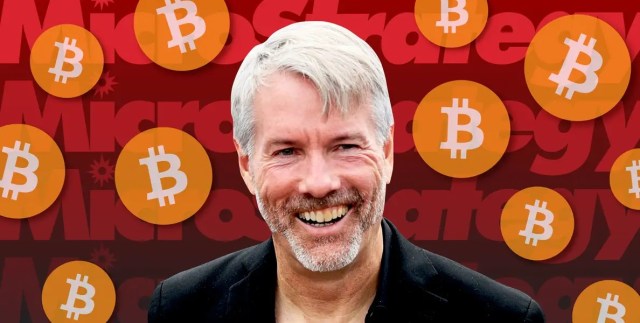

Michael Saylor, executive chairman of Strategy (formerly MicroStrategy), recently explained their massive Bitcoin investment strategy on CNBC. It’s not just about holding onto Bitcoin; it’s about building a business around it.

A Bitcoin-Fueled Business Model

Strategy now owns over 628,000 Bitcoin, worth roughly $72 billion – that’s almost 3% of all Bitcoin! They’ve been aggressively acquiring Bitcoin, recently purchasing 21,021 BTC using funds from a $2.5 billion IPO. This IPO, their fourth fundraising round of the year, was reportedly the largest IPO of 2025 so far.

Saylor sees this model – raising capital to buy Bitcoin – as a way to transform volatile digital assets into more stable securities attractive to institutional investors. He even called their latest offering, “Stretch” (STRC), their most exciting product yet.

The Growing Bitcoin Adoption Among Public Companies

Saylor also highlighted the increasing adoption of Bitcoin by other public companies. He stated that over 160 public companies now hold Bitcoin in their reserves, a significant jump from around 60 a year ago. In total, these companies own about 955,048 BTC (4.55% of the total supply). He believes Bitcoin is replacing traditional assets like gold, real estate, and even equity as a store of value, essentially “demonetizing” them. He suggests that for companies aiming to boost shareholder value, investing in Bitcoin is smarter than holding cash or investing in private equity.

Not a Bitcoin Monopoly

Saylor clarified that Strategy isn’t trying to corner the Bitcoin market. While he doesn’t see owning 3% to 7% of all Bitcoin as excessive, he emphasizes that they want others to participate. He even pointed out that BlackRock, through its iShares Bitcoin Trust (IBIT), currently holds even more Bitcoin – around 740,896 BTC. He also speculated that if SEC regulations didn’t prevent it, major tech companies like Apple and Microsoft might invest in each other and potentially Bitcoin as well.