Bitcoin’s price is always a hot topic, and the latest US jobs report has everyone talking. Let’s break down what happened and what it might mean for Bitcoin in 2025.

A Surprisingly Strong Jobs Market

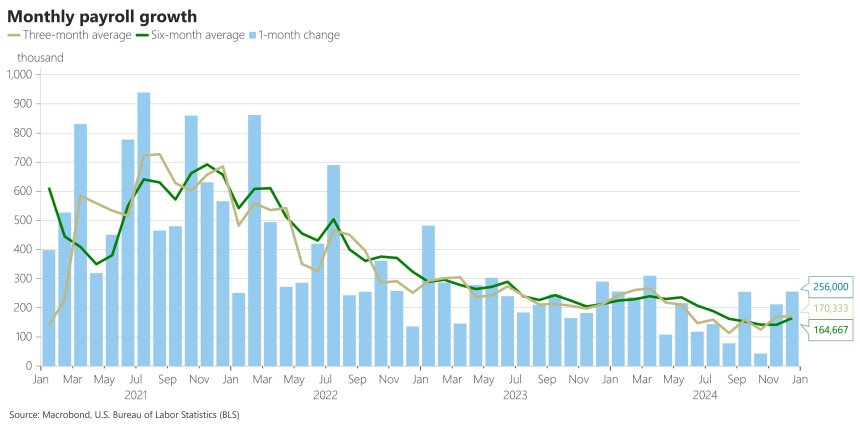

The US added 256,000 jobs in December—that’s 100,000 more than expected! This follows a strong six-month average of 165,000 new jobs, the highest since July 2024. This is significant because…

The Fed’s Plan Might Be Off Track

The Federal Reserve (the Fed) started cutting interest rates in September 2024, expecting slower job growth and inflation. But this new jobs data suggests they might have been wrong. A strong jobs market often leads to higher inflation, which could cause the Fed to stop cutting rates, or even raise them.

cutting rates, or even raise them.

Why This is Bad News (Potentially) for Bitcoin

Lower interest rates are generally good for Bitcoin. They make it easier for investors to take on riskier investments, like cryptocurrencies. If the Fed reverses course and stops cutting rates or even raises them, it could be bad news for Bitcoin’s price. We already saw a small crash in mid-December when the Fed hinted at fewer rate cuts. One analysis suggests there’s only a 44% chance of any rate cuts happening before June 2025.

Bitcoin’s Current State

At the time of writing, Bitcoin is trading around $94,028. While it’s slightly up in the last 24 hours, it’s down a bit over the past week and month.

The Bigger Picture

Despite the potential for higher interest rates, many Bitcoin investors remain optimistic. They point to Bitcoin’s historical performance during bull markets, the possibility of more pro-crypto US government policies, and continued institutional investment (like through spot ETFs). Bitcoin remains the biggest cryptocurrency and one of the world’s top eight assets by market cap.