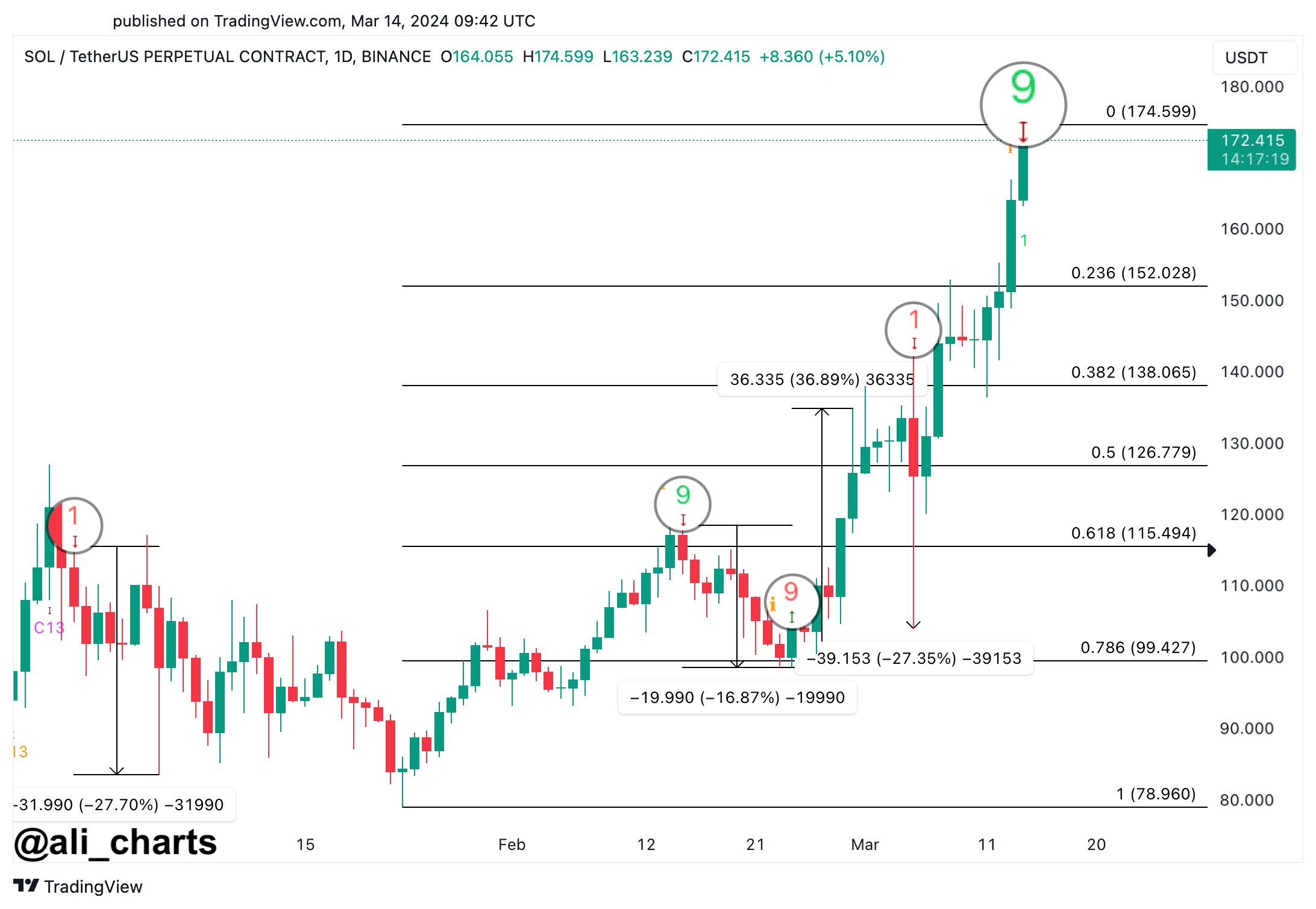

Crypto trader Ali Martinez believes Solana (SOL) may be heading for a correction. According to his analysis, the Tom DeMark (TD) sequential indicator on SOL’s daily chart has signaled a sell signal.

TD Indicator Suggests Potential Drop

The TD indicator is used to identify potential turning points in an asset’s price. Martinez notes that every time this indicator has suggested selling since December 2023, SOL has dropped by 17% to 28%.

Target Prices

Based on this pattern, Martinez predicts that SOL could retrace to $152 or even $127. However, he cautions against shorting assets during a bull market and advises traders to “buy the dips” instead.

Analyst Predicts Brief Correction

Martinez believes that SOL’s correction will be brief and that it will continue to reach higher highs in the future.

Bullish Sentiment

Despite Martinez’s analysis, some traders remain optimistic about SOL. Analyst Kaleo predicts that SOL could rise to $200 after breaking out of a bullish trendline.

Current Market Status

At the time of writing, SOL is trading at $184.13, up 12% in the past 24 hours and 27% in the past week. Despite these gains, SOL remains more than 29% below its all-time high set in November 2021.