The SEC’s approach to crypto enforcement under Gary Gensler saw a surprising shift in 2024. While the number of cases dropped significantly, the total fines reached record levels. Let’s break it down:

Fewer Cases, But Record-Breaking Fines

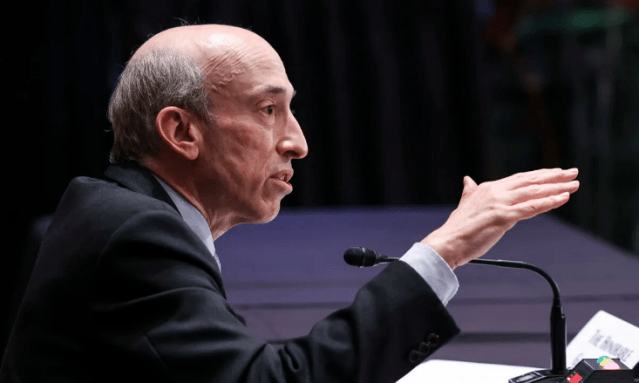

A recent study revealed a 30% drop in SEC crypto enforcement actions in 2024, down from 47 cases in 2023 to just 33. Despite this decrease, the total fines collected soared to almost $5 billion—a new high. This massive sum was largely due to one enormous settlement. This contrasts sharply with previous years under Gensler, where fines were substantial but spread across more cases.

Gensler’s Focus: Fraud and Unregistered Securities

Gensler’s SEC focused heavily on two key areas: fraud and unregistered securities offerings. Around 66% of cases during his tenure involved fraud, a significant increase from previous years. Similarly, unregistered securities sales made up about 63% of enforcement actions. This consistent focus highlights the SEC’s determination to regulate the crypto space.

Comparing Gensler and Clayton

A comparison with the previous administration reveals a significant difference in enforcement approaches. Gensler oversaw 125 enforcement actions in just over three years, compared to 70 under his predecessor, Jay Clayton, in a similar timeframe. Gensler’s administration also resolved a higher percentage of cases, showcasing a more aggressive enforcement strategy.

What’s Next for Crypto Regulation?

The massive fines collected under Gensler underscore the SEC’s powerful influence on the crypto landscape, even with the decrease in cases in 2024. With Gensler’s departure, the future direction of crypto regulation remains uncertain. Industry experts are watching closely to see if the SEC maintains its tough stance or adapts to the evolving crypto market. Gensler’s legacy will likely be remembered as a period of intense scrutiny and record-breaking penalties, suggesting a continued focus on crypto regulation by US authorities.