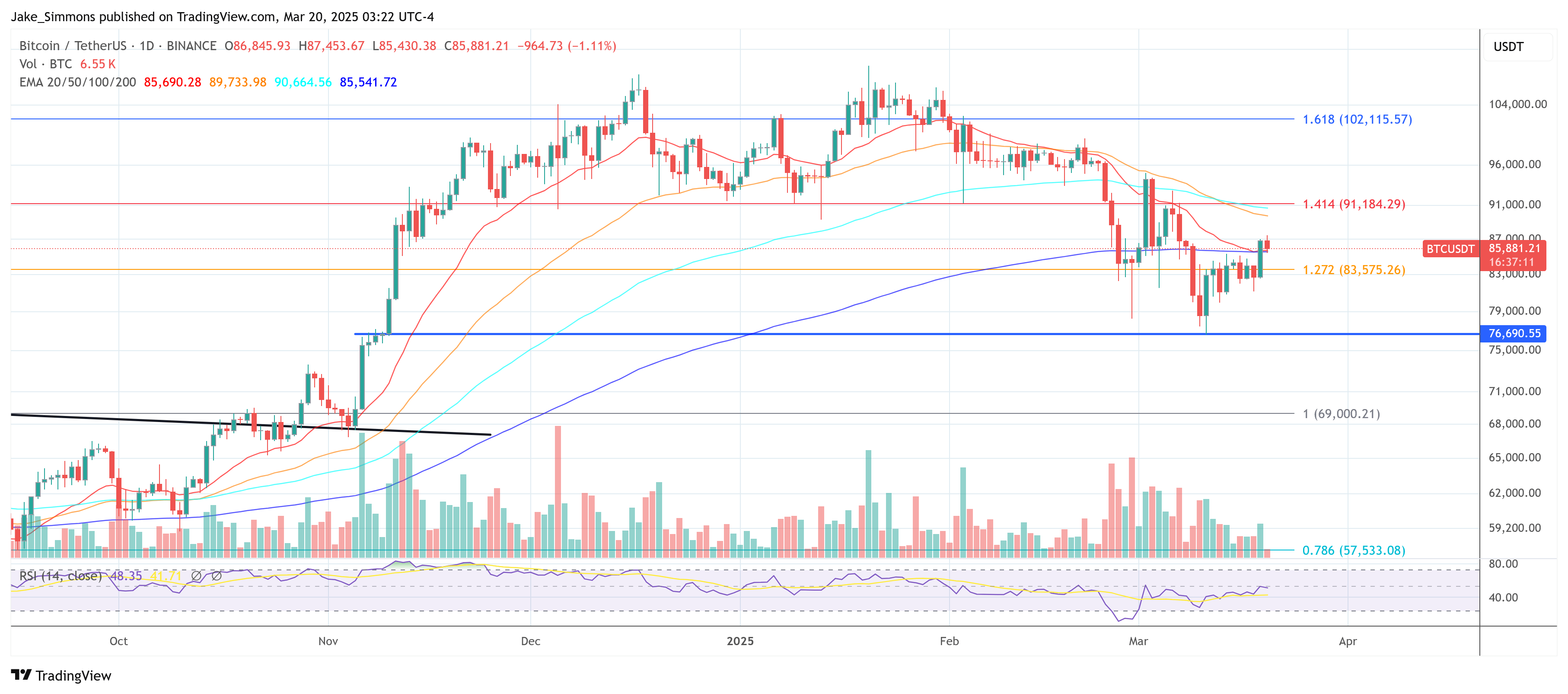

The Federal Reserve (Fed) recently decided to keep interest rates the same, and Bitcoin’s price jumped in response. While many expected this move, the Fed’s updated outlook suggests slower rate cuts and a much slower reduction of its balance sheet.

What the Fed Did

The Fed’s announcement included:

- Fewer Rate Cuts: They now predict only two small interest rate cuts this year, fewer than many investors expected. The timing of these cuts depends on inflation and job numbers.

- Slower Balance Sheet Reduction: The Fed will significantly slow down its selling of government bonds. This shift is seen by many as a step towards a more supportive stance if the economy weakens.

Bitcoin’s Big Reaction

Bitcoin’s price quickly rose by 4-5% after the Fed’s announcement. Experts believe this is directly related to the Fed’s actions.

Expert Opinions

Several experts weighed in on the implications for Bitcoin:

-

Nik Bhatia: He highlighted the Fed’s slower balance sheet reduction as a key factor. He explained that this eases liquidity issues and could boost investor confidence in riskier assets like Bitcoin. He sees this as a first step towards potentially reversing the balance sheet reduction entirely if needed.

-

Arthur Hayes: He believes the Fed’s move essentially ends the balance sheet reduction, and that further actions like easing bank regulations or restarting quantitative easing (QE) could lead to a much bigger Bitcoin rally.

-

Jamie Coutts:

He agrees that the balance sheet reduction is effectively over for now, pointing to decreased volatility in Treasury bonds as a positive sign for liquidity.

He agrees that the balance sheet reduction is effectively over for now, pointing to decreased volatility in Treasury bonds as a positive sign for liquidity.

In short, the Fed’s actions are being interpreted as positive for Bitcoin and other risky assets, potentially signaling a bullish period ahead. At the time of writing, Bitcoin was trading around $85,881.