New Bitcoin investors are experiencing a “pain cycle” as they’re currently holding unrealized losses, according to crypto analytics firm Glassnode.

New Investors Feeling the Heat

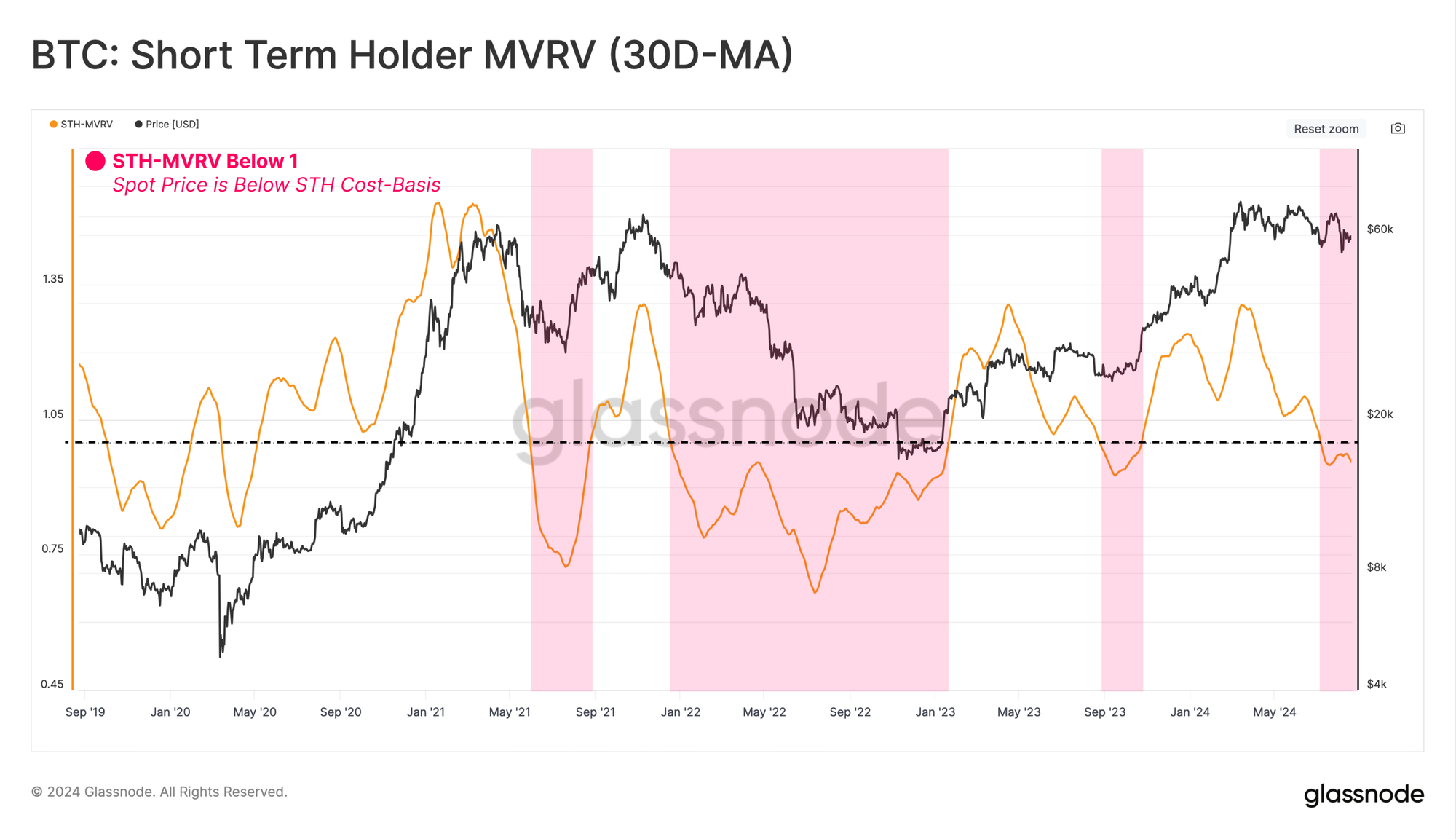

Glassnode defines short-term holders (STHs) as those who’ve held Bitcoin for less than 155 days. They’ve noticed that these new investors have taken the brunt of the recent market downturn.

A key metric, the STH Market Value to Realized Value (MVRV) ratio, has fallen below 1.0, indicating that new investors are holding Bitcoin at a lower price than they bought it for.

Glassnode explains that while short-term losses are common during bull markets, sustained periods of losses can lead to panic selling and a more severe market downturn.

Overreacting to Price Swings

The analytics firm also suggests that new investors tend to overreact to price swings, both positive and negative. They observed that during the recent market correction, new investors sold off their Bitcoin at a higher rate than long-term holders.

Long-Term Holders Stay Strong

Despite the pain felt by new investors, long-term holders are holding strong, accumulating more Bitcoin and remaining unfazed by the market volatility.

Disclaimer: This information is for general knowledge and should not be considered investment advice. Always do your own research before making any investment decisions.

/p>