Saifedean Ammous, author of The Bitcoin Standard, slammed Argentine President Javier Milei’s economic plan as a sham. He calls it a “fiat fraud” propped up by risky bonds and loans, masking deeper problems.

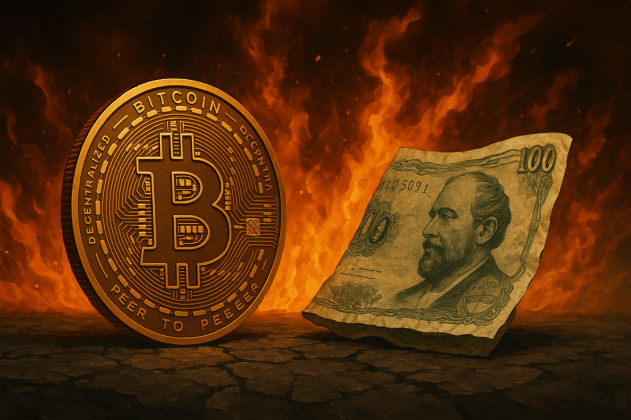

Ammous’s Critique: A Bitcoin vs. Fiat Showdown

Ammous’s main argument is that Milei’s actions contradict his promises. He claims Milei failed to shut down the central bank as promised, instead expanding the money supply and raising taxes. Ammous believes the only solution is to stop creating money – a simple fix, he says, that would curb inflation. Anything less is unacceptable to Bitcoin supporters.

Ammous points to Argentina’s massive debt to the IMF – the highest ever in IMF history – as evidence of the plan’s failure. He also highlights additional billions borrowed from the World Bank and Inter-American Development Bank, totaling a staggering $42 billion. He sees this as a major loss, not a win.

He also criticizes the government’s inflation figures, arguing they understate the true decline in purchasing power. He cites the dramatic drop in the peso’s value against the dollar, both officially and on the black market, as further proof of the plan’s failings.

The “Shitcoin Casino” and Argentina’s Gold

Ammous argues that a free market can’t exist with government manipulation of money. He describes the high-interest peso bonds as a “shitcoin casino,” where speculation is the only profitable activity thanks to the central bank’s manipulation. This, he says, is typical of fiat systems: artificially created yield that eventually collapses. Bitcoin, with its fixed supply, avoids this problem.

He also accuses Milei’s administration of sending Argentina’s gold reserves to London for quick profits and forcing banks to buy more government bonds, risking the savings of Argentinians. This, he warns, could trigger a repeat of the 2001 financial crisis. Ammous emphasizes that Bitcoin’s self-custody model avoids these risks.

Counterarguments and the Core Disagreement

Supporters of Milei’s plan, including some Bitcoiners, point to a decrease in inflation, projected GDP growth, and the successful removal of currency controls as signs of success. They argue that Milei’s more gradual approach is being rewarded by the markets.

However, Ammous dismisses these arguments, highlighting the fundamental difference in their approaches. Ammous advocates for a Bitcoin standard – closing the central bank, controlling the money supply, and letting prices adjust. The government’s approach, he says, is a classic fiat stabilization strategy that relies on confidence and international support, which he sees as inherently unstable.

The Bottom Line

The success or failure of Milei’s plan hinges on several factors: the ability to maintain high interest rates on peso bonds, the rate of disinflation, the stability of the exchange rate, and continued international support. If these factors deteriorate, Ammous’s Bitcoin-centric critique will appear more accurate. However, Ammous firmly believes Bitcoin offers the only sustainable long-term solution. At the time of writing, Bitcoin was trading at $113,612.