Big news for Ondo Finance! 21Shares, a big player in crypto ETFs, just filed with the SEC for a spot ETF tracking ONDO, the platform’s token. This could be huge for getting ONDO into the mainstream.

Institutional Interest in DeFi Heats Up

The news sent ONDO’s price soaring past $1.16, though it’s pulled back a bit since. This shows how much crypto prices react to regulatory news and investor feelings. The overall market’s a bit shaky right now, but this ETF could be a game-changer. More clarity from regulators and growing institutional interest should mean more attention and money flowing into ONDO. Now, everyone’s waiting to see what the SEC says.

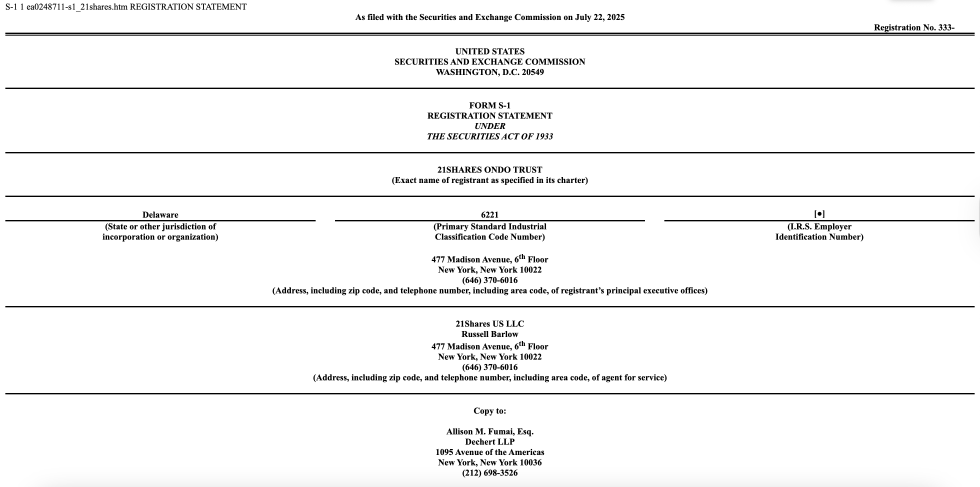

The 21Shares ONDO ETF: The Details

21Shares’s ETF, officially the 21Shares Ondo Trust, is designed to be simple. It’ll passively track ONDO’s price using a benchmark from the CME, without any fancy trading strategies or leverage. Coinbase Custody will keep the tokens safe. Shares will be bought and sold in big chunks. If approved, this ETF will make ONDO look much more legit to traditional finance folks, boosting demand and liquidity.

Price Action and What’s Next

The ONDO price recently broke through a key resistance level at $1.00, then pulled back a bit to around $1.07. This breakout, fueled by the ETF news, happened on high trading volume. The price is now above all its major moving averages (50-day, 100-day, and 200-day), a very bullish sign. This is the strongest breakout ONDO has seen in a while.

The price is currently consolidating between $1.06 and $1.14. If the positive news keeps coming, we could see it climb to $1.30-$1.40. However, if it falls below the 200-day moving average, support levels are around the 100-day moving average and $0.95.