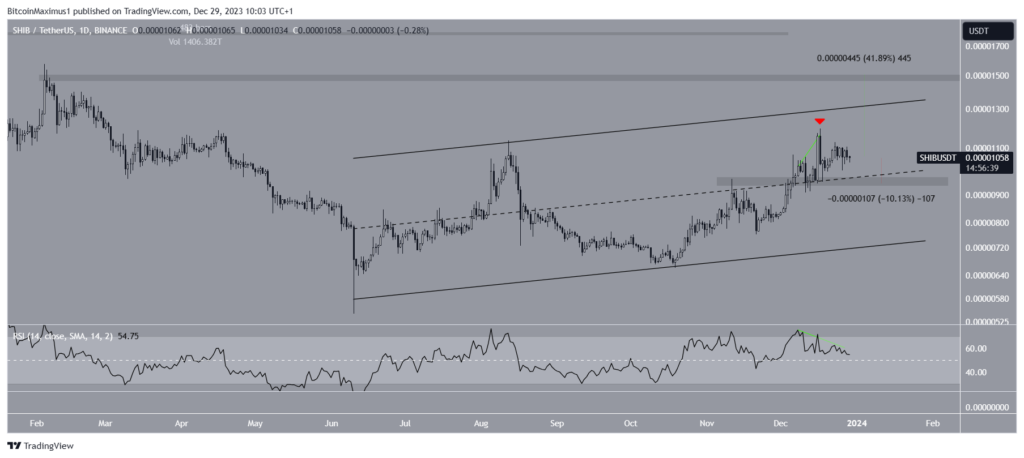

Recently, Shiba Inu (SHIB) has been in a bit of a pickle. Despite trying, it couldn’t muscle its way out of an ascending parallel channel on December 17 and has been on a bit of a slide since then.

What’s interesting is that the weekly and daily outlooks for SHIB aren’t seeing eye to eye. Another point to note is that there’s been a drop in the number of tokens being burned lately — we’re talking a noticeable dip in the past 24 hours.

Shiba Inu Clears Diagonal Resistance

Checking out the weekly charts, we see SHIB has been on an upward trend since hitting a low point in June. Then, in November, things got interesting. SHIB managed to break free from a descending resistance line that had been looming over it for a whopping 480 days.

But don’t pop the champagne just yet. Despite this breakout, SHIB hasn’t really skyrocketed. It’s kind of hovering near that old resistance line. And hey, only about 500,000 tokens were burned in the last day, which is way less than before.

Market pros often use the RSI (Relative Strength Index) to gauge if a crypto is overbought or oversold. Generally, if the RSI is above 50 and trending up, it’s a good sign for the bulls. Below 50? Not so much.

When SHIB broke out, the RSI also climbed above 50, giving some credibility to this upward move.

SHIB Price Prediction: What’s Next?

Now, the daily charts are hinting at a possible price correction for SHIB, which is a bit of a contrast to the weekly view. This is based on the price action and RSI readings we’ve been seeing.

On December 17, SHIB hit a wall at the resistance line of an ascending channel. Then on December 23, it recorded a lower high, which is typically a bearish sign. What’s more, there was a bearish divergence in the daily RSI during this time, meaning the momentum was slowing down even as prices went up. This could point to a correction on the horizon.

If SHIB keeps sliding, we might see it hit a support level around $0.0000095, which would be about a 10% drop from where it’s at now.

But remember, all bets are off if SHIB manages to break out from this channel. If it does, we could see a 42% jump, aiming for the next resistance at $0.0000150.