Investor Luke Gromen predicts a shift in capital from bonds to stocks, gold, and Bitcoin due to rising inflation.

Bond Market Weakness

Gromen points to the weakness of the iShares 20+ Year Treasury Bond ETF (TLT) against risk assets and inflation hedges. He believes this signals a potential flight from bonds into other investments.

Asset Performance Against Bonds

- S&P 500: Strong performance against TLT

- Nasdaq: Similar trend to S&P 500

- Industrials: Also outperforming TLT

- Gold: Positive performance against TLT

- Bitcoin: Volatile but overall positive performance against TLT

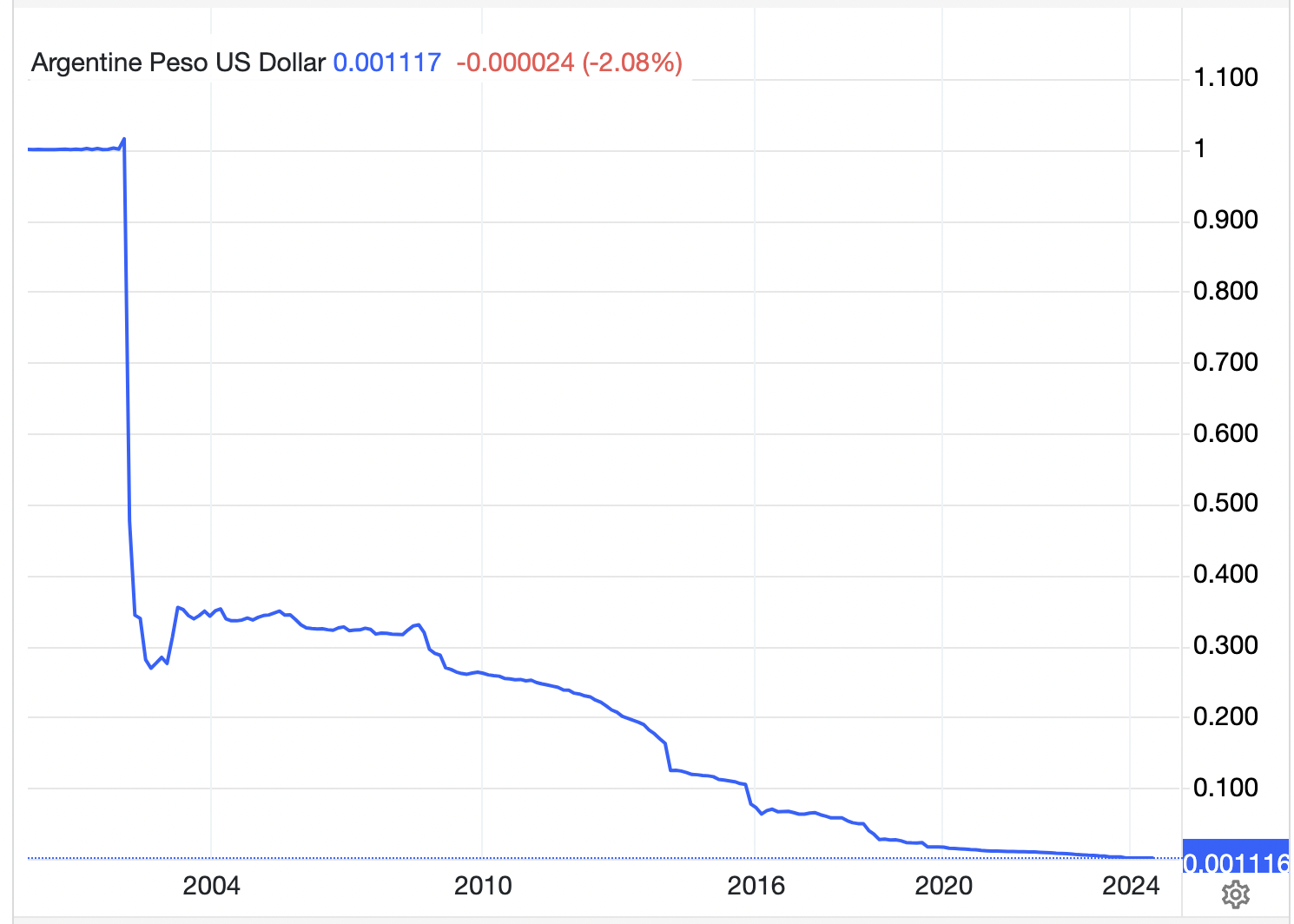

Argentina as a Precedent

Gromen compares the current situation to Argentina’s experience with high inflation. In Argentina, the stock market has soared in peso terms but declined in dollar terms. Gromen suggests that the US may face a similar scenario, with stocks rising in dollar terms but falling against gold and Bitcoin.

Bitcoin Price at Time of Writing

At the time of writing, Bitcoin is trading at $64,689.