Macro strategist Jim Bianco has revealed that retail investors hold a staggering 85% of shares in spot Bitcoin exchange-traded funds (ETFs) as of the first quarter of 2024.

Breaking Down Investor Types

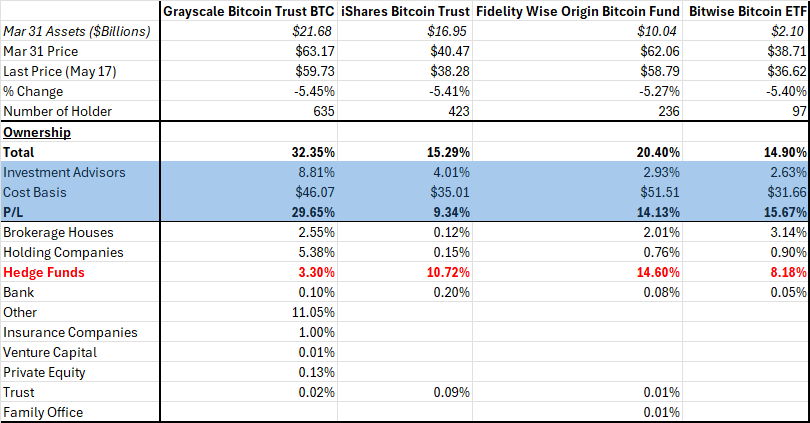

According to Bianco’s analysis of mandatory 13F filings with the SEC, investment advisors hold only a small portion of these ETFs, ranging from 2.5% to 4%. This contradicts the popular narrative that institutions and wealthy investors are driving the surge in Bitcoin ETF ownership.

Retail Dominance

“The Q1 13F filings only further convinced me that the spot BTC ETFs were effectively ‘orange FOMO poker chips,'” said Bianco. “Only ~3% of the outstanding ETF market cap was held by investment advisors.”

Hedge funds hold approximately 10% of the ETFs, while the remaining 85% is held by non-institutional investors, primarily retail traders.

Implications for the Market

This revelation suggests that the recent rally in Bitcoin prices may be driven by retail speculation rather than institutional adoption. It remains to be seen whether institutions will enter the market in the future, but for now, retail investors are the dominant force in the Bitcoin ETF space.