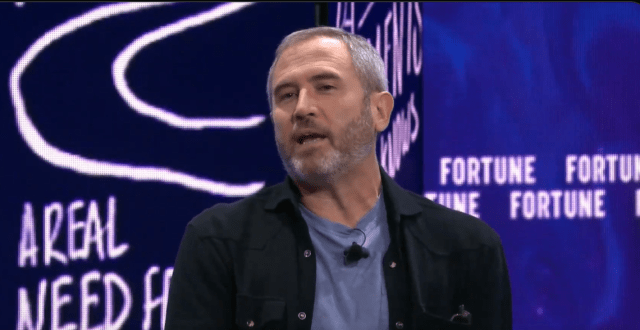

Ripple’s CEO, Brad Garlinghouse, recently spilled the beans on the company’s plans and how they’re taking on the old guard of international payments.

No IPO Anytime Soon

Garlinghouse made it clear that Ripple isn’t rushing to go public. He explained that the current regulatory environment is making them hold off. He even joked that he’s not exactly a favorite with the SEC. Instead of focusing on an IPO, Ripple has been buying back shares from investors and employees. They’ve already bought back $4 billion worth of stock and are in the middle of another buyback program.

Ripple vs. SWIFT: A Battle for the Future of Payments

Garlinghouse took aim at SWIFT, the current system for international money transfers. He called it outdated and compared it to sending telegrams. He believes Ripple’s technology can revolutionize how money moves around the world, making it as easy as sending an email.

He sees Ripple as a bridge between different payment networks, allowing them to work together seamlessly. This is similar to how email protocols connected different platforms, allowing people to communicate regardless of the email service they used.

The XRP Lawsuit: A Long and Costly Battle

Garlinghouse also talked about the legal battle with the SEC over XRP, Ripple’s cryptocurrency. This battle lasted over three years and cost Ripple a whopping $150 million in legal fees. While Ripple won the main point of the lawsuit – that XRP isn’t a security – there are still some details to be settled. Garlinghouse is optimistic that the judge will rule on these remaining issues soon.