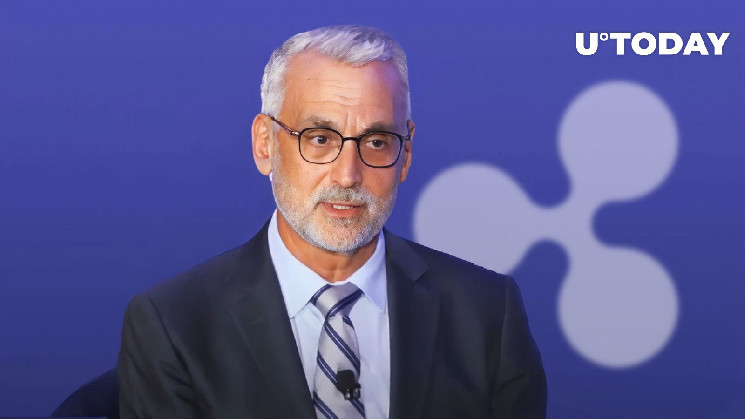

Stuart Alderoty, the chief legal eagle at Ripple, recently shared his thoughts on some of the Securities and Exchange Commission’s (SEC) recent legal hiccups. He’s been pretty vocal on social media, pointing out a couple of big setbacks the SEC has faced in court.

First off, Alderoty talked about a decision from a Federal Appeals Court in the Chamber of Commerce v SEC case. In this one, the court wasn’t too happy with the SEC, saying they didn’t do their job right by missing a deadline to fix some issues in their stock buyback rules. This decision kind of puts a spotlight on whether the SEC is sticking to the rules and procedures it’s supposed to follow.

Then, there’s another situation Alderoty brought up. It’s about these things called syndicated loans, a huge market led by JPMorgan Chase, and whether they should be considered securities. The Supreme Court got involved because the SEC decided not to participate in a lower court’s inquiry about this. This decision came right after some heavy-duty lobbying from big banks, like in the Kirschner v. JPMorgan Chase case.

A “Troubling Pattern” for the SEC

It seems like Alderoty has been keeping an eye on the SEC for a while. He’s flagged a few instances where the SEC’s actions raised some eyebrows. Accusations of hypocrisy, not sticking to legal guidelines, slacking in making rules for the crypto world, and being inconsistent in similar cases – these are some of the issues he’s pointed out.

And that’s not all. The SEC has also been called out for potentially giving misleading information in court.

Alderoty’s Predictions for 2024

Looking into his crystal ball for 2024, Alderoty’s got some guesses about where crypto regulation in the U.S. is headed. He thinks Ripple’s ongoing battle with the SEC will finally reach a climax. But, he’s a bit wary about how the SEC has been handling things, using enforcement as their go-to method of regulation. He’s betting that judges will start pushing back against the SEC’s overreach, which might even lead to a big case in the Supreme Court.

However, he’s not too optimistic about Congress getting its act together on crypto regulation. They agree it’s needed, but can’t seem to decide on the details. This stalemate could leave U.S. crypto companies in a tough spot, especially when other countries are moving ahead with clearer rules.