CryptoQuant’s CEO, Ki Young Ju, is predicting a unique altcoin season, unlike anything we’ve seen before. He claims the usual flow of money from Bitcoin (BTC) into altcoins is drying up, leading to a less predictable market.

Bitcoin’s Shift: Less Liquidity for Altcoins

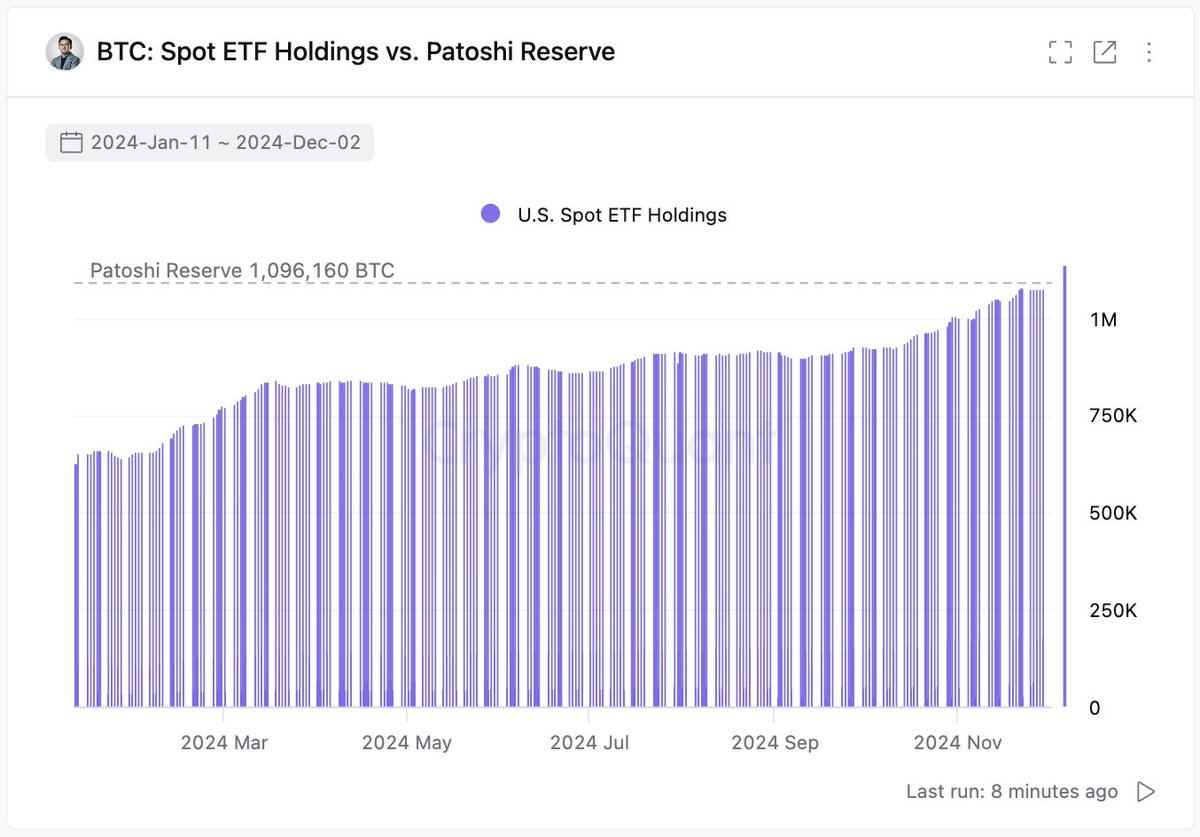

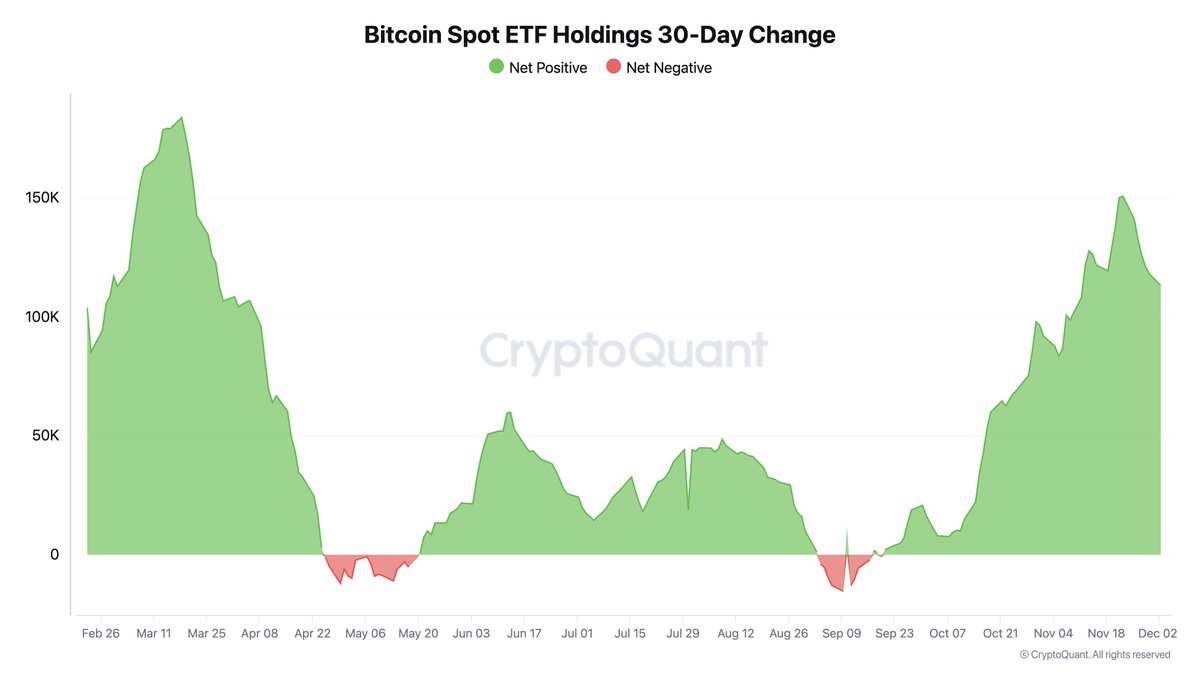

Ju points out that Bitcoin’s involvement with traditional finance is booming. The rise of Bitcoin ETFs and significant buying by companies like MicroStrategy are creating a “paper-based layer-2 ecosystem” for Bitcoin, separate from the rest of the crypto market. This means less liquidity is available to fuel altcoin price increases. He summarizes the situation as: “This alt season won’t be what you expected. It’s going to be weird and challenging.”

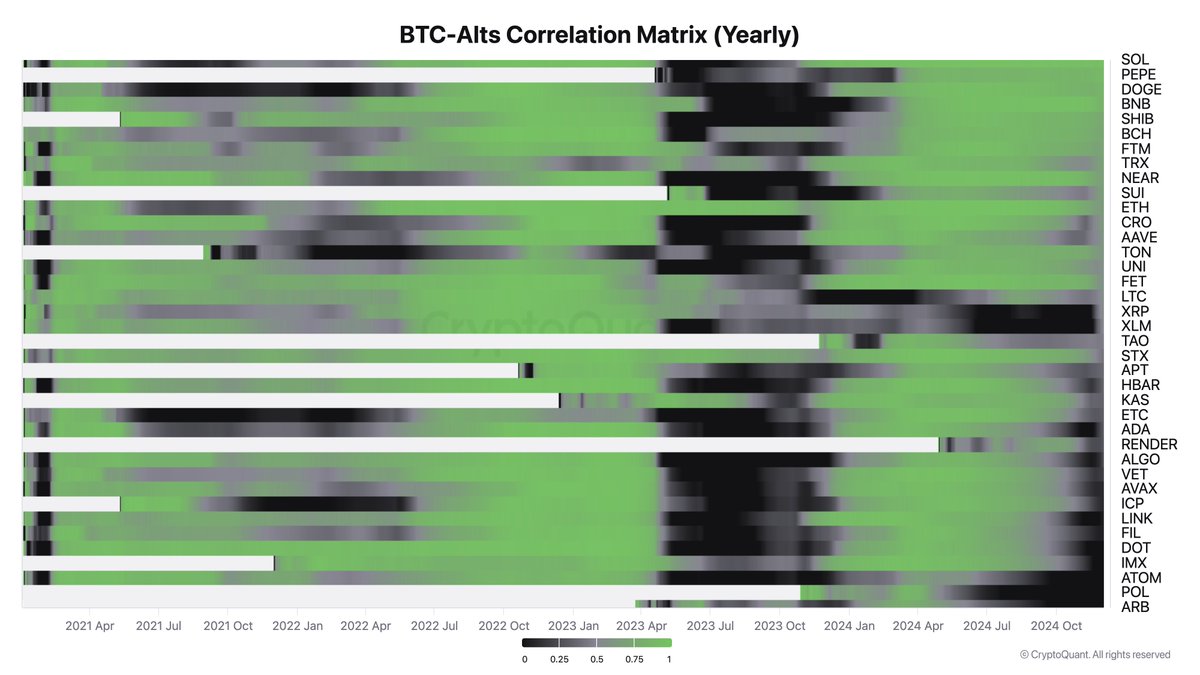

Broken Correlation: Altcoins Go Their Own Way

Historically, altcoins moved in tandem with Bitcoin’s price. But Ju’s charts show this correlation is breaking down. Only a few altcoins are showing independent growth, attracting their own separate investments.

The Satoshi Nakamoto Factor

The impact of Bitcoin ETFs is significant. Ju notes that these ETFs now hold as much Bitcoin as Satoshi Nakamoto is believed to have mined in Bitcoin’s early days. Demand for these ETFs remains incredibly high, further solidifying Bitcoin’s position outside the traditional altcoin market.

The Bottom Line: A Challenging Altseason

Ju’s analysis suggests that this altcoin season will be far less predictable than previous ones. The traditional relationship between Bitcoin and altcoins has weakened, making it a much more challenging environment for investors. Only a select few altcoins are likely to thrive in this new landscape.