ETF Boom Ignites Gold Rush in Crypto World

The introduction of spot Bitcoin ETFs has sparked a surge of interest in the cryptocurrency market, attracting both new and experienced investors. These investment vehicles provide a convenient and accessible way to gain exposure to Bitcoin, but their impact on the cryptocurrency’s core principles and long-term stability remains uncertain.

Initial Surge in Bitcoin Wallets, But Ownership Shift Raises Concerns

Following the SEC’s approval of 11 ETFs, the number of non-zero Bitcoin wallets initially soared, reaching a peak of nearly 53 million in January. However, data from Santiment revealed a concerning trend 30 days later: nearly 730,000 fewer wallets held any Bitcoin, suggesting a shift towards holding through ETFs instead of directly owning the tokens. This raises questions about the long-term impact on Bitcoin’s decentralized nature and the potential for decreased on-chain activity.

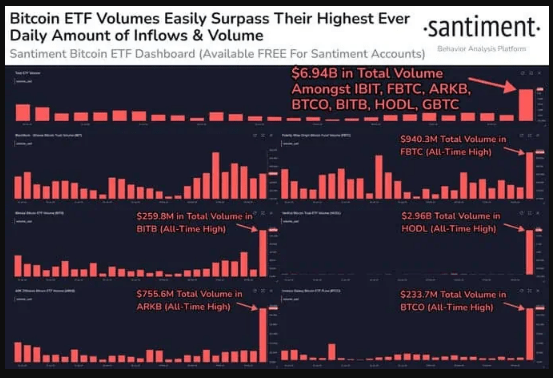

ETF Boom, But Supply/Demand Dynamics Unchanged

While the ETF market is thriving, its impact on Bitcoin’s core principles is less clear. The recent record volume and inflows exceeding $7 billion across the top 7 ETFs highlight strong market interest and the potential for mainstream adoption. However, it’s important to note that these ETFs can hold both actual Bitcoin and futures contracts, meaning investors gain exposure without directly impacting the underlying supply or demand of the cryptocurrency itself. This raises questions about whether ETFs are truly driving adoption or simply creating a derivative-based market with its own set of risks and dynamics.

Speculation Surges, Raising Red Flags

One of the most concerning trends is the surge in speculative trading using derivatives. Open interest on centralized exchanges, particularly for Bitcoin, has reached unprecedented levels, exceeding $10 billion for the first time since July 2022. This indicates investors are taking on more risk by leveraging derivatives, potentially fueled by the “crowd euphoria” surrounding Bitcoin and the allure of potentially quick gains. This echoes the speculative frenzy seen in 2017, raising concerns about potential market volatility and potential crashes.

A Double-Edged Sword: Accessibility vs. Potential Downsides

The arrival of spot Bitcoin ETFs has undoubtedly opened doors for new investors, but it’s important to acknowledge the potential downsides. While accessibility has increased, direct ownership might be decreasing, and the rise of speculative trading using derivatives raises concerns about future market stability. Moving forward, it will be crucial to monitor how these trends evolve and their long-term impact on the overall health of the crypto ecosystem. Additionally, ongoing regulatory developments surrounding ETFs and derivatives could further shape the landscape.