Shorting Altcoins: A Sign of a Bullish Future?

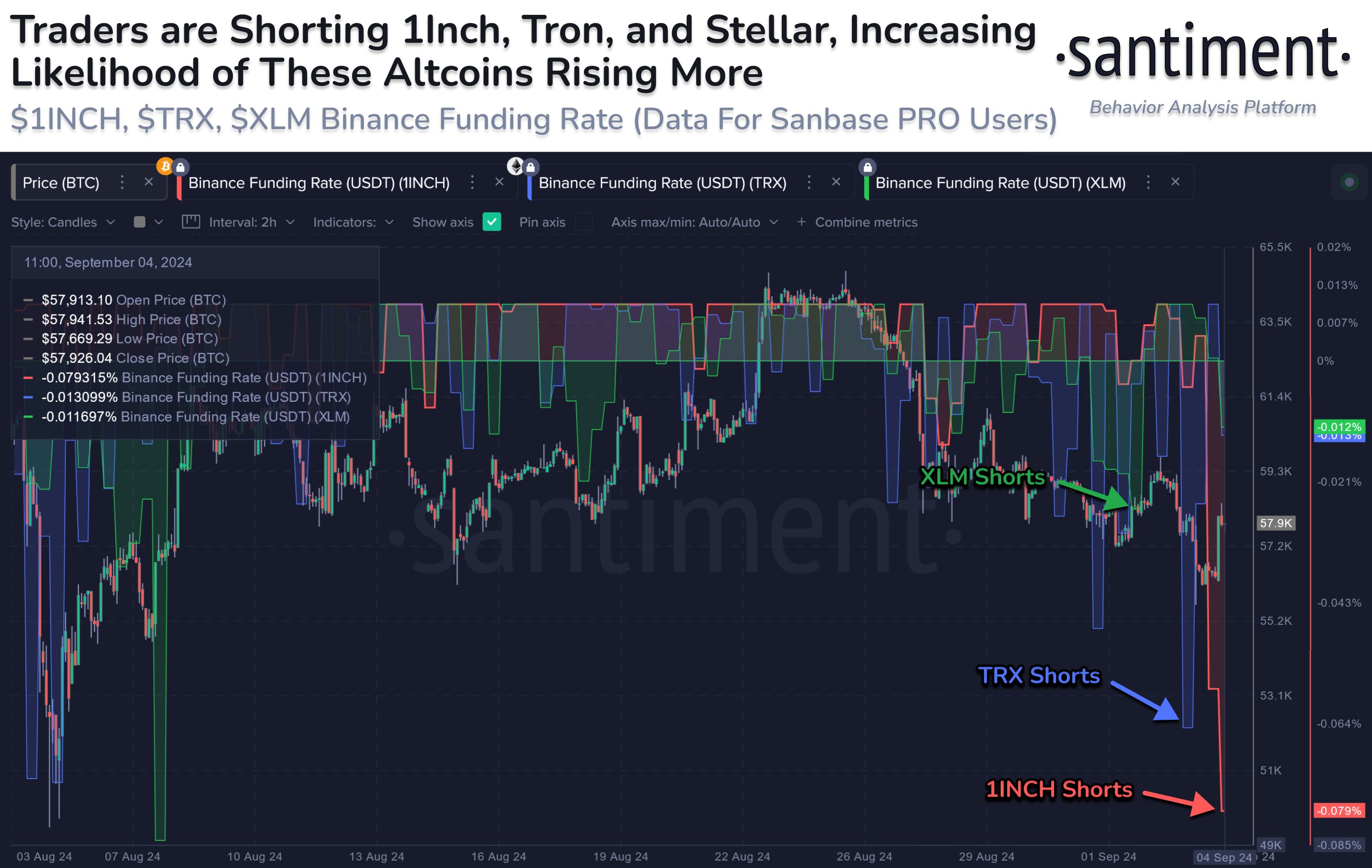

A recent analysis from Santiment, a blockchain analytics firm, reveals that three altcoins – Tron (TRX), Stellar (XLM), and 1inch Network (1INCH) – have seen a surge in short positions on Binance. This means that traders are betting against these coins, expecting their prices to drop.

What Does This Mean for Prices?

The “Funding Rate” on Binance is a key indicator of market sentiment. A positive funding rate means that long-term holders are paying a premium to short-term holders, suggesting a bullish market. A negative funding rate indicates the opposite – short-term holders are dominant, suggesting a bearish market.

Currently, all three altcoins mentioned above have negative funding rates, indicating that more traders are shorting them. This could be a sign that a price drop is imminent.

But Wait, There’s a Twist!

While shorting might seem like bad news for these altcoins, it could actually be a catalyst for a price surge.

Here’s why:

- Liquidations: When a large number of traders short an asset, and the price unexpectedly rises, they are forced to cover their positions, which drives the price up even further. This is known as a “short squeeze.”

- Rocket Fuel: Santiment describes this phenomenon as “rocket fuel” for the asset’s price.

Tron’s Recent Performance

Tron (TRX), the largest of the three altcoins, has seen a slight dip in price this week, but its monthly performance has been impressive, outperforming Bitcoin with an 18% surge.

What’s Next?

The future price movement of these altcoins remains uncertain. While the negative funding rate suggests a bearish market, the potential for short squeezes could lead to unexpected price rallies. It’s important to remember that the market is constantly evolving, and it’s always wise to conduct your own research before making any investment decisions.