Former Goldman Sachs exec and Real Vision CEO Raoul Pal is making waves with his analysis of three charts he believes are crucial for understanding the future of both crypto and the global economy.

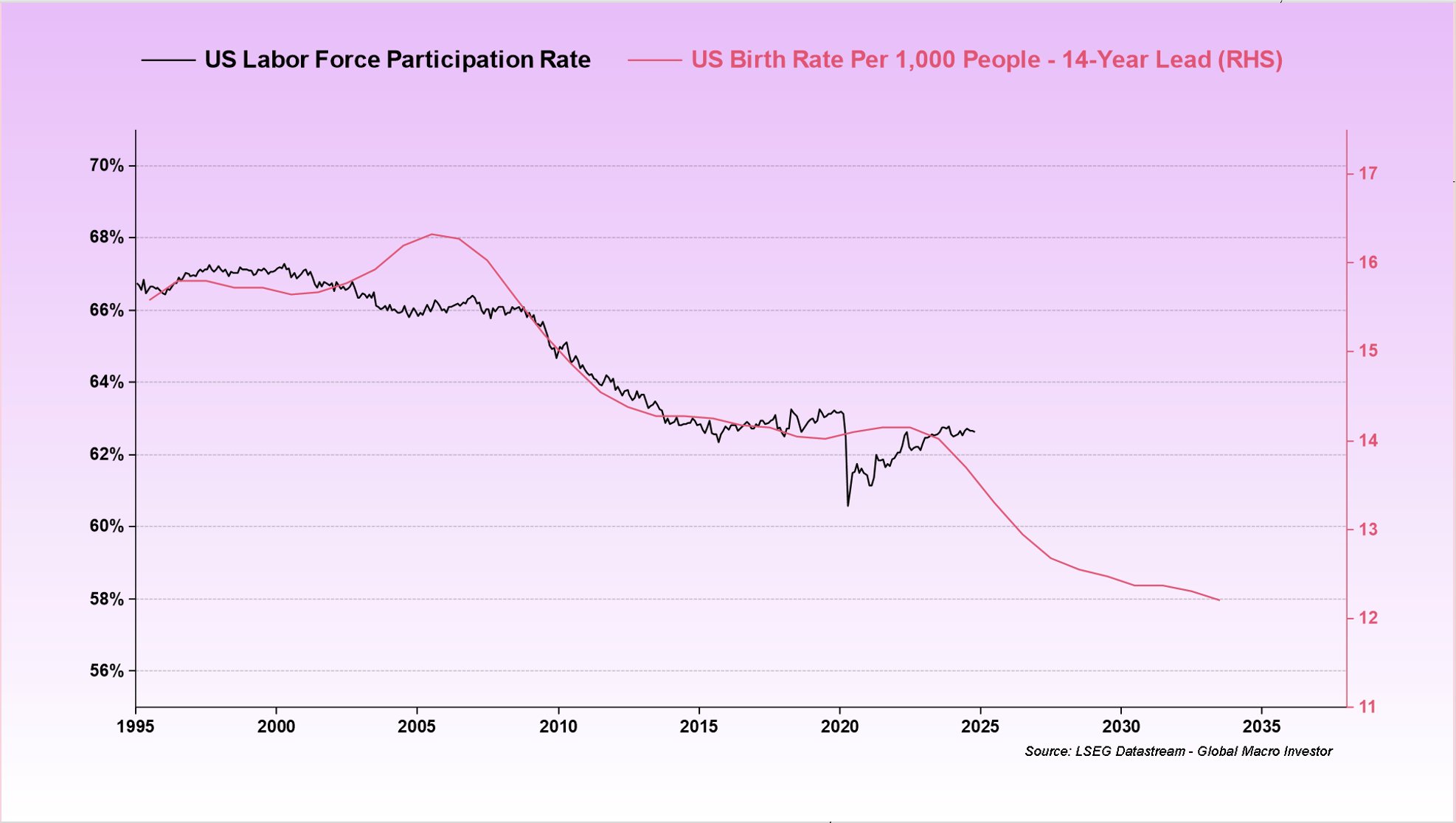

Chart 1: Demographics are Destiny

The first chart shows a worrying trend: the US birth rate and labor force participation rate are both declining. Pal argues this is a major issue because a shrinking workforce leads to slower economic growth.

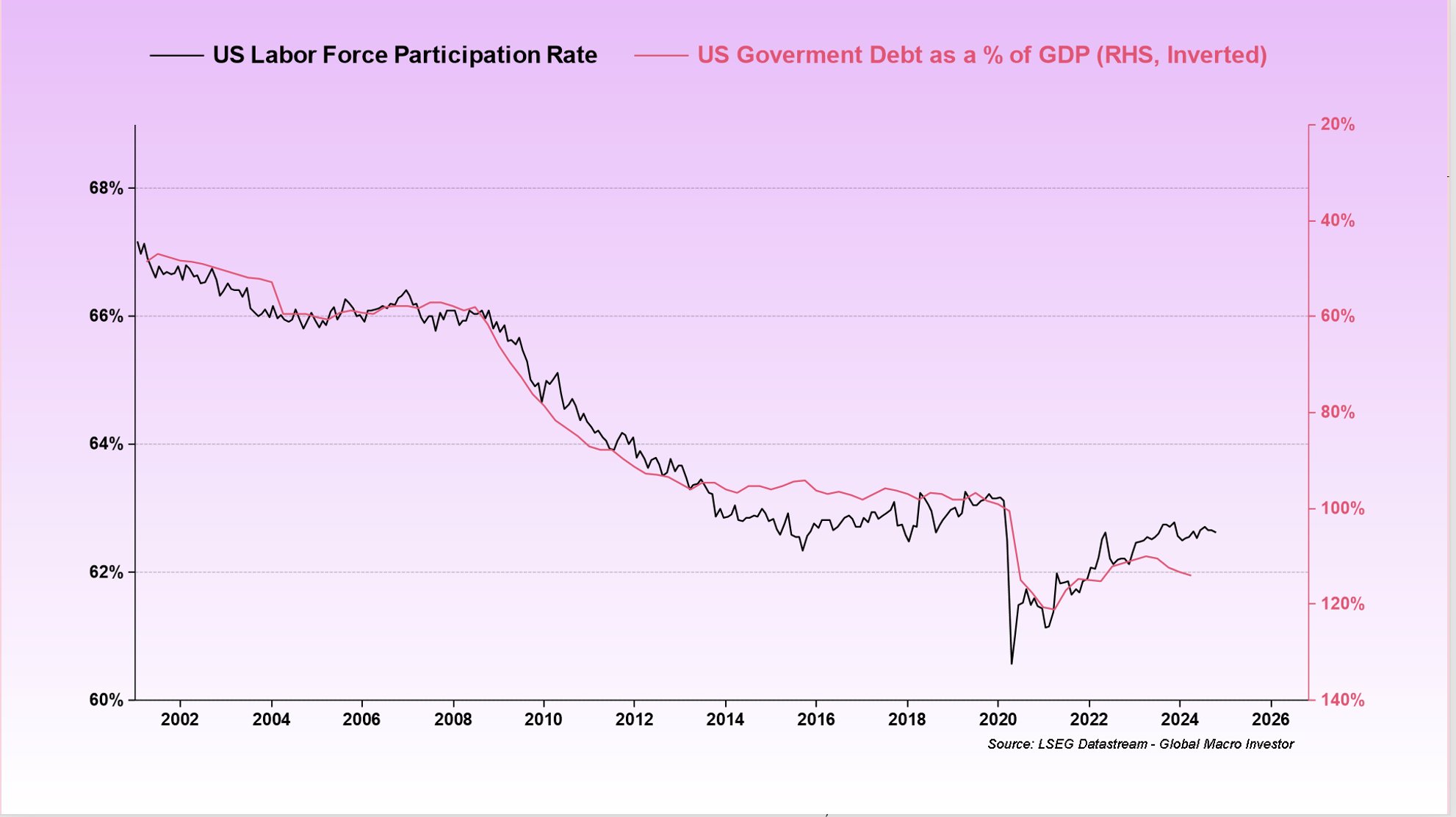

Chart 2: The Debt Bomb

The second chart highlights the link between the declining workforce and rising government debt. As the workforce shrinks, the government needs to borrow more money to maintain growth and support the aging population.

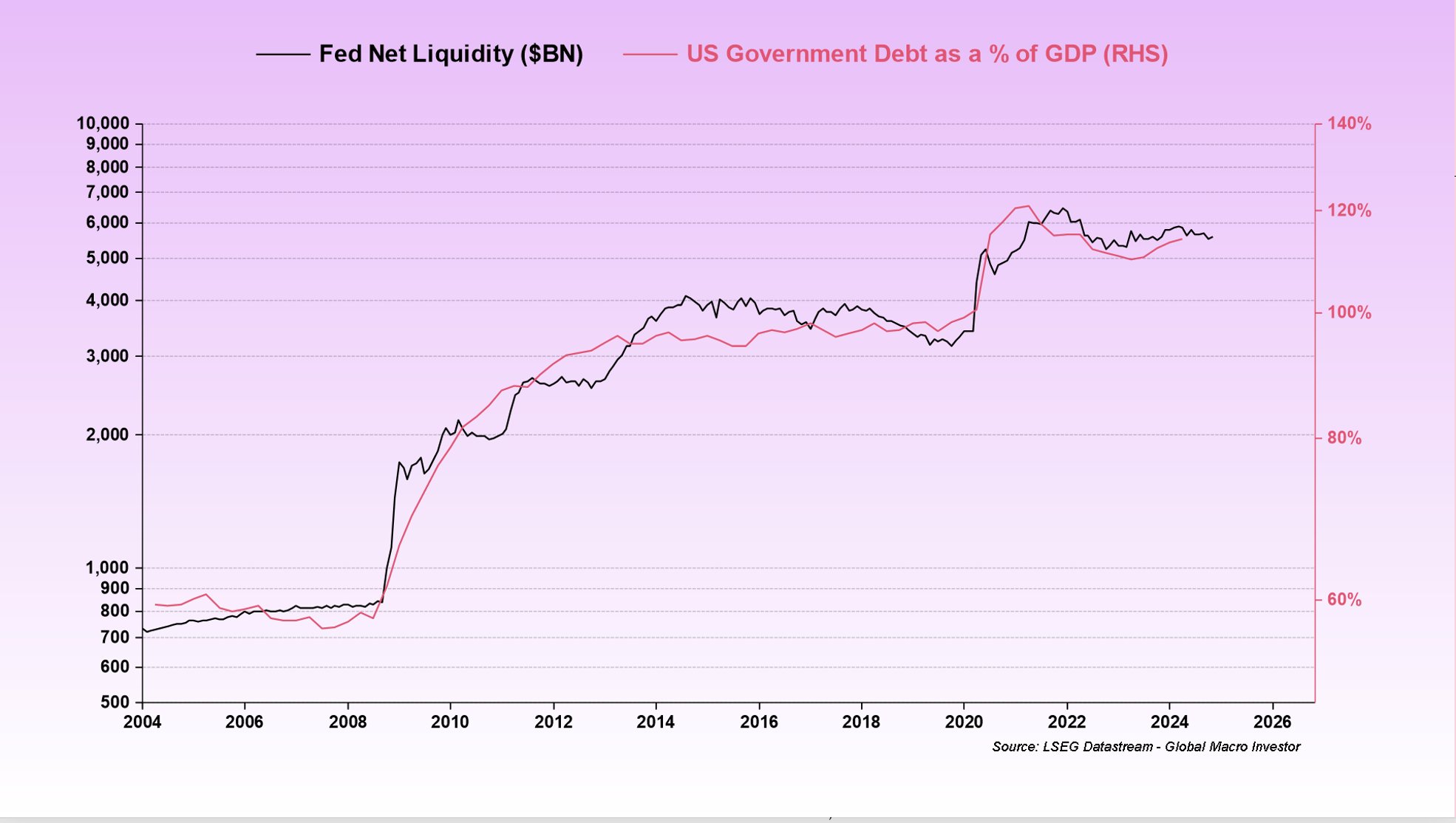

Chart 3: Printing Money to Stay Afloat

The third chart shows the relationship between government debt and the amount of money the Federal Reserve is injecting into the economy. Pal argues that governments are essentially printing money to service their growing debt, which ultimately leads to inflation.

The Big Picture: A Cycle of Debt and Inflation

Pal’s analysis paints a grim picture:

- An aging population leads to slower economic growth.

- To maintain growth, governments borrow more money.

- This leads to a cycle of printing money and inflation.

Pal believes this cycle is a major driver of the current economic landscape and will continue to impact crypto and traditional markets in the years to come.