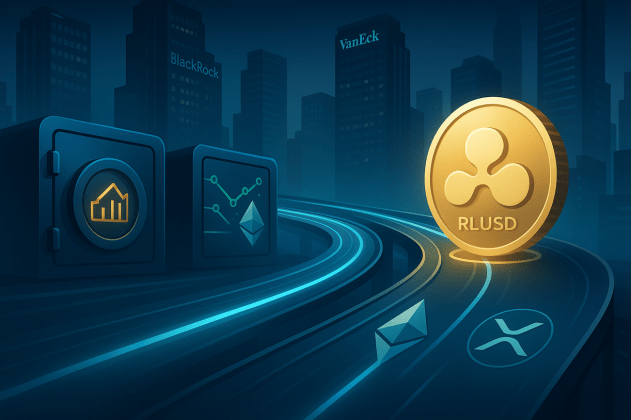

Ripple’s stablecoin, RLUSD, is making waves in the institutional investment world. It’s now a key way for investors to cash out of BlackRock and VanEck’s tokenized funds.

Easy Access to Cash for Tokenized Funds

Holders of BlackRock’s BUIDL and VanEck’s VBILL (tokenized US Treasury funds) can now quickly and easily convert their holdings into RLUSD, Ripple’s stablecoin. This is all thanks to a new partnership with Securitize, a platform that handles tokenized securities. The process is available 24/7, initially on the Ethereum blockchain, with plans to expand to the XRP Ledger (XRPL) soon.

This means investors can access their money anytime, without the usual banking hours limitations. This is a big deal for improving how quickly they can use their assets for trading, lending, and other financial activities.

Ripple’s Strategy: Bridging Tokenization and Transactions

Ripple is positioning RLUSD as a crucial link between the world of tokenized assets and everyday transactions. The company emphasizes RLUSD’s regulatory compliance, stability, and real-world utility. Partnerships with companies like Securitize are vital for expanding RLUSD’s reach and use cases.

This new integration builds on Ripple’s recent collaborations with DBS and Franklin Templeton, further showcasing their commitment to the tokenization of assets. They’re exploring using tokenized funds as collateral, highlighting how tokenization can meet the liquidity needs of large financial institutions.

The Future: XRPL Integration and More

The current RLUSD redemption process happens on Ethereum, but both Ripple and Securitize plan to add support for the XRPL in the near future. This will open up the system to a wider range of users and potentially improve transaction speeds and costs.

BlackRock’s Involvement

BlackRock, a major player in the financial industry, will be at Ripple’s Swell 2025 conference. Their Director of Digital Assets will be speaking about the impact of tokenized assets on capital markets. This further underscores the growing importance of tokenization and RLUSD within the institutional space.

In short, Ripple is aggressively pushing RLUSD as a key player in the institutional tokenization space, and this partnership with BlackRock and VanEck is a significant step in that direction.