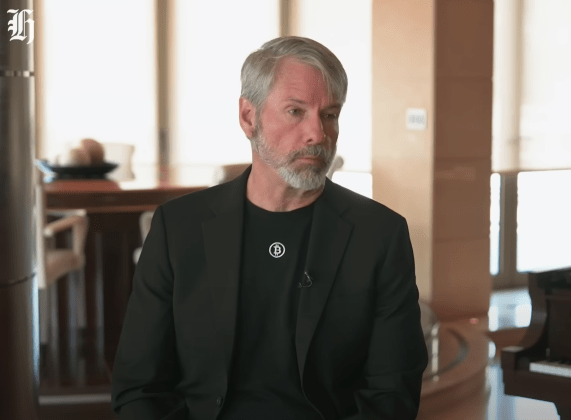

Michael Saylor, the CEO of MicroStrategy, has stirred up a hornet’s nest in the Bitcoin community with his recent comments about custody and regulation.

Saylor’s Argument: Big Institutions Are Safer

Saylor claims that Bitcoin is safer in the hands of regulated institutions like BlackRock, Fidelity, and JP Morgan than with individual holders. He argues that these institutions are more stable and trustworthy because they are subject to government oversight and regulations. He believes that “crypto anarchists” who hold Bitcoin outside of these regulated systems pose a greater risk of government intervention.

The Gold Confiscation Analogy

Saylor dismissed the comparison between Bitcoin and the gold confiscation during the Great Depression, calling it a “myth” and a “trope” spread by paranoid Bitcoiners. He claims that the situation is different because the US was on the gold standard at the time, and the government needed to control gold to devalue the dollar. He believes that the government has no incentive to seize Bitcoin held in custody any more than it would seize stocks or real estate.

Bitcoin Community Backlash

Saylor’s comments have been met with strong criticism from many in the Bitcoin community, who value decentralization and self-custody as core principles.

Jack Mallers, CEO of Strike, argues that self-custody is about freedom and protecting your right to own what’s yours. He believes that dismissing self-custody as “crypto-anarchism” oversimplifies the power of Bitcoin.

Sina Nader, co-founder of 21st Capital, criticizes Saylor’s position, calling it a “terrible look” for him to become a “shill” for the government and banking system. He believes that Saylor is trying to turn Bitcoin into a simple investment asset and stifle its potential as a currency.

Samson Mow, CEO of JAN3, warns that governments don’t need to physically confiscate Bitcoin. They can simply lock custodial Bitcoin into approved institutions, effectively creating “Institutional Bitcoin.” He believes that governments might still have an incentive to undermine Bitcoin because it represents a “harder and superior money” that could threaten fiat currencies. He urges the community to plan for the possibility of government intervention and embrace self-custody.

The Debate Continues

Saylor’s comments have reignited the debate about the role of institutions in the Bitcoin ecosystem. While some believe that institutional custody can provide stability and security, others argue that it undermines the core principles of decentralization and self-ownership. The debate is likely to continue as the Bitcoin community grapples with the evolving relationship between Bitcoin and traditional financial systems.