance (TradFi) is emerging as the dominant force in tokenizing real-world assets (RWA), according to blockchain data provider Kaiko Analytics.

TradFi Giants Join the Tokenization Wave

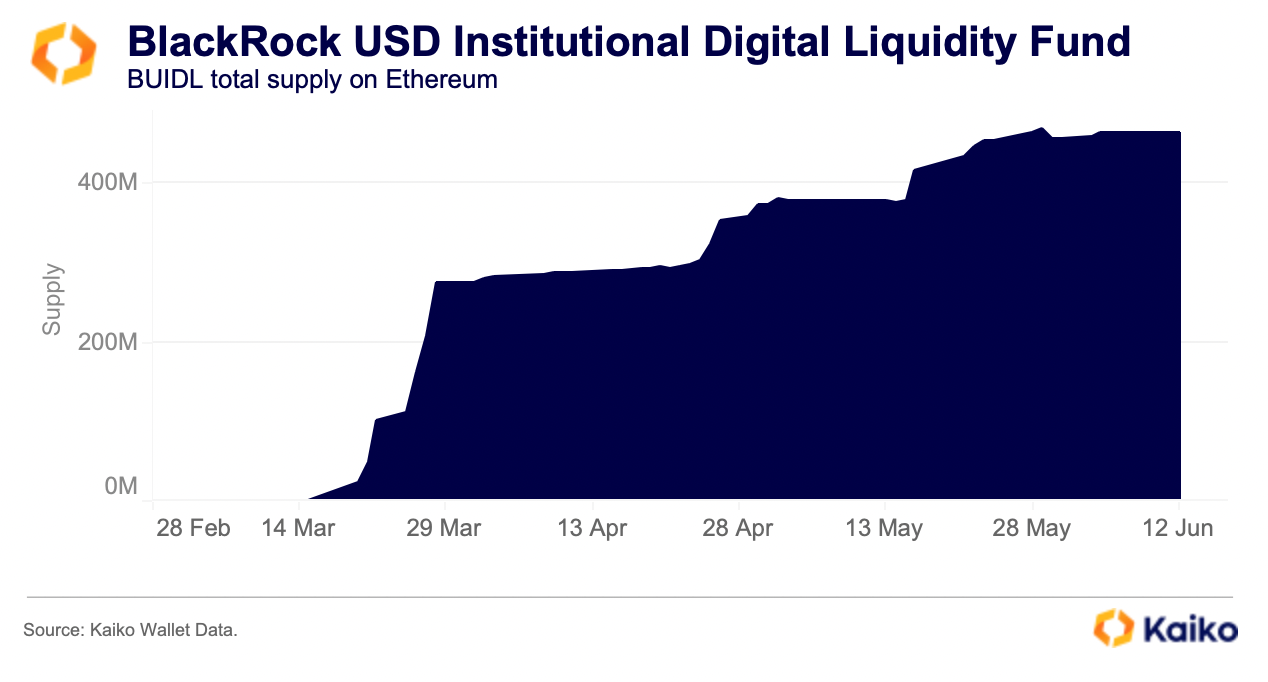

Major TradFi players such as Fidelity, JPMorgan, and BlackRock are leading the charge in tokenizing RWAs using crypto. Fidelity recently joined JPMorgan’s tokenized network, while BlackRock’s tokenized liquidity fund, BUIDL, has grown to over $460 million.

BlackRock’s BUIDL Outperforms Crypto-Native Firms

BUIDL has surpassed several crypto-native firms in terms of asset accumulation, including Maple Finance’s Cash Management Fund, which focuses on short-term cash instruments.

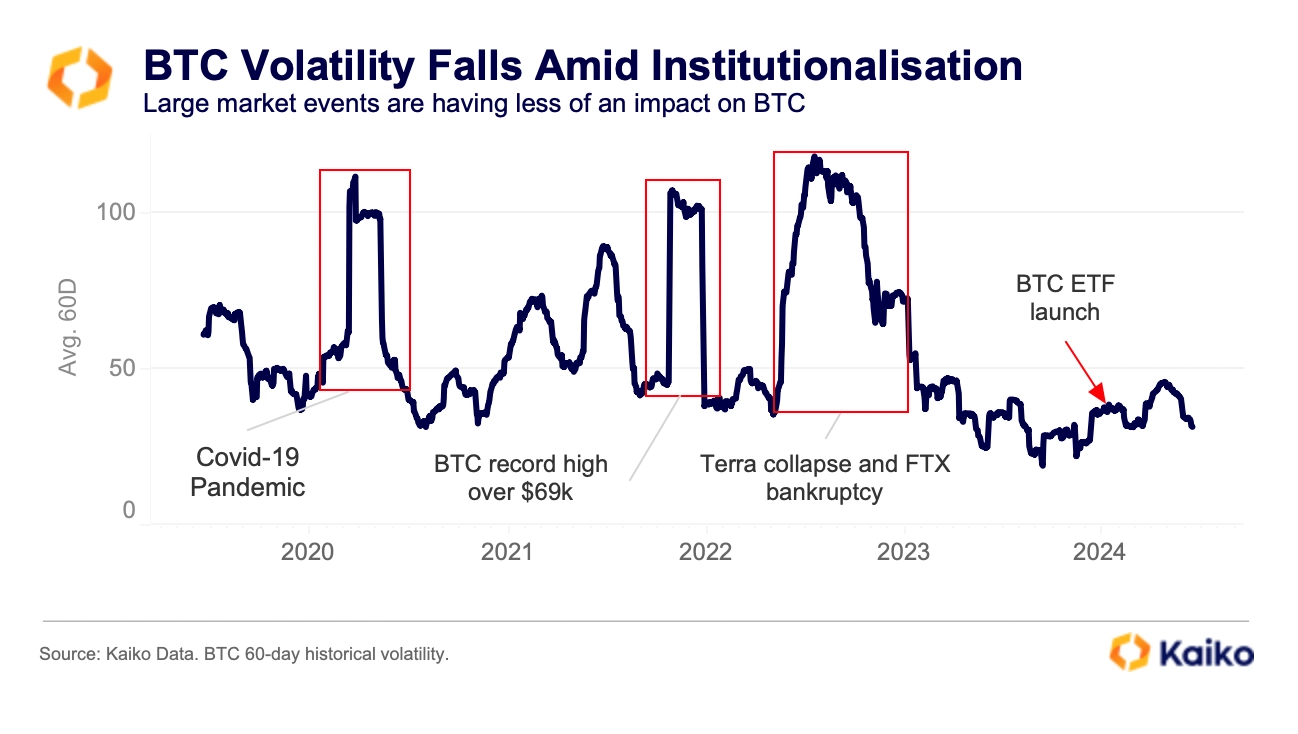

Bitcoin’s Reduced Volatility Signals Maturation

Kaiko also notes that Bitcoin’s (BTC) reduced volatility is a sign of its growing maturity. BTC’s 60-day historical volatility has remained below 50% since the beginning of 2023, a stark contrast to the significant fluctuations seen in 2022.